In the context of home loans, you might have heard of the term “mortgage trigger rate,” which refers to the point at which your adjustable-rate mortgage (ARM) is adjusted

When market interest rates hit this mark, your monthly mortgage payment adjusts accordingly. Knowing your trigger rate, particularly if you have an ARM, is essential for effective budgeting and long-term financial planning. When exploring mortgage options, be sure to inquire about your trigger rate with your lender. Let’s understand how it may influence your finances and discuss strategies to mitigate potential impacts.

What is the Trigger Rate?

Your mortgage trigger rate is the point where your usual payment isn’t sufficient to cover all the interest that has built up since your last payment. When you hit this trigger rate, your entire mortgage payment goes toward interest, and none of it goes toward paying down the actual amount you borrowed (the principal).

When you hit your trigger rate, your balance increases. Since your regular payment can’t cover the borrowing cost any more, all of it goes toward interest. Any unpaid interest is added to your balance, which you must pay off later. Reaching your trigger rate means you’ve stopped reducing your mortgage debt and started borrowing more instead. This situation is referred to as negative amortization.

Understanding Two Different Triggers

In the mortgage industry, it’s crucial to understand two key triggers: your trigger rate and your trigger point. To understand these terms better, let’s break down how variable-rate mortgages operate.

Every mortgage payment comprises principal and interest. The principal chips away at your balance owed, while interest is what you pay the bank for borrowing their money. With a variable-rate mortgage, your interest rate is tied to your lender’s prime rate. For instance, your rate might be prime minus 1.20%. When the prime rate rises, your mortgage rate increases your monthly interest payments.

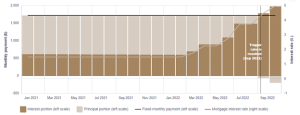

To add predictability, many lenders offer variable-rate mortgages with fixed payments. Instead of adjusting your payment size with every prime rate change, your lender maintains a consistent payment amount and adjusts the portion allocated to interest. If you have a variable-rate mortgage with adjustable payments, there’s no cause for concern. However, fixed-payment variable-rate mortgages can pose challenges. Rising interest rates lead to a more significant portion of your payment going toward interest, stretching the time it takes to pay off your mortgage.

With the rise in the interest rate, the interest portion of a fixed payment for a variable-rate mortgage grows till the trigger rate is reached.

Differences between variable and fixed-rate mortgages in terms of financial stability and long-term planning

Variable Rate Mortgages Fixed Rate Mortgages

| ● Variable-rate mortgages start with lower interest rates but can change over time, making monthly payments unpredictable. This variability can make budgeting tricky and affect your financial stability, especially if rates rise. | ● Fixed-rate mortgages keep the same interest rate for the loan term, ensuring consistent monthly payments. This stability helps you budget and offers peace of mind, shielding you from market fluctuations. |

| ● These mortgages suit those comfortable with some risk and expect rates to stay steady or drop. It can be good if rates fall, but it can become costly if rates rise unexpectedly. | ● Ideal for those seeking stability, fixed-rate mortgages provide predictability in housing costs, making it easier to plan for the future without worrying about rate changes. |

How is the mortgage trigger rate calculated?

The trigger rate for a variable-rate mortgage varies depending on the mortgage size, monthly payment, and interest rate. Each homeowner will have a unique trigger rate. Looking through your mortgage documentation is the most accessible approach to determine your trigger rate. This is the original agreement that you signed. You’ll be able to easily see your trigger rate and know when to anticipate receiving a call from your bank. However, the trigger rate listed in your documents is based on the assumption that no prepayments have been made. Your trigger rate rises each time you make a prepayment since it is applied directly to your principal.

Alternatively, you can use the following calculation to find your trigger rate:

(payment amount X number of payments per year / Balance owing) X 100 = Trigger rate in %

Assume you have a $500,000 mortgage balance that needs to be paid off with $1,100 biweekly installments or 26 payments annually. This is how your formula would appear:

5.72% ($1,100 X 26 / $500,000) X 100

Your trigger rate, in this case, would be roughly 5.72%. For streamlining your trigger rate calculations, utilize this user-friendly calculator.

Note: Each lender determines your trigger rate using a slightly different algorithm, so if you want an exact figure, you need to contact them. However, using this calculator, you can approximately estimate yours.

What happens when you reach the mortgage trigger point?

After you reach your mortgage trigger point, your lender will get in touch with you to discuss your choices. The intention is to prevent a situation where your payments fall short of what the interest will cost. You may:

- Boost your monthly payment: Increase your payment amount so some money goes towards actually paying down your loan, not just interest. You might extend your amortization period (like going from 20 years to 25 years) to make the sudden rise manageable.

- Make a lump sum payment: A one-time big payment lowers your loan balance, raising your trigger rate. You can also consider making smaller extra payments each month towards the principal. Check your mortgage terms for any limitations on extra payments.

- Switch to a fixed rate (carefully): Your lender might allow you to switch to a fixed-rate mortgage at current rates. This gives you peace of mind but could cost more in the long run as rates may stay low or even decrease.

How can you avoid the mortgage trigger rate?

Here are two powerful ways to avoid hitting your mortgage trigger rate:

- Throw Extra Money at Your Loan: Make bigger monthly payments or lump sum prepayments whenever you can. This shrinks your loan balance faster, pushing up your trigger rate and ensuring more money goes towards paying down the loan, not just interest.

- Refinance Before Rates Spike: Keep an eye on interest rates. If they’re rising and your trigger rate is close, consider refinancing to a lower rate. This locks you in for the long term and saves you money. However, beware of any penalties for breaking your current mortgage contract. Factor those into your decision.

What should I do if I’m concerned about reaching my trigger rate?

Rising interest rates can trigger concerns, but don’t wait until it’s too late! Here’s what you can do:

- Boost Your Payments Now: Increase your monthly payment before you reach the trigger rate. This ensures you keep chipping away at the loan, not just paying interest.

- Consider a Fixed Rate: Explore switching to a fixed-rate mortgage. While payments might be higher, it provides stability and prevents future rate hikes from pushing you to the trigger point again.

Prevent Your Anxiety From Being Triggered by The Trigger Rate:

Suppose you bought a house and paid 20% of the price upfront. If you didn’t get mortgage default insurance, most lenders would let you increase your mortgage balance to 80% of the property’s value. However, your trigger point changes if you get insurance because you paid less than 20% down. With insurance, you can only hit the trigger point once your mortgage balance is 105% of the property’s value. When you reach this point, you’ll need to fix your mortgage. You can do this in a few ways: by making a big payment to lower your balance (but not everyone can do this), increasing your regular payments, or refinancing your mortgage to spread out your payments over a longer time.

The Bottom Line

Managing trigger rates is an important aspect of overall financial planning, especially when considering long-term goals like retirement savings or investment strategies. Trigger rates impact mortgage payments, so understanding and managing them effectively can significantly affect financial stability and growth. By staying informed about trigger rates, individuals can make informed decisions to adjust their budget, accelerate debt repayment, and protect against potential risks posed by interest rate fluctuations. This approach ensures that financial goals remain aligned and provides a solid foundation for achieving long-term financial success