The Bank of Mom and Dad has become a critical lifeline for many young adults, especially in the face of rising living costs and an uncertain economy. As housing prices soar and inflation erodes purchasing power, more young people are turning to their parents for financial assistance. While parental generosity is commendable, parents need to maintain their financial well-being and avoid jeopardizing their retirement security.

This article will delve into the delicate balance between providing financial support for adult children and protecting personal finances, while presenting detailed statistics, charts, and tables to illustrate the current trends and advice for navigating this complex issue.

Key Statistics on Parental Financial Support

Here are some important statistics that highlight the current landscape of parental financial assistance:

- 56% of parents in the U.S. provide financial support to their adult children. (Source: Pew Research Center) This support encompasses a wide range of expenses, including housing, food, transportation, and healthcare.

- 29% of parents have dipped into their retirement savings to help their adult children. (Source: Merrill Lynch) This concerning trend underscores the potential long-term consequences of parental financial support.

- The average amount of financial support provided by parents to their adult children is $18,000 per year. (Source: Savings.com) This significant sum can strain parents’ finances and impact their ability to save for their own future.

- 79% of parents believe that providing financial support to their adult children is their responsibility. (Source: AgeWave) This sense of obligation can make it difficult for parents to set boundaries and prioritize their own financial needs.

Why Parents Need to Tread Carefully

As parents offer financial assistance to their children, they must carefully assess their financial standing. Many parents may not fully understand the risks of supporting their children without considering the impact on their retirement savings.

Here are the key factors influencing parental financial support today:

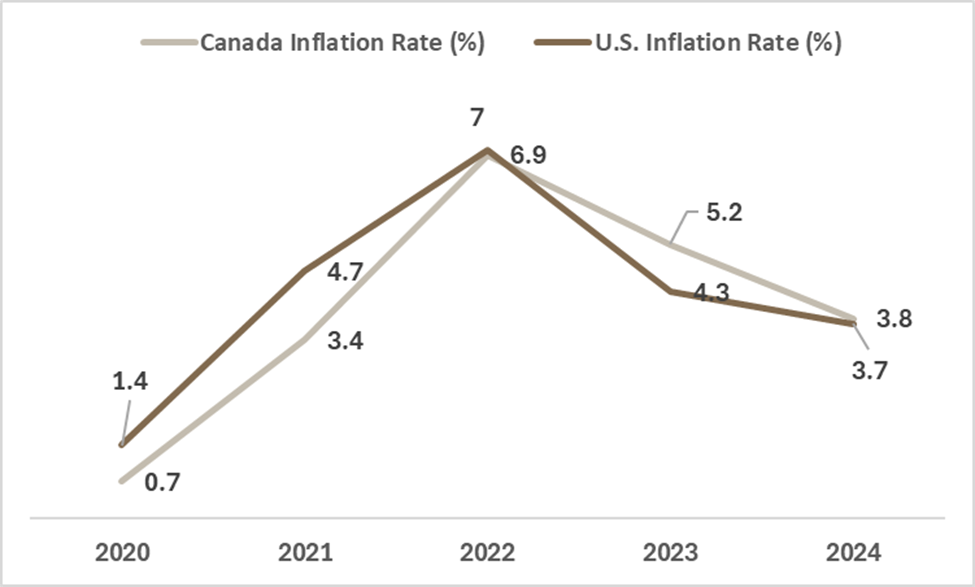

Rising Inflation:

- Inflation in Canada and the U.S. has been steadily increasing, impacting the cost of essential goods and services.

- Canada: 3.8% in 2024 (Source: Statistics Canada)

- U.S.: 3.7% in 2024 (Source: U.S. Bureau of Labor Statistics)

- Rising prices for essentials like groceries, gas, and utilities are straining household budgets, leaving young adults financially vulnerable.

- Home prices in Canada and the U.S. have surged dramatically in recent years, making it nearly impossible for young adults to enter the housing market without parental help.

- Canada: The average home price in 2024 is $716,000 (Source: Canadian Real Estate Association)

- U.S.: Average home price in 2024 is $416,000 (Source: National Association of Realtors)

- These prices are well out of reach for many first-time homebuyers, even with mortgage rate cuts.

- Toronto, ON: $1,055,000

- Vancouver, BC: $1,234,000

- New York, NY: $765,000

- Los Angeles, CA: $932,000

Student Loan Debt:

- The increasing cost of higher education has led to a significant rise in student loan debt, placing a substantial financial burden on young adults.

- In the U.S., the average student loan debt for the class of 2023 is $37,338 (Source: Education Data Initiative).

