The dream of homeownership is deeply ingrained in Canadian culture, but achieving it seems increasingly out of reach for many millennials. Soaring property values, stringent mortgage requirements, and stagnant wage growth have created a perfect storm of challenges. The Bank of Mom and Dad is the growing trend of parents providing financial assistance to their adult children to help them purchase their first home.

A 2023 Statistics Canada report found that immigrant parents are more likely to co-own property with their adult children than Canadian-born parents. This trend is particularly pronounced in British Columbia, where nearly 40% of co-owned properties involve immigrant parents. Additionally, research from the University of British Columbia suggests that cultural factors, such as a stronger emphasis on family support and intergenerational wealth transfer among some immigrant communities, may contribute to this trend.

The Growing Phenomenon of the Bank of Mom and Dad

Bank of Mom and Dad refers to the financial assistance parents provide to their adult children to help them purchase a home. This assistance can take many forms, including co-signing for a mortgage, providing a down payment gift, or helping with closing costs. A report by the Canadian Imperial Bank of Commerce (CIBC) revealed that nearly 30% of first-time homebuyers received a monetary gift from their parents, marking a significant increase from 20% in 2015.

Moreover, recent studies have shown that the Bank of Mom and Dad plays an increasingly significant role in the Canadian housing market. In fact, it’s estimated that a significant percentage of millennial homebuyers receive financial assistance from their parents, ranging from down payment gifts to co-signing mortgages. This trend is particularly pronounced in major urban centers like Toronto and Vancouver, where housing affordability has reached crisis levels.

In contrast, Atlantic Canada’s more affordable housing makes it less necessary, though it is still increasing due to rising prices. The Prairie Provinces, particularly Alberta, see fluctuations based on the health of the oil and gas industry, with parental aid more crucial during downturns. These differences underscore the need to consider regional economic and housing factors when assessing the impact of the Bank of Mom and Dad.

The Pros and Cons of Parental Financial Assistance:

| Pros | Cons |

| Overcoming Financial Barriers: The most obvious advantage of parental financial assistance is that it helps millennials overcome Financial Hurdles that stand in the way of homeownership. | Widening Wealth Inequality: Reliance on parental wealth can exacerbate existing wealth disparities, giving an unfair advantage to those born into affluent families. |

| Building Equity Sooner: With a larger down payment or help with mortgage payments, millennials can start building equity in their homes sooner, setting them on a path to long-term financial stability. | Delayed Financial Independence: Receiving substantial financial assistance may delay millennials’ achieving true financial independence. |

| Reduced Financial Stress: Knowing that they have parental support can alleviate some of the financial stress and anxiety associated with homeownership, allowing millennials to focus on other aspects of their lives. | Strained Family Relationships: Money matters can be sensitive, and disagreements over financial assistance can strain relationships between parents and children. |

Parental Homeownership Across Provinces and Income Levels

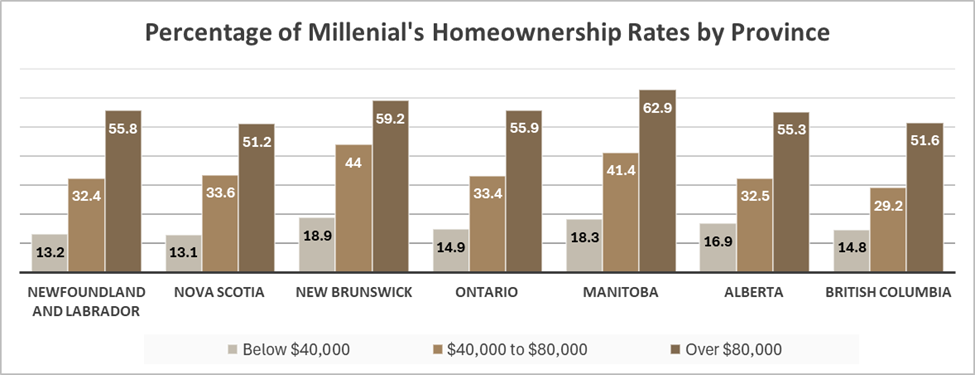

According to the Canadian Housing Statistics Program (CHSP) statistics, parental homeownership impacts adult children’s likelihood of owning a home across different provinces and income groups. Even when considering adult children’s age and income, the number of properties their parents own significantly predicts homeownership.

- Lowest income group (<$40,000): Parental homeownership had the most substantial positive effect, with homeownership rates for adult children of multiple property owners being at least twice as high as those of non-homeowners in every province. The most significant impact was observed in Manitoba, where the likelihood of homeownership increased over fivefold for this group.

- Middle-income group ($40,000 – $80,000): New Brunswick had the highest homeownership rate, while British Columbia had the lowest. Manitoba again showed the largest increase in homeownership rates based on parental property ownership.

