The Bank of Canada’s decision to cut interest rates for the first time in over four years has sparked mixed reactions in the housing market. While a lower overnight rate means lenders will offer slightly lower prime rates on mortgages, home equity lines of credit (HELOCs), and other loans, the 25-basis point reduction may not significantly impact homebuyers’ ability to afford properties. Despite the Bank of Canada’s interest rate cut, high housing prices, stringent mortgage stress tests, and depleted down payment savings remain major barriers for first-time homebuyers in cities like Toronto. However, some anxious prospective buyers may perceive this as a sign of rising purchasing power, potentially igniting fear of missing out (FOMO) and boosting interest in the real estate market.

Impact of the Rate Cut on Affordability

The Bank of Canada’s rate cut has sparked mixed reactions in the housing market, with some experts suggesting it may not significantly improve affordability for homebuyers. Despite the potential for slightly lower mortgage rates, high housing prices, stringent mortgage stress tests, and depleted down payment savings remain major obstacles, particularly for first-time buyers in cities like Toronto.

- Initial Market Reactions: Immediately following the announcement, some prospective buyers anxiously awaiting improved affordability viewed the rate cut as a signal that their purchasing power could rise. This fueled fear of missing out (FOMO) and drove more interest in the real estate market from those hoping to capitalize on the potential for increased affordability.

- Expert Opinions on Affordability: However, many experts caution that the 25-basis point reduction may not meaningfully impact homebuyers’ ability to afford properties. Given the persistently high home prices and stringent mortgage qualification rules, we expect a minimal overall impact on affordability from lower prime rates. Economists and housing analysts suggest that more substantial rate cuts or complementary measures, such as adjustments to the mortgage stress test, may be necessary to significantly improve affordability for prospective homebuyers, particularly in major urban centres.

Effects on Variable Mortgage Rates

The Bank of Canada’s rate cut will immediately impact variable mortgage rates, providing some relief to borrowers with adjustable- or variable-rate mortgages. Here’s what homebuyers need to know:

1) Immediate Changes in Monthly Payments:

- For those with adjustable-rate mortgages, the interest rate reduction will immediately translate into lower monthly payments.

- Consider a homeowner with an adjustable five-year mortgage rate of 5.95% and a mortgage balance of $328,000 (the average based on CMHC data).

- After a 25-basis point rate cut, their $2,170 monthly payment would decline by $47, assuming they still have 23 years left to pay the mortgage fully.

For variable-rate mortgage holders, while the installment amount usually remains the same until the end of the loan term, a lower rate means more of the payment goes toward the principal rather than interest. This reduces the outstanding balance more quickly.

2) Strategies for Variable Mortgage Holders

- While the rate cut provides some immediate relief, variable rates are still considerably higher than some fixed-rate options. Borrowers need to weigh their options carefully.

- Those renewing soon face a dilemma: lock into a competitive fixed rate or opt for a still-elevated variable rate, betting on future cuts. For example, a borrower choosing between a 4.95% three-year fixed rate or a 6.2% variable rate may find the variable only becomes more affordable after a year or longer of cuts.

- The choice comes down to immediate payment relief and security with a fixed rate, or potential long-term savings but uncertainty with a variable rate. Ultimately, some may prioritize short-term affordability over potential future savings.

This single cut may not provide much relief to homeowners burdened by variable debt, particularly if they have additional high-interest debt. It could take three or four more reductions before households see significant relief, which may not happen until 2025.

Changes to Fixed Mortgage Rates: A More Indirect Impact

Bond yields and overall investor confidence determine fixed mortgage rates, which the Bank of Canada’s rate cut will indirectly impact. While the central bank’s decisions influence bond markets, fixed rates were already largely priced in the 25-basis point reduction.

Long-Term Implications: A Balancing Act

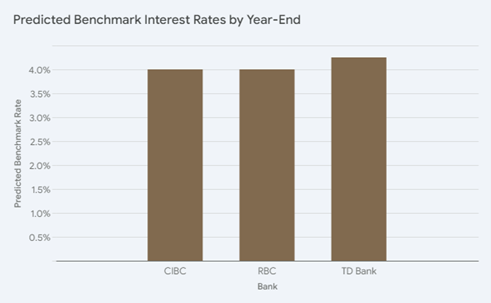

Bank of Canada Governor Tiff Macklem stated that further rate cuts are reasonable to expect, but the central bank is making decisions one at a time. Major banks have varying predictions, with TD Bank forecasting two more cuts by year-end (bringing the benchmark to 4.25%), while CIBC and RBC anticipate three more cuts (to an even 4%). A full percentage point reduction on a $600,000 mortgage could translate into around $349 in monthly savings. However, a key insight is that the downward pressure on consumption from rate hikes could last longer than the rate hike cycle itself. This is because higher rates not only temporarily increase mortgage payments, but also reduce the share of payments that pay off the principal. A few years of elevated rates will lead to a larger remaining balance, negatively affecting borrowers’ consumption in the future. Unexpected rate increases have reduced the average mortgage borrower’s consumption by 2.8% as of April 2024, expected to reach 3.8% in early 2028.

