Land transfer tax calculator

Estimate Your Land Transfer Tax in Canada

When purchasing a home in Canada, buyers are required to pay a land transfer tax (LTT), which varies by province and municipality. Our Land Transfer Tax Calculator helps estimate the total tax amount based on the property purchase price and location, factoring in applicable rebates for first-time homebuyers.

Land transfer tax

Provincial:

Muncipality:

Rebate:

Total Tax:

Key Features of Our Land Transfer Tax Calculator:

- Accurate Tax Estimation: Get a precise breakdown of provincial and municipal land transfer taxes.

- First-Time Homebuyer Rebates: Calculate applicable rebates based on your eligibility.

- Location-Specific Tax Calculations: Understand tax variations in Ontario, Toronto, and other provinces.

- Clear Cost Breakdown: View how taxes impact your overall closing costs.

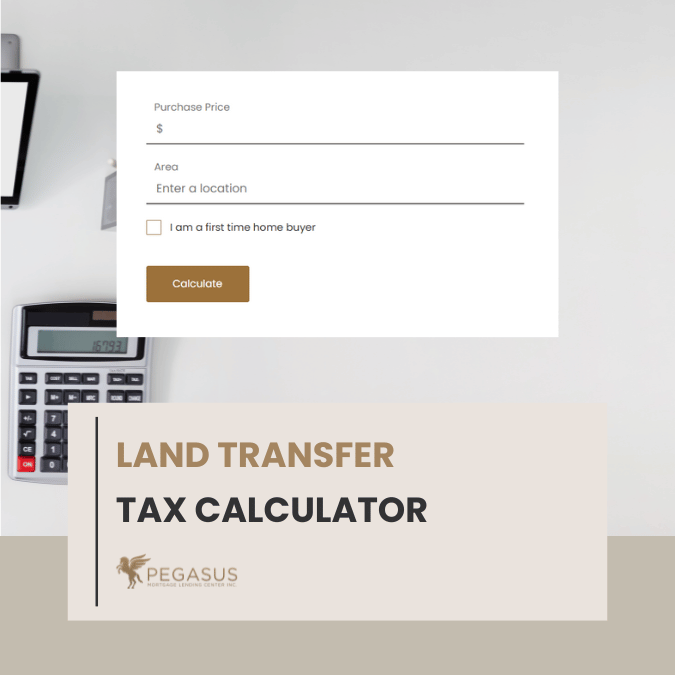

How to Use the Land Transfer Tax Calculator

- Enter the Purchase Price: Input the cost of the property you are buying.

- Select the Province/City: The tax structure varies by region (e.g., Ontario, Toronto).

- Indicate First-Time Buyer Status: If applicable, enter your first-time homebuyer status to calculate rebates.

- Calculate: View the total land transfer tax amount, including rebates and provincial/municipal taxes.

Understanding Land Transfer Tax in Canada

What is Land Transfer Tax?

Land transfer tax is a one-time fee paid when purchasing real estate. Each province, and some municipalities, impose their own rates. Buyers in cities like Toronto must pay both provincial and municipal land transfer taxes.

How to Calculate Land Transfer Tax

If you’re wondering how to calculate land transfer tax, the formula is:

Rates vary by province. Here’s a breakdown for Ontario:

- Up to $55,000 → 0.5%

- $55,000 – $250,000 → 1%

- $250,000 – $400,000 → 1.5%

- $400,000 – $2,000,000 → 2%

- Above $2,000,000 → 2.5%

For Toronto, add the municipal LTT using the same rate structure.

Use our Ontario land transfer tax calculator or Toronto land transfer tax calculator for exact amounts.

Land Transfer Tax Rebates

First-Time Homebuyer Rebates

Ontario offers rebates up to $4,000, and Toronto provides an additional rebate of up to $4,475.

Eligibility criteria:

- Must be a first-time homebuyer.

- Must occupy the home as a primary residence.

- Cannot have previously owned property worldwide.

Our land transfer tax calculator Ontario factors these rebates into your tax estimate.

Other Closing Costs to Consider

Besides LTT, homebuyers should budget for:

- Legal Fees: $1,000 – $2,500

- Title Insurance: $300 – $1,000

- Home Inspection: $300 – $500

FAQs on mortgage payment calculator

How do you calculate land transfer tax?

Use our Land Transfer Tax Calculator to determine the tax based on purchase price and location.

How is land transfer tax calculated in Ontario?

Ontario applies a tiered tax rate, ranging from 0.5% to 2.5%, with additional municipal tax in Toronto.

Do first-time homebuyers pay land transfer tax?

First-time buyers may qualify for rebates, reducing or eliminating the tax in some cases.

Can land transfer tax be added to a mortgage?

No, LTT must be paid upfront at the time of property transfer.

Does every province charge land transfer tax?

Most provinces charge LTT, except Alberta and Saskatchewan, which have smaller registration fees.

Be Prepared for Your Home Purchase

Land transfer tax can be a significant expense when buying a home. Use our Land Transfer Tax Calculator to estimate your costs and plan your finances accordingly.

Get Expert Mortgage Advice with Pegasus Mortgage Lending

Ensure a smooth home-buying process with Pegasus Mortgage Lending. Use our Land Transfer Tax Calculator today and explore mortgage options with expert guidance.