Despite the continuously rising inflation and interest rates, Canadian individuals are optimistic that there will be an economic improvement with the start of the new year.

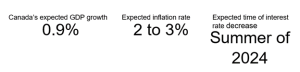

While we can’t predict the future with absolute certainty, our experienced team has examined several indicators to determine the economic forecast for 2024. The estimates rely on a few things, like how Canada’s economy is performing and how Canada depends on other central banks, especially the ones in the US and European Union. The central bank is starting to control inflation better, and some things like the GDP and job numbers suggest the economy might bounce back. This could mean the bank might lower interest rates by summer.

Canadian Mortgage Forecast 2024

- Demand for fixed-rate mortgages will decline throughout 2024.

- It will now become more accessible to qualify for mortgages as there will be relaxations in the stress test.

- Increased expectations for income growth and market returns might boost the demand for variable-rate mortgages. However, the risk of rising rates and higher payments can be a significant concern.

- Real estate rates will have a modest rise throughout 2024.

- Renewing into higher rates will strain household budgets, but most homeowners will be able to manage.

Some key Predictions for 2024:

Canadian Housing Market Forecast 2024:

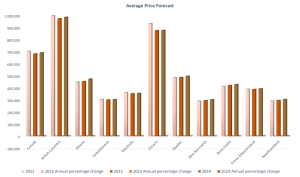

While national home sales dropped around 9.8% in 2023, projections from CREA suggest a rebound of about 9% in 2024. This brings sales closer to the national average. Leading the charge in home sales for 2024 are Ontario (up 10.8%), Nova Scotia (up 10.4%), Newfoundland and Labrador (up 9.8%), and Alberta (up 9.6%). Home prices are expected to make modest gains this year, likely around 1.5% nationwide. Despite a projected 10.8% increase in sales in Ontario, prices are predicted to remain stable. The provinces set to experience the most significant price hikes in 2024 are Alberta (up 4.8%), New Brunswick (up 2.7%), and Newfoundland and Labrador (up 2.6%). The economy might seem uncertain, but it’s not all negative news. While interest rates could be a concern for some, there will be plenty of opportunities for those planning moves in 2024. Whether buying or selling, reaching out to an experienced mortgage agent who understands local insights and trends could be your key to success. The graph below will help clarify the data mentioned above.

Investment Outlook Canada 2024

In 2023, rising interest rates took a toll on most bonds, stocks, and equities. This impacted cautious investors’ portfolios holding bonds, real estate investment trusts (REITs), utilities, and financials. However, in 2024, these sectors are expected to recover while guaranteed investment certificates and money market funds might need to catch up. In Canada, utilities dropped by over seven percent in the past two years. Capped REITs fell over 10 percent, and capped financials only rose by two percent during the same period. We predict overall improvement in the bond market, though not massive gains. Lower rates might benefit the long end of the bond market the most. Still, significant drops in long-term bond yields aren’t expected from current levels. They’re also quite unpredictable. Middle-range corporate bonds might offer better risk/reward returns in 2024. High-yielding structured notes offer promising returns of 10 percent to 14 percent. But these high yields might only last for a while, so seizing this opportunity now could be wise.

The Bottom Line

Over the years, we’ve seen that making precise futuristic predictions is tough. However, that won’t stop us from giving it a shot. At Pegasus, we base our analysis on how well Canada’s economy is doing and its ties with global banks. The Canadian housing market has been full of surprises in the last three years, seeing soaring prices, limited supply, and a drastic change from low to high interest rates. Mortgage trends for 2024 show changes in fixed and variable rates and the ease of attaining a mortgage. Home sales might bounce back by 9%, coming close to the national average. Even with uncertainties, real estate and investment opportunities exist for those ready to navigate the changes.