In today’s globalized world, the economic policies of one nation can send significant ripples across borders, impacting businesses, industries, and ultimately, the wallets of everyday citizens. For Canadians, the trade relationship with the United States is paramount, representing the largest bilateral trading partnership globally. However, this relationship isn’t immune to friction. The imposition or threat of US tariffs on Canada has become a recurring theme, raising concerns about import costs, domestic inflation, and the overall cost of living for Canadians from coast to coast. Understanding how these trade measures function and their potential consequences is crucial for navigating personal finances in an increasingly complex economic environment. This blog post delves into the intricacies of US tariffs on Canada, analyzing their impact on import costs, inflation, and consumer expenses, and exploring practical financial strategies Canadians can employ amidst these economic pressures.

The conversation around US tariffs on Canada isn’t just abstract economic theory; it translates into tangible effects on household budgets. Whether it’s the price of groceries, building materials for a home renovation, or the cost of a new vehicle, trade policies enacted south of the border can influence the final price tag here in Canada. As these costs potentially rise, understanding the underlying mechanisms and seeking sound financial advice becomes more critical than ever.

Understanding the Trade Landscape: Tariffs and the Canada-US Relationship

Before diving into the specific impacts, let’s clarify what tariffs are and the context of their application between Canada and the US. A tariff is essentially a tax imposed by a government on goods and services imported from another country. The primary purposes are usually to increase revenue for the government and, more strategically, to protect domestic industries from foreign competition by making imported goods more expensive.

The Canada-US trade relationship, while vast and generally free-flowing under agreements like the Canada-United States-Mexico Agreement (CUSMA), formerly NAFTA, has seen periods where specific US tariffs on Canada have been implemented or threatened. These often target particular industries where trade disputes arise, such as softwood lumber, steel, aluminum, and sometimes agricultural products. Reasons cited by the US for imposing tariffs can range from allegations of unfair subsidies (like in softwood lumber), concerns about national security (the rationale used for steel and aluminum tariffs under Section 232), or broader political and economic leverage.

It’s crucial to understand that these actions often provoke a response. When facing US tariffs on Canada, the Canadian government frequently retaliates with its own tariffs on US goods. So, the question arises: Does Canada have tariffs on US goods? Yes, often as a countermeasure. These retaliatory Canada tariffs on US goods are strategically chosen to impact US exporters, aiming to create pressure for the removal of the initial US tariffs. This back-and-forth creates a complex web of increased costs affecting businesses and consumers on both sides of the border.

The Direct Hit: How US Tariffs on Canada Impact Canadian Businesses and Import Costs

When the US imposes tariffs on Canadian goods, the immediate impact is felt by Canadian exporters in the targeted sectors. Let’s take the example of steel and aluminum, which faced significant US tariffs on Canada in recent years.

- Increased Costs for Exporters: Canadian producers (e.g., steel mills, and aluminum smelters) suddenly face a hefty tax when selling their products into the US market. They have a few choices, none ideal:

- Absorb the Cost: This cuts directly into their profit margins, potentially making operations unsustainable.

- Pass the Cost to US Buyers: This makes their products more expensive compared to US domestic producers or suppliers from other countries not subject to the tariff, leading to a loss of competitiveness and market share.

- Reduce Production or Investment: Facing reduced profitability and market access, companies might scale back operations, delay investments, or even face closures, impacting Canadian jobs.

- Supply Chain Disruptions: Many industries rely on cross-border supply chains. A US Tariff on Canada for a primary material like steel can disrupt production for manufacturers in both countries who rely on that specific input. Businesses might scramble to find alternative suppliers, potentially incurring higher costs or facing delays.

- Uncertainty: Perhaps one of the most damaging aspects is the uncertainty created by the threat or imposition of tariffs. Businesses thrive on predictability. When the rules of trade can change abruptly, companies become hesitant to make long-term investments, hire new staff, or expand operations. This chilling effect can dampen overall economic activity.

While the direct target is Canadian exports to the US, the ripple effects quickly spread throughout the Canadian economy and eventually reach the consumer, often through indirect channels and retaliatory measures.

The Ripple Effect: Connecting US Tariffs on Canada to Your Grocery Bill and Cost of Living

While US tariffs on Canada directly tax Canadian goods entering the US, the impact on the average Canadian’s wallet often comes through a combination of retaliatory tariffs and broader inflationary pressures.

