A mortgage renewal calculator is an essential tool for Canadian homeowners nearing the end of their mortgage term. It helps estimate the new payment structure, potential interest rates, and overall costs associated with renewing a mortgage. If you’re wondering how to calculate mortgage renewal payment, using a well-structured calculator can simplify the process, providing clear insights into what to expect.

Mortgage renewal is an opportunity to reassess financial commitments and explore better interest rates, loan terms, and lender options. Before renewing, it is crucial to evaluate whether your current mortgage provider offers the best terms or if switching to a new lender could be more beneficial.

How a Mortgage Renewal Calculator Works

A Mortgage Renewal Calculator Canada helps estimate your new monthly payments by considering the following factors:

- Outstanding mortgage balance

- Interest rate offered on renewal

- Amortization period

- Mortgage term

- Additional payment options

By inputting these values, homeowners can compare different renewal offers and decide whether to stick with their existing lender or explore competitive mortgage rates from new providers.

Key Factors That Influence Mortgage Renewal Payments

1. Interest Rates

Interest rates play a crucial role in determining your renewal payment. Even a slight increase in rates can significantly impact your monthly mortgage payments.

2. Remaining Mortgage Balance

The amount left on your mortgage determines how much financing is needed upon renewal. Using a renew mortgage calculator can help you estimate the financial impact based on different repayment scenarios.

3. Amortization Period

Extending the amortization period can lower monthly payments, but it increases the total interest paid over the loan’s lifespan.

4. Additional Lump Sum Payments

Some lenders allow lump sum payments, reducing the overall mortgage balance and lowering renewal payments.

5. Type of Mortgage (Fixed vs. Variable Rate)

Choosing between a fixed or variable-rate mortgage can impact your renewal payments. A mortgage calculator renewal can help compare potential outcomes.

How to Calculate Mortgage Renewal Payment?

To calculate your mortgage renewal payment using a mortgage renewal calculator, follow these steps:

- Enter your remaining mortgage balance.

- Select an estimated interest rate.

- Choose your preferred mortgage term (e.g., 1, 3, or 5 years).

- Decide on the amortization period.

- Include any lump sum payments if applicable.

- The calculator will generate your estimated monthly mortgage payment.

The key to a successful renewal is to compare different scenarios and choose the best financial strategy based on your future goals.

Comparing Mortgage Renewal Scenarios: Fixed vs. Variable Rate

The table below compares mortgage renewal options for fixed and variable rates in 2024 and 2025. A mortgage loan of $800,000 is considered for both scenarios. Variable rates tend to fluctuate based on market conditions, potentially offering lower payments when interest rates decrease but posing a risk if rates rise.

| 2024 Scenario | ||||

| Terms | Fixed Rate | Variable Rate | ||

| 8,00,000.00 | Monthly Payment | 8,00,000.00 | Monthly Payment | |

| 1-Year | 6.74% | $5,522.24 | – | – |

| 3-Year | 5.39% | $4,860.29 | 6.25% | $5,277.36 |

| 5-Year | 5.29% | $4,812.88 | 6.30% | $5,302.11 |

| 2025 Scenario | ||||

| Terms | Fixed Rate | Variable Rate | ||

| 8,00,000.00 | Monthly Payment | 8,00,000.00 | Monthly Payment | |

| 1-Year | 5.24% | $4,789.26 | – | – |

| 3-Year | 4.79% | $4,579.36 | 4.30% | $4,356.33 |

| 5-Year | 4.39% | $4,396.86 | 4.50% | $4,446.66 |

| Savings | ||

| Term | Fixed Rate | Variable Rate |

| 1-Year | $732.98 | – |

| 3-Year | $280.92 | $921.02 |

| 5-Year | $416.02 | $855.45 |

Should You Renew with Your Current Lender or Switch?

While many homeowners opt for convenience by renewing with their existing lender, it’s advisable to explore alternative lenders. A mortgage renewal calculator Canada can assist in comparing new offers and identifying cost-saving opportunities. Factors to consider include:

- Interest rate differentials: A lower rate elsewhere can save thousands over time.

- Flexibility in payments: Some lenders offer better prepayment privileges.

- Overall cost-benefit analysis: Fees associated with switching versus potential savings.

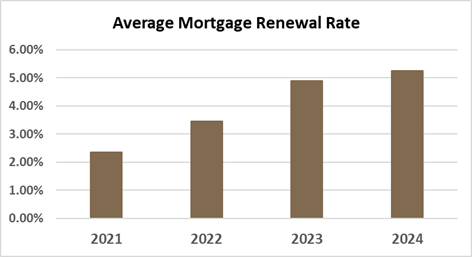

Mortgage Renewal Trends in Canada

This data highlights the importance of planning, as renewal rates fluctuate over time.

How to Get the Best Mortgage Renewal Deal

Preparing for Your Mortgage Renewal

Here are some key steps to take as your mortgage renewal approaches:

- Start Early: Begin the renewal process a few months before your current term expires. This gives you ample time to research options and compare offers.

- Check Your Credit Score: A good credit score can help you secure a better interest rate.

- Shop Around: Don’t automatically renew with your current lender. Get quotes from other banks, credit unions, and mortgage brokers. Using a mortgage calculator renewal for each potential lender can help you compare.

- Consider Your Financial Goals: Think about your long-term financial plans. Do you want to pay off your mortgage faster? Are you considering any major renovations? Your mortgage renewal is a good time to adjust your mortgage to align with your goals.

- Consult a Mortgage Professional: A mortgage broker or advisor can provide valuable guidance and help you find the best mortgage for your needs.

Understanding Different Mortgage Renewal Options

During your mortgage renewal, you may have several options:

- Renew with your current lender: This is often the easiest option, but it’s essential to compare their offer with others.

- Switch lenders: This can be a good option if you find a better interest rate or more favourable terms elsewhere. Be aware of any potential fees associated with breaking your existing mortgage.

- Change your mortgage terms: You might want to adjust your amortization period, payment frequency, or add features like portability or prepayment options.

The Importance of Seeking Professional Advice

Navigating the world of mortgages can be complex. A qualified mortgage professional can provide invaluable assistance by:

- Explaining different mortgage products and features: They can help you understand the nuances of various mortgage options and choose the best one for your situation.

- Negotiating with lenders: They have experience negotiating with lenders and can often secure better rates and terms than you might be able to get on your own.

- Providing personalized advice: They can assess your financial situation and goals and recommend the most appropriate mortgage strategy.

Final Thoughts: Maximizing Savings on Mortgage Renewal

Renewing your mortgage is a critical financial decision that requires careful consideration. By leveraging a mortgage renewal calculator Canada, homeowners can estimate their new payments and explore competitive interest rates. Avoid auto-renewing without comparing multiple options, as a proactive approach can lead to significant savings.

Take Action with Pegasus Mortgage Lending Today!

At Pegasus Mortgage Lending Center, we specialize in helping homeowners secure the best mortgage renewal deals. With expert guidance, fast approvals, and personalized mortgage solutions, we ensure you get the most competitive rates in Canada. Start your mortgage renewal journey today! Contact Pegasus Mortgage Lending for a customized consultation and discover how we can help you save on your mortgage renewal.