Advice for Prospective Buyers

For those contemplating fixed-rate mortgages or debt, the impact will depend on how the Bank of Canada’s decision affects investors’ expectations. If the central bank appears more timid about future cuts than expected, fixed rates could rise, and vice versa if it seems more aggressive.

Practically speaking, a 25-basis point cut may not significantly impact affordability for home buyers. If fixed rates remain static, it could take up to eight rate cuts for variables to become the cheaper option. Buyers still face obstacles such as high housing prices, the mortgage stress test, and depleted down payment savings. While some may view the rate cut as a sign of improved buying power, fueling FOMO, the overnight rate only has an impact on variable rates. Buyers who couldn’t qualify for lower fixed rates previously will likely still face the same challenges.

Psychological Impact on Homebuyers

The likelihood of a higher-rate environment for the foreseeable future may convince some buyers to stay on the sidelines for now. However, many will probably accept the new reality and push ahead with their homebuying plans, partly because of shifting buyer psychology when the bank is more likely to cut than hike. There is a realization that lower rates down the line could lead to a corresponding increase in competition and prices.

News of the interest rate cut will usher a sense of relief into the market. While a quarter-percentage-point rate cut itself may not spur a flood of new buyers, the shift in monetary policy and suggestions from Bank of Canada officials that further drops are on the cards could have a psychological impact on buyers. Hopes for additional interest rate cuts this year will bring more buyers off the sidelines.

| Market Confidence | Potential Future Rate Cuts |

| Many buyers have been delaying their house hunting in anticipation of an interest rate cut. New homebuyers, including those who were previously inactive as well as individuals who deferred purchasing in anticipation of more favourable interest rates, are likely to re-enter the market this summer in search of deals with a supportive environment.We expect this pent-up demand to drive both sales and, to some extent, prices higher than what we’ve seen recently. | Previous studies in housing markets indicate that future price appreciation expectations moderate the impact of rate cuts.If buyers expect future housing prices to rise, the summer housing market is likely to experience a higher sales volume. Therefore, even moderate rate cuts will impact sales volume in the short term, if not prices. |

The Bottom Line

The Bank of Canada’s decision to cut interest rates has stirred mixed reactions in the housing market. Although the rate reduction might offer some respite to borrowers with adjustable or variable-rate mortgages, we anticipate a limited impact on the overall affordability for potential homebuyers. High housing prices, stringent mortgage stress tests, and depleted down payment savings remain significant barriers, especially for first-time buyers in major urban centres.

However, we cannot overlook the psychological impact of the rate cut. The prospect of further rate reductions and improved affordability in the future may fuel fear of missing out (FOMO) among potential buyers, driving renewed interest in the real estate market. This pent-up demand could increase sales volume, although its effect on housing prices remains uncertain and largely dependent on buyers’ expectations of future price appreciation.

FAQs

- How will a rate hike by the Bank of Canada impact your mortgage?

A rate hike can lead to increased mortgage payments, which may also result in a larger portion of these payments going towards interest rather than the principal. This means that over a few years, you might end up with a significantly larger mortgage balance to pay off, which could negatively impact your future spending.

- What is the implication of a rate cut by the Bank of Canada?

When the Bank of Canada cuts its interest rates and your lender lowers their prime rate accordingly, you, as a holder of a variable-rate mortgage, stand to gain in one of two ways. You may see a reduction in your regular mortgage payments, or a larger portion of your payments may go towards reducing your mortgage’s principal amount.

- What happens to my mortgage payments if interest rates increase?

If you have a discount or standard variable rate mortgage, an increase in the base rate will likely cause your mortgage payments to rise. The exact amount will depend on the terms set by your lender. Conversely, if the base rate falls, your payments might decrease.

- What is the financial impact of a 1-percent change in mortgage interest rates?

A 1 percent change in the mortgage rate can lead to substantial savings, potentially amounting to thousands or even tens of thousands annually. The exact savings depend on your home’s purchase price, overall mortgage rate, and total amount financed.