- Retaliatory Tariffs (Canada Tariffs on US Goods): When Canada imposes countermeasures, specific US products imported into Canada become more expensive. These often include consumer goods. For example, past retaliatory tariffs targeted items like ketchup, orange juice, whiskey, appliances, and prepared meals. This directly increases the price Canadian consumers pay for these specific American products. If you frequently buy US brands subject to these Canada tariffs on US goods, you’ll notice the difference at the checkout.

- Increased Input Costs for Canadian Producers: Canadian manufacturers often rely on US-made components or materials. Even if the final Canadian product isn’t subject to a US tariff, if Canada imposes retaliatory tariffs on US inputs (machinery parts, specific ingredients, chemicals), the cost of production in Canada goes up. Businesses facing these higher input costs may have no choice but to pass them onto consumers through higher prices for domestically produced goods.

- Supply Chain Adjustments and Inefficiencies: Both US tariffs on Canada and Canadian retaliatory tariffs can force businesses to rework their supply chains. Sourcing materials or components from alternative, potentially more distant or expensive suppliers, adds costs. Logistics become more complex. These inefficiencies eventually filter down into the prices consumers pay.

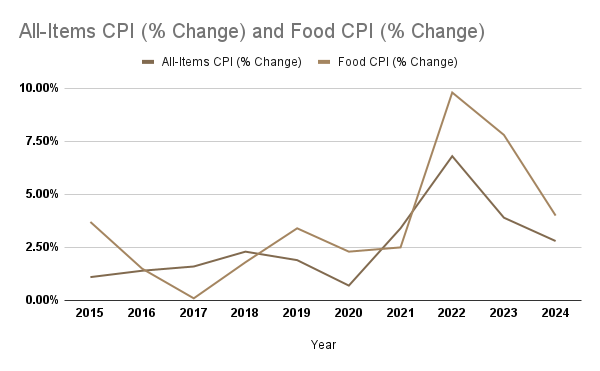

- Inflationary Psychology and Uncertainty: Trade wars and tariff threats contribute to overall economic uncertainty. In such an environment, businesses may become more cautious and might raise prices preemptively to buffer against potential future cost increases or market volatility. Furthermore, significant tariffs can influence currency exchange rates. If the Canadian dollar weakens against the US dollar (partly due to trade tensions impacting investor confidence), the cost of all imported goods, not just those directly tariffed, increases for Canadians. This contributes to broader inflation.

- The Grocery Bill Example: Consider your grocery shopping. While tariffs might not be directly applied to every food item, the system is interconnected.

- Direct: Canadian retaliatory tariffs increase the price of specific US food products (e.g., orange juice, some prepared foods).

- Indirect: Tariffs on US steel/aluminum could increase the cost of new food processing machinery for Canadian companies. Tariffs on packaging materials imported from the US increase costs. Higher fuel costs (potentially influenced by broader economic factors linked to trade) impact transportation costs for all goods. If Canada retaliates against US agricultural products, those specific items rise in price. The question “what tariffs does Canada have on the US?” becomes directly relevant to specific aisles in the supermarket.

Therefore, while pinpointing the exact percentage increase on your grocery bill solely due to US tariffs on Canada is complex, it’s undeniable that they contribute to the upward pressure on prices for a wide range of goods and services, exacerbating the overall cost of living challenges many Canadians face.

Broader Economic Tremors: The Macro Impact of US Tariffs on Canada

Beyond individual consumer wallets, US tariffs on Canada and the resulting trade friction have wider implications for the Canadian economy:

- Impact on GDP: Reduced exports in key sectors directly subtract from Canada’s Gross Domestic Product (GDP). Prolonged trade disputes can lead to slower overall economic growth.

- Investment Chills: As mentioned earlier, uncertainty discourages business investment. Foreign direct investment (FDI) into Canada might also slow if international companies perceive Canada as being caught in persistent trade disputes with its largest partner. This impacts long-term productivity and job creation.

- Sectoral and Regional Disparities: The impact isn’t uniform across Canada. Regions heavily reliant on industries targeted by tariffs (e.g., forestry in BC, steel in Ontario, aluminum in Quebec) suffer disproportionately from job losses and economic slowdowns.

- Trade Diversification Efforts: Persistent trade friction with the US encourages Canada to intensify efforts to diversify its trade relationships with other markets, such as the European Union (CETA) and Asia-Pacific nations (CPTPP). While beneficial long-term, building these new relationships takes time and cannot immediately replace the volume of US trade.

- Strain on Bilateral Relations: Trade disputes inevitably strain the broader diplomatic relationship between Canada and the US, potentially affecting cooperation on other important files.

- The imposition of US tariffs on Canadian goods acts as a drag on economic potential, creating headwinds that policymakers and businesses must constantly navigate.

