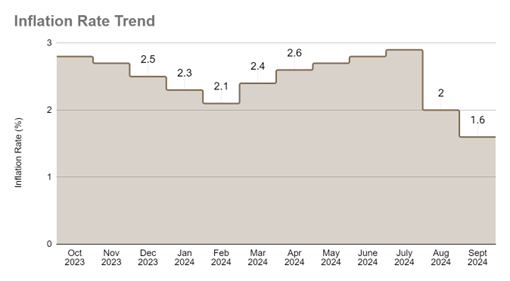

In a welcome development for Canadians, the inflation rate fell to 1.6% in September, according to Statistics Canada. This marks the lowest rate since February 2021 and falls below the Bank of Canada’s 2% target. The decline was primarily driven by lower gasoline prices, which fell 10.7% year-over-year.

While this news is undoubtedly positive, it’s important to note that prices for many essential goods and services remain elevated. For example, food prices continued to rise faster than overall inflation, increasing by 2.4% year-over-year. Rent prices also continued to climb, albeit slower than in August.

What’s Driving the Decline?

The main factor contributing to the lower inflation rate is the decrease in gasoline prices. This is a welcome relief for consumers who have been feeling the pinch at the pumps. However, other factors are also at play, including:

- Easing Supply Chain Disruptions: Global supply chain issues that have plagued the economy in recent years are starting to resolve, leading to lower prices for some goods. For instance, semiconductor shortages that impacted the automotive industry are easing, resulting in lower prices for new and used vehicles. Similarly, congestion at major ports has decreased, leading to lower shipping costs and ultimately lower prices for imported goods.

According to the New York Federal Reserve’s Global Supply Chain Pressure Index (GSCPI), supply chain pressures have eased significantly from their peak in December 2021. The GSCPI, which tracks various indicators such as shipping costs and delivery times, has fallen by over 40% since then.

- Stronger Canadian Dollar: The Canadian dollar has appreciated against the US dollar in recent months, making imports cheaper. This is due to various factors, including higher commodity prices and a more optimistic outlook for the Canadian economy compared to the US. A stronger Canadian dollar reduces the cost of imported goods, which puts downward pressure on inflation. This is particularly impactful for goods like electronics, clothing, and other consumer products that Canada imports in large quantities. This reduction in import costs helps to ease inflation, even for products that aren’t produced domestically.

The Canadian dollar has risen by approximately 4% against the US dollar since July 2024. This appreciation makes imported goods, such as electronics, clothing, and automobiles, less expensive for Canadian consumers.

- Bank of Canada Rate Hikes: The Bank of Canada’s previous interest rate hikes are starting to have an impact on consumer spending and demand, which is helping to cool inflation. Higher interest rates make borrowing more expensive, which discourages consumer spending and business investment. This reduced demand helps to moderate price increases.

Retail sales in Canada have slowed in recent months, indicating that higher interest rates are starting to curb consumer spending. Furthermore, housing market activity has also cooled down, with both sales and price growth moderating.

Understanding Overall vs. Core Inflation

While the headline inflation rate provides a general overview of price changes, it’s important to also consider core inflation. Core inflation excludes volatile items such as gasoline and food, giving a clearer picture of persistent price pressures in the economy. In September, core inflation remained at 2.2%, indicating that underlying inflationary pressures persist even as gasoline prices have fallen. This means that while lower gas prices provide some relief, other sectors of the economy may still be experiencing significant price increases.

Why are Food and Rent Prices Still Climbing?

Despite the overall cooling of inflation, food and rent prices continue to be a concern for many Canadians. Here’s a closer look at the factors contributing to these persistent price pressures:

| Food Prices | Rent Prices |

| Global supply chain disruptions: The war in Ukraine, extreme weather events in key agricultural regions, and ongoing logistical challenges continue to disrupt global food supply chains, leading to higher prices for many food items.Increased input costs: Farmers and food producers are facing higher costs for inputs such as fertilizer, fuel, and packaging, which are being passed on to consumers in the form of higher prices.Strong domestic demand: Robust demand for food products in Canada, coupled with limited domestic production of certain items, can contribute to upward pressure on food prices. | Housing supply shortage: A chronic shortage of affordable housing in many Canadian cities, particularly in major urban centers, is driving up rent prices.Increased demand: Strong population growth, immigration, and urbanization are increasing demand for rental housing, further exacerbating the supply shortage and pushing rents higher.Rising operating costs: Landlords are facing higher costs for property taxes, maintenance, and utilities, which they may pass on to tenants in the form of rent increases. |

What Does This Mean for the Future?

The lower-than-expected inflation rate increases the likelihood of a larger interest rate cut at the Bank of Canada’s upcoming meeting on October 23rd. This could lead to lower mortgage rates, making it more affordable for homebuyers to enter the market.

However, the Bank of Canada faces a delicate balancing act. While rate cuts can stimulate economic growth and make borrowing more affordable, they can also lead to higher inflation if applied too aggressively. The Bank must carefully weigh the potential benefits of stimulating the economy against the risk of reigniting inflation. They will likely continue to monitor the situation closely, considering factors such as core inflation, economic growth, and employment levels, before making any decisions about further rate adjustments.