- Highest income group (>$80,000): New Brunswick maintained the highest rate, while Nova Scotia had the lowest. The advantage of parental property ownership was most pronounced in the priciest markets of British Columbia and Ontario, suggesting that parental wealth plays a more significant role in expensive housing markets.

However, parental homeownership consistently increased the likelihood of homeownership for adult children across provinces and income levels, highlighting the importance of parental wealth in the Canadian housing market.

Homeownership Outcomes for Young Canadians Aged 29-31

- Increasing Homeownership with Age: Young Canadians steadily increase their homeownership rates as they age.

- Parental Influence: Parental property ownership significantly impacts homeownership rates for adult children, with those whose parents own multiple properties being more likely to own homes.

- Income Matters: Higher income levels correlate with higher homeownership rates, regardless of parental property ownership. However, parental property ownership can significantly boost homeownership chances, even for lower-income individuals.

- Multiple Property Advantage: Adult children of parents who own multiple properties tend to have higher incomes.

| Data Particulars | None | One | Two | Three or More |

| Mean Total Income of Adult Children (2020 constant dollars) | ||||

| Non-owner | 39,000 | 47,000 | 49,000 | 49,000 |

| Homeowner | 64,000 | 70,000 | 70,000 | 72,000 |

| Homeownership Rates by Income Level and Parental Property Ownership (Aged 29-31) | ||||

| < $40,000 | 8.50% | 13.70% | 21.00% | 26.70% |

| $40,000 – $80,000 | 21.00% | 36.80% | 47.70% | 53.80% |

| > $80,000 | 46.20% | 61.40% | 70.20% | 76.80% |

This data reveals a complex interplay between age, parental property ownership, and income in shaping homeownership outcomes for young Canadians. While income plays a crucial role, parental housing wealth can significantly impact homeownership rates, even for those with lower incomes.

The Implications for the Housing Market

- The trend of parents providing financial assistance to their children to help them purchase a home is significantly impacting the Canadian housing market. It is increasing house prices and making it even more difficult for young adults to afford a home.

- Addressing the issue of affordability requires several steps. One is increasing the supply of affordable housing, which could be done by building more units or incentivizing developers to build affordable housing.

- Another option is to provide more financial assistance to young adults. This could be done by increasing the amount of money available through the Home Buyers’ Plan or by providing tax breaks for parents who provide financial assistance to their children.

- The Bank of Mom and Dad presents a complex economic picture. While it offers immediate benefits for some individuals and families, it raises concerns about long-term economic consequences such as wealth concentration, reduced social mobility, and intergenerational debt. Striking a balance between supporting aspiring homeowners and addressing these broader economic concerns requires careful consideration and potential policy interventions.

Alternative Pathways to Homeownership

- Rent-to-Own Programs: Rent-to-own programs offer a unique opportunity for aspiring homeowners who may not have the savings for a traditional down payment. In this model, a portion of the monthly rent payment goes towards building equity in the home. This allows individuals to gradually accumulate the funds needed for a down payment while living in the property. After a predetermined period, the renter can purchase the home at a price agreed upon at the contract’s start.

- Shared Equity Mortgages (SEMs): Shared Equity Mortgages provide another avenue for affordable homeownership. In an SEM, the buyer purchases a portion of the home, while a third party, often a government agency or non-profit organization, invests in the remaining share. This reduces the upfront costs for the buyer, making homeownership more accessible. When the home is sold, the third-party investor receives a share of the profit, reflecting their initial investment.

- Co-housing Models: Co-housing models offer an alternative living arrangement that can be more affordable than traditional single-family homes. In co-housing communities, residents typically own private living spaces but share common areas like kitchens, gardens, and recreational spaces. This shared ownership model can significantly reduce the financial burden of homeownership, as costs for amenities and maintenance are spread among residents.

Tips for Navigating the Bank of Mom and Dad

- Open Communication: Honest and transparent communication between parents and children is crucial. Discuss expectations, repayment plans, and any potential tax implications.

- Treat it as a Loan: Consider treating parental financial assistance as a loan rather than a gift if possible. This can help maintain a sense of financial responsibility and avoid potential misunderstandings.

- Seek Professional Advice: Consult with financial advisors or tax professionals to understand the best way to structure any financial assistance and ensure compliance with tax laws.

The Bottom Line

The Bank of Mom and Dad is a complex issue with positive and negative implications. While it can be a lifeline for millennials struggling to enter the housing market, it’s important to be mindful of the potential drawbacks and ethical considerations. By approaching this topic with open communication, responsible financial planning, and a clear understanding of the implications, parents and children can navigate this financial landscape to benefit everyone involved.