Navigating the Financial Squeeze: Practical Advice Amidst Rising Costs & Trade Friction

Given that factors like US tariffs on Canada contribute to a higher cost of living and economic uncertainty, how can Canadians proactively manage their finances? Financial institutions often advise clients to focus on fundamentals, but framing this advice practically in the context of trade-related pressures is key:

- Forensic Budgeting & Expense Tracking: This goes beyond basic budgeting. Actively track where your money is going, paying close attention to categories most susceptible to inflation (groceries, imported goods, fuel). Identify areas where price increases, potentially linked indirectly to US tariffs on Canada or retaliatory Canada tariffs on US goods, are hitting hardest. Knowing this allows for targeted adjustments, like seeking Canadian-made alternatives or reducing consumption of heavily impacted imported items. Understanding “what tariffs does Canada have on the US?” can inform shopping choices.

- Strategic Debt Management: Rising costs make servicing debt, especially high-interest debt like credit cards, significantly harder. Trade uncertainty can also influence Bank of Canada interest rate decisions, potentially affecting variable-rate loans and mortgages.

- Prioritize High-Interest Debt: Attack credit card balances aggressively.

- Explore Consolidation: Consider consolidating multiple high-interest debts into a single, potentially lower-interest payment, such as through a home equity line of credit (HELOC) or a debt consolidation loan. This can free up monthly cash flow, providing breathing room in an inflationary environment. Pegasus Mortgage Lending specializes in exploring these debt consolidation options, leveraging your home equity to potentially reduce your interest burden.

- Mortgage Strategy Review: Your mortgage is likely your largest expense. Economic uncertainty and inflation-linked to factors including trade friction impact mortgage rates.

- Renewal Planning: If your mortgage is nearing renewal, start exploring options well in advance. Locking in a favourable fixed rate can provide payment certainty in volatile times.

- Pre-Approval Power: If planning to buy, getting pre-approved establishes your borrowing power and often holds a rate for a period, protecting you from interim rate hikes. Pegasus offers Instant Pre-Approval to clarify your home buying potential quickly.

- Refinancing Considerations: If you have significant equity, refinancing could be an option to access funds for debt consolidation or essential renovations, but weigh the costs and benefits carefully in the current rate environment. The experts at Pegasus can provide personalized advice on whether refinancing makes sense for your situation.

- Bolster Emergency Funds: Economic uncertainty underscores the need for a robust emergency fund (ideally 3-6 months of essential living expenses). This buffer protects you from unexpected job loss (which could be a remote consequence of tariffs impacting your employer’s industry) or sudden large expenses without resorting to high-interest debt.

- Informed Consumer Choices: While not always easy, pay attention to the origin of goods. Supporting Canadian producers not only helps the local economy but might shield you from the direct cost increases associated with specific Canada tariffs on US goods.

- Seek Professional Guidance: Navigating complex financial decisions during uncertain times is challenging. Consulting with experienced financial professionals is invaluable. At Pegasus Mortgage Lending, we provide more than just mortgages; we offer expert financial solutions and unbiased advice tailored to your unique circumstances. Whether you’re a first-time buyer navigating affordability challenges, looking to consolidate debt amidst rising costs, or planning your next mortgage renewal, our team is committed to helping you achieve your financial goals, even when external factors like US tariffs on Canada complicate the landscape.

Building Financial Resilience in a Shifting Trade World

The intricate dance of international trade, particularly the imposition of US tariffs on Canada and subsequent retaliatory measures, undeniably impacts the Canadian economy and the financial well-being of its citizens. From the direct costs faced by exporters to the indirect pressures on consumer prices and inflation, the effects are widespread, contributing to the cost of living challenges felt across the country. While Canadians cannot directly control international trade policies, understanding these dynamics is the first step toward empowerment.

By adopting proactive financial strategies – meticulous budgeting, strategic debt management, careful mortgage planning, building emergency savings, and making informed consumer choices – individuals can build resilience against economic headwinds. The uncertainty stemming from US tariffs on Canada underscores the importance of sound financial planning and seeking expert guidance. Remember, knowledge and preparation are your best assets in navigating these complex times and securing your financial future.

Take Control of Your Financial Future with Pegasus Mortgage Lending

Feeling the pinch of rising costs? Concerned about how economic factors like US tariffs on Canada might be impacting your mortgage or debt situation? Don’t navigate these challenging waters alone. Don’t let economic uncertainty dictate your financial well-being. Take proactive steps today. Let Pegasus Mortgage Lending be your trusted partner in achieving financial stability and homeownership success. Start your journey today!