Navigating retirement planning in Canada can feel like a complex journey, but at its heart lies a cornerstone of financial security for millions: the Canada Pension Plan (CPP). Understanding the Canada Pension Plan is crucial for every working Canadian, from those just starting their careers to those nearing retirement. This comprehensive guide will delve into the intricacies of the Canada Pension Plan, exploring its purpose, how it functions, its ongoing enhancements, and how it impacts your financial future. We’ll also cover essential details like the Canada Pension Plan login process, how to use a Canada Pension Plan Calculator, and address common questions such as “Is Canada Pension Plan taxable?”.

What is a Pension Plan in Canada? The Foundation of Retirement Security

What is a pension plan in Canada? At its core, a pension plan in Canada is a savings vehicle designed to provide income during retirement. These plans can take various forms, from employer-sponsored defined benefit or defined contribution plans to individual Registered Retirement Savings Plans (RRSPs). However, the Canada Pension Plan stands apart as a mandatory, government-administered social insurance program. It’s a fundamental pillar of Canada’s retirement income system, ensuring a baseline level of financial support for eligible contributors when they retire, become disabled, or pass away, providing benefits to their survivors. The Canada Pension Plan is a universal program for most working Canadians outside of Quebec (Quebec has its own similar program, the Quebec Pension Plan, or QPP).

Understanding the Canada Pension Plan: A Deep Dive into Contributions and Benefits

The Canada Pension Plan operates on a contributory principle, meaning that individuals contribute to the plan throughout their working lives, and these contributions, along with investment income, fund the benefits paid out. Every employed and self-employed person in Canada (excluding Quebec) aged 18 and over, earning more than a minimum annual amount, is required to contribute to the Canada Pension Plan.

The contributions to the Canada Pension Plan are shared between employees and employers. For employees, a portion of their earnings is deducted from each paycheque and remitted to the Canada Pension Plan. Employers match these contributions. Self-employed individuals contribute both the employee and employer portions. The contribution rates and the maximum amount of earnings on which contributions are made (known as the Year’s Maximum Pensionable Earnings, or YMPE) are adjusted annually. For example, for 2025, the Year’s Maximum Pensionable Earnings (YMPE) is $71,300, with a basic exemption of $3,500. Contributions are paid on earnings between these two figures.

The Canada Pension Plan offers several types of benefits, including:

- Retirement Pension: The most common benefit, providing a regular monthly income when you retire.

- Disability Benefits: Financial support for contributors who become severely disabled and unable to work.

- Survivor Benefits: Payments to the spouse or common-law partner and dependent children of a deceased contributor.

- Death Benefit: A one-time payment to the estate of a deceased contributor.

The amount of your Canada Pension Plan retirement pension depends on several factors, notably how much and for how long you contributed, and the age at which you begin receiving your pension. While the standard age to start receiving the Canada Pension Plan is 65, you have the flexibility to begin as early as age 60 or as late as age 70. Starting earlier will result in a permanently reduced pension, while delaying it will lead to a permanently increased pension. This decision is a crucial aspect of retirement planning and should be carefully considered.

Canada Pension Plan Enhancements: A Stronger Future

Since 2019, the Canada Pension Plan has been undergoing a significant enhancement designed to provide greater financial security for future retirees. This enhancement involves a gradual increase in both contributions and benefits. Before the enhancement, the Canada Pension Plan aimed to replace one-quarter (25%) of a contributor’s average work earnings. With the enhancement, the long-term goal is for the Canada Pension Plan to replace one-third (33.33%) of covered average work earnings.

This enhancement is being phased in through two additional components. The first additional component was phased in between 2019 and 2023, and the second additional component is being phased in over 2024 and 2025. This means that Canadians who work and contribute to the Canada Pension Plan in 2019 or later will gradually receive higher benefits, leading to greater financial stability in retirement. For instance, the maximum level of earnings protected by the Canada Pension Plan has also been increased by 14% over 2024 and 2025, further bolstering its ability to provide comprehensive coverage.

Is Canada Pension Plan Taxable? Understanding Your Tax Obligations

A common question among Canadians planning for retirement is, “Is Canada Pension Plan taxable?” The answer is yes. Your Canada Pension Plan retirement pension, along with other CPP benefits such as disability and survivor benefits, is considered taxable income by the Canada Revenue Agency (CRA). This means that the payments you receive from the Canada Pension Plan will be included in your total income for tax purposes and will be subject to income tax based on your individual tax bracket. It’s essential to factor this into your retirement budgeting and financial planning. While the Canada Pension Plan provides vital income, understanding its taxable nature is key to managing your finances effectively in retirement.

Accessing Your Canada Pension Plan Information: The Canada Pension Plan Login and Calculator

To stay informed about your Canada Pension Plan contributions and estimated future benefits, the Government of Canada provides online tools. The primary portal for accessing your Canada Pension Plan information is through your My Service Canada Account (MSCA). This secure platform allows you to:

- View your Statement of Contributions: This detailed record outlines your Canada Pension Plan contributions and pensionable earnings over your working life.

- View your estimated monthly Canada Pension Plan benefits: Based on your contributions, you can see an estimate of what your future Canada Pension Plan retirement pension might be.

- Check your application status: If you’ve applied for Canada Pension Plan benefits, you can track the progress of your application.

- Update your personal information: While some changes might require direct contact, you can often update details like your telephone number.

To utilize these features, you’ll need to complete the Canada Pension Plan login process. This typically involves registering for a My Service Canada Account if you don’t already have one, and then securely logging in using a GCKey or a Sign-in Partner (your online banking credentials). The Canada Pension Plan login is designed to be user-friendly and secure, providing you with direct access to your vital pension information.