Possible Scenarios:

- Aggressive Rate Cut: If the Bank of Canada believes that the economic slowdown is more severe than anticipated, they may opt for a larger rate cut (e.g., 50 basis points) to stimulate economic activity and prevent inflation from falling too far below the target.

- Cautious Approach: Alternatively, if the Bank is concerned about persistent core inflation, they may choose a smaller rate cut (e.g., 25 basis points) or even hold rates steady. This approach would prioritize keeping inflation expectations anchored and prevent a resurgence of inflationary pressures.

Impact on Homebuyers and Homeowners

The cooling inflation rate and the potential for lower interest rates are good news for both homebuyers and homeowners. Here’s how:

Homebuyers:

- Lower mortgage rates: A rate cut could lead to lower mortgage rates, making it more affordable to purchase a home. This could potentially offset the impact of rising home prices, making homeownership more attainable for first-time buyers.

- Example: A 50 basis point reduction in mortgage rates on a $500,000 mortgage amortized over 25 years could result in monthly savings of approximately $150.

- Increased affordability: Lower inflation means that the cost of goods and services is decreasing, which could free up more money for a down payment or mortgage payments. This improved affordability could make it easier for potential homebuyers to save for a down payment and qualify for a mortgage.

- Less competition: A more balanced housing market could mean less competition for homes, giving buyers more negotiating power. With less competition, buyers may be able to negotiate better prices and avoid bidding wars, leading to more favorable purchase terms.

Homeowners:

- Lower mortgage payments: If you have a variable-rate mortgage, a rate cut could lead to lower monthly payments. This could provide some financial relief for homeowners who are struggling with rising costs of living.

- Increased affordability: Lower inflation could make it easier to manage household expenses, including mortgage payments and property taxes. This could free up more disposable income for homeowners, allowing them to save, invest, or pay down debt.

- Potential for increased home equity: While a more balanced market might mean slower price growth, it also reduces the risk of a sharp decline in home values. This provides stability and security for homeowners, protecting their investment in their property.

Regional Variations in Inflation While the national inflation rate provides a useful overview, it’s important to recognize that inflation can vary significantly across different regions of Canada.

- Atlantic Canada: Inflation in Atlantic Canada has been persistently higher than the national average, driven by factors such as higher energy costs, a tighter labour market, and increased demand for housing. For example, in September 2024, Prince Edward Island recorded an inflation rate of 2.7%, significantly higher than the national average of 1.6%. This regional disparity highlights the need for tailored economic policies that address the specific challenges faced by different provinces.

- The Prairies: In contrast, inflation in the Prairies has been relatively lower, due in part to lower housing costs, a strong agricultural sector, and increased energy production. Saskatchewan, for instance, had an inflation rate of just 1.1% in September 2024, well below the national average. This demonstrates how regional economic factors can influence inflation rates and underscores the importance of considering regional nuances when analyzing economic trends.

Global Economic Risks and Their Impact on Inflation

The global economic landscape is constantly evolving, and various geopolitical events and risks could impact Canada’s inflation rate in the future.

- The war in Ukraine: The ongoing conflict in Ukraine has disrupted global supply chains, particularly for energy and agricultural commodities. This has contributed to higher prices for fuel and food, which could continue to put upward pressure on inflation in Canada.

- Energy price fluctuations: Geopolitical tensions, supply disruptions, and changes in global energy demand can lead to significant price swings, affecting transportation costs, production expenses, and ultimately consumer prices. A sudden surge in energy prices could reignite inflationary pressures, while a sharp decline could lead to deflationary concerns.

- Global trade disruptions: Trade tensions, protectionist policies, and geopolitical events can disrupt global trade flows, impacting the availability and cost of imported goods in Canada. This could lead to higher prices for consumers and businesses, contributing to inflationary pressures.

- Climate-related challenges: Extreme weather events, such as droughts, floods, and wildfires, can disrupt agricultural production and supply chains, leading to higher food prices and increased costs for other goods and services. As climate change intensifies, these types of events may become more frequent and severe, posing a growing risk to price stability.

Canada’s Inflation Cools Down: A Glimmer of Hope, But Challenges Remain

The recent drop in Canada’s inflation rate to 1.6% offers a much-needed respite for consumers and provides a glimmer of hope for the economy. Looking ahead, the Bank of Canada faces a delicate balancing act. They must carefully consider the need for further interest rate cuts to stimulate the economy while remaining vigilant about the risk of reigniting inflation. The global economic landscape, with its geopolitical tensions and potential disruptions, adds further complexity to the outlook. For homebuyers and homeowners, the cooling inflation and potential for lower mortgage rates offer some welcome relief. However, affordability challenges persist, particularly in the housing market.

Ultimately, navigating the current economic environment requires careful monitoring of inflation trends, prudent financial planning, and adaptability to changing circumstances. While the recent decline in inflation is encouraging, it’s essential to remain mindful of the ongoing challenges and uncertainties that lie ahead.