The weight of debt is a heavy burden for countless Canadians, with mortgages, car loans, student debt, and escalating credit card balances dominating our financial landscape. As we grapple with this reality, exploring effective debt management strategies is essential. Yet, a crucial factor often remains hidden in plain sight: the stark contrast between 10-year fixed-rate mortgages and loans with renewal options. This seemingly insignificant choice can significantly impact your financial well-being and determine whether you fall prey to the insidious debt trap.

In the land of maple syrup and hockey, household debt has reached unprecedented levels, fueled by historically low interest rates, easy access to credit, and a consumer culture that encourages spending. In this climate, understanding the long-term consequences of your loan choices is more important than ever. The allure of low initial rates and flexible terms can easily mask the potential dangers lurking beneath the surface, especially when the dreaded renewal period arrives.

This comprehensive guide is your roadmap to navigating the complexities of Canadian debt, focusing on the critical distinction between 10-year fixed-rate loans and those with renewal options. Whether you’re a homeowner struggling to manage your mortgage, a student buried in loan payments, or simply seeking to gain control of your finances, this information is essential for your financial journey.

Understanding the Canadian Debt Landscape

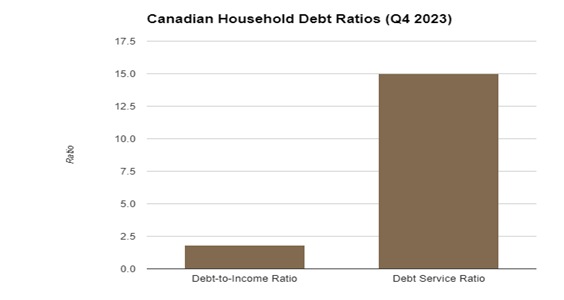

Before we dive into the specifics, it’s important to understand the broader debt landscape in Canada. As of Q4 2023, Statistics Canada reports that the average Canadian household owes $75,674 in credit market debt, excluding mortgages. This figure represents a significant portion of household disposable income, with households owing $1.79 in credit market debt for every dollar of disposable income in Q4 2023. This concerning trend has been fueled by factors like low interest rates, easy access to credit, and a culture of consumerism, contributing to the growing concern surrounding household debt in Canada. Furthermore, the Bank of Canada’s data reveals that Canada’s debt service ratio (DSR) – the share of household disposable income that goes towards paying down principal and interest – rose to 15% in the fourth quarter of 2023. This increase highlights the growing financial strain on households as they grapple with rising debt levels and higher interest payments.

Provincial Variations in Household Debt:

| Provincial Variations | Factors |

| Highest Debt | British Columbia and Ontario consistently rank among the provinces with the highest average household debt levels. In Q4 2023, the average household debt in British Columbia was $100,279, while Ontario’s average was $96,547. |

| Lowest Debt | Atlantic provinces generally have lower average household debt levels. For instance, in the same quarter, New Brunswick’s average household debt was $45,401. |

| Contributing Factors | The variation can be attributed to factors like higher housing costs in B.C. and Ontario, differing economic structures, and regional income disparities. |

The Appeal of 10-Year Fixed Terms

10-year fixed-term loans, particularly for mortgages, have gained popularity in Canada. They offer several advantages:

- Predictability: Your interest rate and monthly payments remain the same throughout the 10-year term, providing stability and peace of mind.

- Protection from Rising Rates: If interest rates increase during your term, you’re shielded from the hikes.

- Simplified Budgeting: Knowing your exact payments makes financial planning easier.

What are considered as Hidden Threats of Renewals?

While 10-year terms offer stability, loans with renewal options can be a double-edged sword. Here’s why:

- The Interest Rate Reset: When your initial term ends, your loan is subject to a rate reset. This means your lender can adjust your interest rate based on prevailing market conditions. If interest rates have risen, your payments could skyrocket.

- Compounded Interest: Each time you renew your loan at a higher interest rate, the amount of interest you owe increases. This can lead to a snowball effect, where a significant portion of your payments goes towards interest, not principal.

- The Debt Trap: The combination of rising interest rates and compounded interest can make it increasingly difficult to pay down your debt. You might find yourself caught in a cycle of renewals, always owing more than you did before.

- Penalties for Breaking Terms: If you decide to switch lenders or refinance your loan before the renewal date, you might face hefty penalties. This can encourage borrowers to seek better deals.

To understand this better, let’s consider a typical Canadian homeowner with a $500,000 mortgage. Here’s how the numbers might play out over 25 years, comparing a 10-year fixed-term mortgage to one with a 5-year renewal term:

| Scenario | Initial Rate | Renewal Rates | Total Interest Paid |

| 10-Year Fixed | 3.5% | N/A | $235,000 (approx.) |

| 5-Year Renewal | 2.5% | 3.0%, 3.5%, 4.0% | $295,000 (approx.) |

As you can see, even starting with a lower rate, the renewal scenario leads to significantly more interest paid over the life of the loan.

Strategies for Avoiding the Debt Trap

- Choose Wisely: Consider the pros and cons of fixed-term loans vs. renewals. A fixed term might be a safer bet if you anticipate rising interest rates.

- Negotiate: Don’t accept the renewal rate your lender offers without question. Shop around and negotiate for a better deal.

- Refinance: If you’re locked into a high-interest loan, consider refinancing to a lower rate.

- Accelerate Payments: Paying more than the minimum can help you chip away at the principal faster and reduce the overall interest you pay.

The Bigger Picture: Financial Literacy in Canada

There are few Government Initiatives to Address Debt:

- Mortgage Stress Test: The federal government implemented a stricter mortgage stress test in 2018 to ensure borrowers can afford higher interest rates, potentially mitigating excessive borrowing.

- Financial Literacy Programs: Various government-funded programs aim to improve financial literacy among Canadians, covering topics like budgeting, saving, and debt management.

- Consumer Protection Measures: Regulations are in place to protect borrowers from predatory lending practices and ensure fair treatment by financial institutions.

Additionally,

- Seek professional advice: If you’re unsure which loan option is right for you, consult a financial advisor.

- Stay informed: Keep up to date with interest rate trends and economic forecasts.

- Build an emergency fund: Having savings can help you avoid taking on more debt in unexpected situations.

- Prioritize debt repayment: Make paying down your debt a top financial priority.

By taking these steps, you can navigate the Canadian debt landscape with confidence and achieve your financial goals.

The Bottom Line

The choice between 10-year fixed-term loans and those with renewal options is not merely a matter of preference; it’s a decision that can significantly impact your financial future. As Canadians grapple with rising debt levels, understanding the nuances of these loan structures is paramount. Don’t let hidden costs and the debt trap catch you off guard. By arming yourself with knowledge, carefully evaluating your options, and proactively managing your debt, you can pave the way for a more secure financial future. Remember, knowledge is power. Take control of your finances, make informed choices, and break free from the cycle of debt. Your future self will thank you.