The Bank of Canada’s recent decision to keep its key interest rate steady at 5% has sparked widespread interest and speculation

Amidst ongoing worries about inflation and economic uncertainties, the central bank’s cautious stance highlights the challenges of balancing economic stability and inflationary pressures. This article explores the factors shaping the Bank of Canada’s decision, its effects on consumers and businesses, and what it could mean for future monetary policy adjustments.

Understanding the Decision

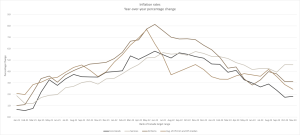

The decision to keep the interest rate stable reflects worries about inflation. Despite recent changes in consumer prices, the Bank of Canada is still careful about deeper inflation trends, which play a big part in the bank’s decisions about monetary policy. “Recent inflation data suggest monetary policy is working largely as expected,” said Macklem. By keeping the interest rate steady, the bank aims to tackle inflation while keeping the economy stable and robust.

Economists expected the Bank of Canada to be cautious, given the uncertainties in the global economy. Increased global risks, such as geopolitical tensions and supply chain issues, have worsened inflation concerns, making the central bank cautious in policy decisions.

Key Points:

| ● Interest Rate Status: The Bank of Canada has opted to keep its key interest rate steady at 5% due to ongoing concerns about underlying inflation.● Inflation Concerns: Economists had anticipated a rate hold, with the central bank emphasizing concerns about underlying inflation, particularly in light of global risks impacting inflationary pressures. The central bank expects inflation to remain around three percent in the first half of this year before gradually decreasing.

● Global Risks: Governor Tiff Macklem highlighted potential global risks, such as attacks on Red Sea shipping routes, which could escalate and contribute to higher inflation. The Lehman Brothers crash ten years ago still affects Canada’s economy. Important signs like the loonie and oil prices haven’t bounced back completely. Even after trying to fix things for a decade, the Canadian dollar is much weaker than before the crisis, and oil prices are still lower. This Lehman Brothers collapse shows how global events can keep hurting Canada’s economy for a long time. It’s a clear example of how what happens worldwide can affect how things go at home. ● Domestic Economy: While the Canadian economy has avoided recession, growth remains subdued, with GDP increasing by only 1% in January. ● Future Rate Outlook: Despite speculation about potential rate cuts, Macklem stressed the need to give higher interest rates more time to influence the economy effectively. The central bank expects inflation to remain close to 3% in the first half of the year before gradually easing. |

Impact on the Domestic Economy:

The Bank of Canada’s decision reflects its assessment of the domestic economic landscape. While Canada has avoided recession, economic growth remains frigid, with GDP increasing by only 1% in January. This modest growth underscores the need for continued support from monetary policy measures to stimulate economic activity.

Moreover, inflationary pressures continue to pose challenges for consumers and businesses alike. Despite efforts to mitigate price increases, inflation remains elevated, impacting household purchasing power and business operations. The central bank’s decision to maintain the interest rate signals its commitment to addressing inflation concerns while supporting sustainable economic growth.

Future Rate Outlook:

The Bank of Canada’s decision-making process is influenced by evolving economic indicators and global developments. Factors like rising inflation, robust GDP growth, and low unemployment could prompt rate hikes to control inflation. Conversely, sluggish economic growth and high unemployment may lead to rate cuts to boost borrowing and spending. Global events such as trade tensions or geopolitical instability also affect rate decisions, impacting Canada’s economic outlook. Despite speculation about rate cuts, Governor Tiff Macklem stresses the need to allow higher interest rates time to influence the economy effectively. The central bank anticipates inflation to remain around 3% in the first half of the year before gradually easing. Future rate adjustments will depend on assessing economic trends and the effectiveness of current policy measures in addressing inflation concerns.

Implications for Consumers and Businesses:

The Bank of Canada’s decision affects everyone – consumers and businesses alike. For consumers, a steady interest rate means stable borrowing costs for mortgages and loans. But with rising inflation, household budgets might feel the squeeze, reflecting the need for smart money management.

Businesses need to roll with the punches of changing economic conditions and inflation. Even though the interest rate stays put, they’ve got to watch their pennies and tweak pricing to handle rising costs. It’s tough out there, but businesses can stay afloat by cutting unnecessary expenses and finding new ways to make money.

Consumers dealing with high interest rates and inflation can take charge of their finances. Paying off debts, sticking to a budget, and considering investments that beat inflation, like real estate or inflation-protected assets, can help. Meanwhile, businesses can adjust prices, negotiate better deals with suppliers, and find other income sources. Streamlining operations is also crucial for staying profitable despite economic challenges. With these moves, consumers and businesses can confidently ride out the impact of high-interest rates and inflation.

The Bottom Line

The Bank of Canada’s decision to maintain the key interest rate at 5% reflects its commitment to addressing inflation concerns while supporting sustainable economic growth. Despite speculation about potential rate cuts, the central bank’s cautious approach underscores the need for prudence in monetary policy decisions. As Canada’s economy continues to evolve, the Bank of Canada remains vigilant in promoting economic stability and resilience.