- This debt can hinder young adults’ ability to save for a down payment on a home, start a family, or achieve other financial goals.

Wage Stagnation:

- Despite increases in the cost of living, wages have not kept pace, making it difficult for young adults to afford necessities and save for the future.

- According to the Economic Policy Institute, wages for the bottom 90% of earners have stagnated over the past four decades.

- This wage stagnation further exacerbates the financial challenges faced by young adults and increases their reliance on parental support.

Shifting Family Dynamics:

- The traditional family structure is evolving, with parents offering financial support to adult children longer than in previous generations.

- Many parents continue to provide financial assistance into their children’s 30s and 40s, driven by increasing costs of education, housing, and daily living expenses.

- This prolonged support can delay parents’ retirement plans and impact their financial security.

- Several factors contribute to this shift, including:

- Delayed Marriage: Young adults are marrying later in life, often delaying their financial independence.

- Increased Life Expectancy: Parents are living longer, requiring more robust retirement savings.

- Changing Expectations: Societal expectations about financial independence have shifted, with parents feeling more pressure to support their adult children.

Actionable Advice for Parents

Navigating financial support for adult children can be tricky, but here are several key steps parents can take to maintain financial security:

1. Assess Affordability:

- Before providing financial support, parents should ensure they can afford it without risking their retirement.

- A thorough financial review, including assessing savings, investments, and projected expenses, is critical.

- Financial planners recommend maintaining at least 10-15 times your annual income in retirement savings by the time you retire.

2. Set Clear Boundaries:

- It’s important to set parameters for financial assistance. Will it be a one-time gift, ongoing support, or a loan?

- Defining these boundaries early will avoid future misunderstandings and resentment.

- Consider a written agreement to formalize the terms of any loans, including repayment schedules and interest rates.

3. Encourage Financial Responsibility:

- If adult children are continually asking for financial help, it may be time to encourage them to seek professional financial advice.

- Establishing responsible spending and saving habits early is essential for long-term financial stability.

- Offer to help them create a budget, track their expenses, and explore options for increasing their income.

4. Open Communication:

- Maintain regular and transparent communication about finances with your children.

- Discuss your financial situation openly and honestly, including your concerns about retirement security.

- Encourage your children to share their financial goals and challenges with you.

- Acknowledge the emotional complexities involved and strive for empathy and understanding in your conversations.

- Consider involving a neutral third party, such as a financial advisor or therapist, to facilitate productive discussions.

5. Protect Your Future:

- While helping your children is admirable, it’s important to remember that your financial security comes first.

- Saving for retirement should be the top priority, and parents should not sacrifice their future to support their children.

| Age Group | Recommended Retirement Savings Multiple of Income |

| 30-35 | 1x Annual Income |

| 40-45 | 3x Annual Income |

| 50-55 | 6x Annual Income |

| 60-65 | 10x-15x Annual Income |

Exploring Alternatives:

- In addition to parental support, young adults can explore alternative resources to help them achieve financial stability:

- Government Programs: Research government programs that offer financial assistance for education, housing, and other needs.

- Financial Aid: Explore scholarships, grants, and student loan forgiveness programs.

- Community Resources: Seek guidance from community organizations that provide financial counselling and support services.

Conclusion: Balancing Support with Financial Security

The Bank of Mom and Dad has become a significant source of financial assistance for many young adults struggling with rising living costs and housing prices. However, parents must approach this role cautiously, setting clear financial boundaries and ensuring their retirement savings remain intact.

With careful planning, open communication, and professional advice, parents can strike a balance between supporting their children and securing their financial future. By following these strategies, families can ensure that the Bank of Mom and Dad remains a helpful, yet sustainable, resource for the next generation.

Bank of Mom and Dad Running Dry? Pegasus Mortgage Lending Can Help.

Are you a parent struggling to balance supporting your adult children with securing your financial future? You’re not alone. Many families are facing similar challenges in today’s economy.

While the Bank of Mom and Dad can be a valuable resource, it’s important to protect your financial well-being. That’s where Pegasus Mortgage Lending comes in.

We understand the complexities of intergenerational financial support. Our experienced mortgage advisors can help you and your children explore a range of options, including:

- First-time homebuyer programs: Access to affordable mortgage solutions designed for first-time buyers.

- Co-signing options: Explore the possibilities and implications of co-signing a mortgage with your child.

- Financial planning resources: Gain valuable insights and guidance on budgeting, saving, and achieving financial goals.

Don’t deplete your retirement savings to help your children achieve their homeownership dreams. Let Pegasus Mortgage Lending help you find a solution that works for everyone.