The Toronto Housing Market is a topic that dominates conversations in Canada, especially for those dreaming of homeownership or managing existing property investments. Fluctuations in this dynamic market trigger widespread speculation, particularly the burning question: Will the Toronto housing market crash? This blog delves into the intricate factors influencing the housing market Toronto, providing a detailed analysis of current trends, historical data, and future predictions. We’ll explore the nuances of the Toronto GTA housing market, and even touch upon the unique pockets like the Kensington market house Toronto, to provide a holistic view.

Understanding the Current Landscape of the Toronto Housing Market

The Toronto Housing Market has long been characterized by its resilience, but recent years have presented unprecedented challenges. From pandemic-induced shifts to rising interest rates, the market has navigated a complex web of economic forces. To truly understand the current state, we need to examine key indicators:

- Supply and Demand:

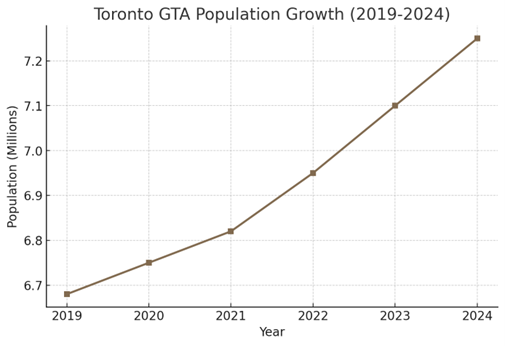

- Toronto’s population continues to grow, fueled by immigration and internal migration. This consistently high demand puts pressure on the limited housing supply.

- Development restrictions and zoning laws contribute to the scarcity of new housing, especially in desirable urban areas.

- Interest Rates:

- The Bank of Canada’s interest rate policies significantly impact mortgage affordability. Recent rate hikes have cooled the market, but the long-term effects remain to be seen.

- Economic Factors:

- Inflation, employment rates, and overall economic stability play crucial roles in shaping the housing market in Toronto Canada.

- Global economic uncertainties can also have ripple effects on the Canadian housing market.

Historical Trends and Their Implications

To predict the future, we must understand the past. The housing market Toronto has experienced periods of rapid growth and subsequent corrections. Examining historical data reveals patterns and trends that can inform our analysis.

Past Booms and Busts:

- Toronto has seen several housing booms, often followed by periods of adjustment. Understanding the causes and effects of these cycles is essential.

The 2008 financial crisis had a relatively mild impact on Toronto’s housing market compared to other regions, showcasing its resilience.

Long-Term Growth:

- Toronto has seen long term growth, because of immigration and a strong economy.

Even with dips, the long term trend is a upward one.

Analyzing Key Market Segments: The Toronto GTA Housing Market and Beyond

The Toronto GTA housing market is not a monolith. Different segments within the market exhibit unique characteristics.

Condominiums:

Condos have been a popular option for first-time buyers and investors. Fluctuations in condo prices and rental rates provide valuable insights into market trends.

Detached Homes:

Detached homes remain highly sought after, especially in suburban areas. However, affordability concerns have shifted demand towards more affordable options.

The Kensington Market House Toronto Example:

Unique neighborhoods like Kensington Market showcase the diversity of Toronto’s housing market. Historic homes and vibrant communities contribute to the area’s desirability, but also present challenges in terms of affordability and development.

Will the Toronto Housing Market Crash? Factors to Consider

The question of whether the Toronto Housing Market will crash is complex. Here are the key factors that will influence the market’s trajectory:

- Interest Rate Policies:

- Future interest rate decisions by the Bank of Canada will have a significant impact on mortgage affordability and market activity.

- Government Policies:

- Government initiatives aimed at increasing housing supply and addressing affordability concerns can shape the market’s direction.

- Economic Stability:

- A strong and stable economy is crucial for maintaining a healthy housing market. Any economic downturn could trigger a correction.

- Population Growth:

- Continued population growth will add pressure to the market.