Another valuable resource is the Canada Pension Plan Calculator. While the My Service Canada Account provides personalized estimates, a general Canada Pension Plan Calculator can help you explore different scenarios. These calculators, often found on government websites or reputable financial planning sites, allow you to input various factors like your age, earnings history, and desired retirement age to get an approximate idea of your potential Canada Pension Plan payments. While not as precise as your personalized Statement of Contributions, a Canada Pension Plan Calculator can be a useful tool for initial planning and understanding the impact of different retirement decisions.

Canada Pension Plan March 2025 Payment and Beyond: Staying Informed

Staying abreast of payment dates and any potential changes to the Canada Pension Plan is important for financial planning. The Canada Pension Plan March 2025 payment, like all monthly payments, will be distributed towards the end of the month. Generally, CPP payments are issued on the third-to-last business day of each month. It’s always advisable to consult the official Government of Canada website for the most up-to-date payment schedules for the Canada Pension Plan.

While there isn’t a specific “Canada Pension Plan 2025 bonus payment” in the traditional sense, the ongoing Canada Pension Plan enhancement effectively acts as a long-term bonus. As contributions continue to increase and the enhanced components fully phase in, future retirees will receive higher benefits than they would have under the old system. This gradual increase in the maximum benefits means that those who have contributed to the enhanced Canada Pension Plan for many years will see a substantial increase in their retirement income. This isn’t a one-time lump sum but a permanent increase in your monthly Canada Pension Plan benefit amount, which will become increasingly significant over time.

The Canada Pension Plan in Your Retirement Strategy

The Canada Pension Plan forms a fundamental layer of retirement income for most Canadians. However, it’s crucial to remember that the Canada Pension Plan alone may not be sufficient to maintain your desired lifestyle in retirement. It’s designed to replace a portion of your pre-retirement income, not all of it. Therefore, integrating the Canada Pension Plan into a broader retirement strategy is essential.

Consider these aspects when incorporating the Canada Pension Plan into your financial planning:

- Diversify your income sources: Supplement your Canada Pension Plan with personal savings (like RRSPs and TFSAs), employer pension plans, and other investments.

- Understand the impact of early vs. late retirement: Use a Canada Pension Plan Calculator to see how starting your pension at different ages affects your monthly benefit.

- Account for inflation: While Canada Pension Plan benefits are indexed to inflation, your other retirement savings need to keep pace with the rising cost of living.

- Factor in taxes: Remember that your Canada Pension Plan payments are taxable income.

- Review your Statement of Contributions regularly: This helps ensure your contributions are accurately recorded and gives you the most precise estimate of your future benefits. Regularly checking your Canada Pension Plan login ensures you’re always informed.

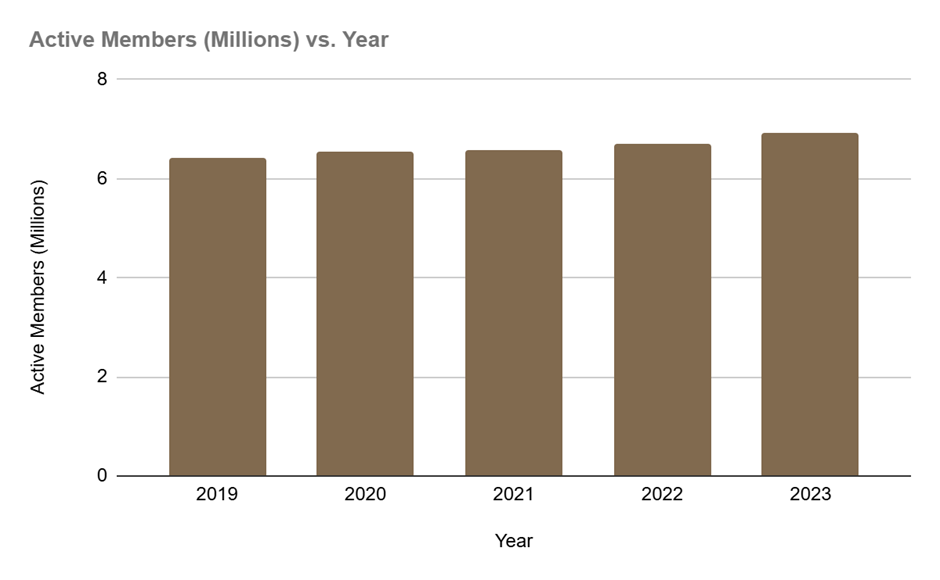

Registered Pension Plans (RPPs) in Canada – Active Members

Source: Statistics Canada

Canada Pension Plan Maximum Monthly Retirement Pension at Age 65 (Selected Years)

Source: Canada.ca – Canada Pension Plan: Pensions and benefits monthly amounts (January data for new beneficiaries at age 65)

Your Canada Pension Plan and a Secure Tomorrow

The Canada Pension Plan is more than just a government program; it’s a collective investment in the financial well-being of all Canadians. From its fundamental role in providing retirement income to its ongoing enhancements ensuring a stronger future, the Canada Pension Plan is an indispensable part of our national social fabric. Understanding how the Canada Pension Plan works, utilizing the Canada Pension Plan login and Canada Pension Plan Calculator, and knowing that your Canada Pension Plan is taxable are all vital steps in taking control of your financial future. While the Canada Pension Plan provides a solid foundation, a truly secure retirement requires comprehensive planning.

Ready to take the next step in securing your financial future and perhaps even making your homeownership dreams a reality?