While recent data recognizes Canadian mortgage holders’ perseverance in the face of increased borrowing prices, it also presents a worrying picture.

Equifax Canada’s fourth-quarter 2023 report reveals a troubling trend: an increasing number of borrowers are falling behind on their mortgage payments, particularly as they face renewals at higher rates. In Ontario, mortgage negligence rates have skyrocketed by 135.2%, while British Columbia has seen a 62.2% surge. These jumps stand out even more than what we witnessed during the pandemic when many couldn’t afford to pay.

Renewed mortgages bring added financial strain, with payments across Canada rising by an average of $457. However, the burden is even heavier in British Columbia and Ontario, with payments soaring by over $680. It’s evident that despite past resilience, mortgage holders are now facing mounting pressure, demanding immediate attention and proactive measures.

Since the Bank of Canada initiated its rate hiking cycle in March 2022, 68.5% of respondents have found meeting their mortgage payments challenging. Among this group, an alarming 66.9% express genuine concern about their ability to afford mortgage payments upon renewal.

The financial burden has increased due to the rise in fixed and variable mortgage rates from 2020. Being able to finance a mortgage is getting harder and more complex; therefore, being proactive is crucial to surviving these rough economic conditions.

Understanding Canadian Household Debt: Improving Trends Linked to Rising Rates

The latest wealth and income data from Statistics Canada show that household debt increased by 3.4% in 2023. It is the slowest growth rate since the 1990s, mainly because higher interest rates have made it more challenging for people to afford big mortgages. This means borrowers now qualify for smaller loans. Consequently, the debt-to-income ratio decreased by 0.5% to 178.7%, marking its lowest point since Q2 2021. In Q4, the household debt service ratio reached 15%, the highest ever recorded. The main boost to wealth came from the bond and stock markets. Thanks to them, household net worth increased by 1.8% in Q4 to $16.42 trillion.

Understanding Canada’s Private Mortgage Lending Challenges

Canada’s mortgage market is valued at C$2 trillion, with the “Big Six” major banks (TD, Royal Bank, Bank of Montreal, Scotiabank, CIBC, and National Bank) primarily controlling $1.5 trillion of this total. However, for individuals unable to meet the stringent criteria for a bank loan, there has always been an alternative: private lenders offering short-term mortgages at significantly higher interest rates. Among these lenders are Mortgage Investment Companies (MICs), which have experienced rapid growth over the last three years, particularly during the housing market surge in 2022 fueled by record-low borrowing costs. However, as the real estate market cooled down over the past year and living costs and interest rates surged, homeowners faced challenges in meeting their mortgage payments. This led to increased defaults, forcing many MICs to sell properties at discounted rates to mitigate losses.

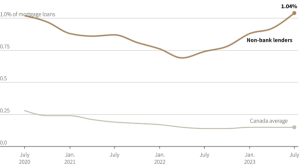

Rising Mortgage Delinquencies Among Canadian Non-Banking Lenders

Unpaid Mortgage Loans: Share Outstanding for Over 90 Days Past Due Date

Source: Canada Mortgage and Housing Corporation

Statistics from the Canada Mortgage and Housing Corp reveal that nearly 1% of mortgages from private lenders were delinquent in the third quarter of 2023, significantly contrasting to the industry-wide delinquency rate of 0.15%. In the first quarter of 2023, the market share of newly extended mortgages by private lenders surged to 8%, while that of big banks declined to 53.8%.

Research conducted by Toronto-based commercial mortgage brokerage LandBank Advisors illustrates the strain on private lenders. Approximately 90% of homeowners who were compelled to sell their properties due to defaults in the Greater Toronto Area had acquired mortgages from private lenders. Of these, more than half were provided by MICs.

Private lenders, under the oversight of provincial governments, operate with notably fewer regulations than significant banks. Unlike their banking counterparts, they aren’t bound by federally mandated mortgage stress tests, which ascertain borrowers’ ability to manage payments despite rising interest rates. Despite the absence of direct oversight from the Office of the Superintendent of Financial Institutions, Peter Routledge remains vigilant. He acknowledges the potential risks posed by an unchecked expansion of unregulated lending. However, Routledge assures that, as of now, the sector’s growth trajectory doesn’t raise immediate alarms.

The story highlights the resilience of Canadian homeowners in the face of adversity:

| In Langley, British Columbia, the Dueck family embarked on a mission amid the pandemic, selling their townhome to invest in a house with a basement suite for vulnerable youth. But as interest rates soared unexpectedly, their mortgage payments nearly doubled, forcing tough choices. Dueck and her spouse’s monthly mortgage payment is $6,300, which has increased by $2,700 since they purchased the home. They stopped investments, cancelled vacations, and rented out rooms to stay afloat. Similar struggles were felt by families across Canada who chose variable-rate mortgages during low-interest periods. |

The Bottom Line

In light of the recent surge in mortgage payment defaults, it’s crucial to acknowledge the pivotal role of government programs in supporting homeowners confronting foreclosure. While private lenders have offered alternatives for those unable to meet conventional bank loan criteria, it’s essential to recognize the associated risks. Government programs serve as a vital lifeline for homeowners facing foreclosure, offering assistance, guidance, and potential financial relief to distressed borrowers. Whether through loan modifications, refinancing options, or counselling services, government intervention aims to prevent unnecessary foreclosures and ease the burden on struggling homeowners.