- Investor Behavior:

- Investor confidence in the market is important.

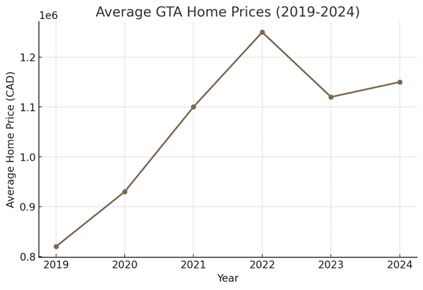

Average GTA Home Prices (2019-2024)

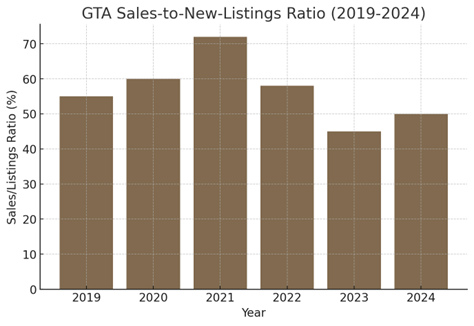

GTA Sales-to-New-Listings Ratio (2019-2024)

Toronto GTA Population Growth (2019-2024)

Impact of Interest Rates on the Toronto Housing Market

| Year | Interest Rate (%) | Home Sales (Units) | Average Home Price (CAD) |

| 2019 | 1.75 | 88000 | 820000 |

| 2020 | 0.25 | 95000 | 930000 |

| 2021 | 0.5 | 120000 | 1100000 |

| 2022 | 3 | 110000 | 1250000 |

| 2023 | 4.5 | 90000 | 1120000 |

| 2024 | 4 | 92000 | 1150000 |

The Impact of Interest Rates on the Toronto Housing Market

Interest rates are a critical factor influencing the housing market in Toronto Canada.

- Mortgage Affordability:

- Rising interest rates increase mortgage payments, making homeownership less affordable for many buyers.

- Market Cooling:

- Higher interest rates can cool the market by reducing demand and increasing the supply of available homes.

- Long-Term Effects:

- The long-term effects of interest rate changes depend on the overall economic climate and the Bank of Canada’s policies.

Government Policies and Their Influence

Government policies play a significant role in shaping the Toronto Housing Market.

- Affordability Measures:

- Policies aimed at increasing housing supply, such as zoning reforms and development incentives, can address affordability concerns.

- Foreign Buyer Taxes:

- Taxes on foreign buyers can help curb speculative investment and make homes more accessible to local residents.

- Rental Market Regulations:

- Regulations governing the rental market can impact rental rates and the availability of rental housing.

The Future of the Toronto Housing Market

Predicting the future of the Toronto Housing Market is challenging, but by analyzing current trends and historical data, we can make informed projections.

- Continued Demand:

- Toronto’s population growth and strong economy suggest that demand for housing will remain high.

- Potential Corrections:

- While a full-blown crash is unlikely, the market may experience periods of correction as it adjusts to changing economic conditions.

- Long-Term Growth:

- Despite short-term fluctuations, the long-term outlook for the Toronto Housing Market remains positive.

Navigating the Toronto Housing Market: Informed Decisions for Your Future

The Toronto Housing Market is a complex and dynamic landscape, influenced by a multitude of economic and social factors. While the question of Will the Toronto housing market crash? remains a topic of debate, understanding the underlying trends and data is crucial for making informed decisions. The housing market Toronto has proven its resilience, but careful consideration of interest rates, government policies, and economic stability is essential. Whether you’re a first-time buyer, an investor, or a homeowner, staying informed and adaptable will help you navigate the ever-changing market.

Start Your Mortgage Journey with Pegasus Mortgage Lending! Ready to take the next step in your homeownership journey? At Pegasus Mortgage Lending Center, we understand the complexities of the Toronto GTA housing market. With over 20 years of experience, we provide expert guidance, fast approvals, and personalized mortgage solutions to help you achieve your dreams.