Exciting news for aspiring homeowners in Canada! Scotiabank’s recent positive shift in its mortgage business means securing your dream home is becoming more achievable.

Scotiabank, one of Canada’s leading financial institutions, has recently announced a positive shift in its mortgage business, marking an inflection point that indicates promising growth in the coming quarters. Despite a dip in mortgage volumes compared to the previous year, the bank’s strategic focus on deposit growth and customer relationships is paying off, laying a solid foundation for future expansion.

What does this mean for You?

- More Choices, Sooner: Though mortgage options have been a bit limited recently, Scotiabank anticipates a significant increase in availability soon. Get ready to explore a wider range of mortgage solutions tailored to your needs.

- Bundle and Save: Scotiabank’s popular “mortgage plus” packages combine your mortgage with other financial products. This could lead to better interest rates and a more comprehensive financial plan – simplifying your life and potentially saving you money.

- Stability You Can Trust: Scotiabank’s focus on growing deposits and reducing reliance on external funding creates a solid foundation for its mortgage offerings. You can have confidence in their long-term stability and ability to support your homeownership goals.

- Personalized Guidance Every Step of the Way: Scotiabank is committed to building strong customer relationships. Expect dedicated support and tailored advice throughout your entire mortgage journey, ensuring you feel confident and informed every step of the way.

- Proven Track Record: Even with rising interest rates, Scotiabank’s existing mortgage portfolio remains strong. This showcases their commitment to responsible lending and providing solutions that stand the test of time.

Why Scotiabank’s Approach is Your Advantage?

Scotiabank’s strategic focus on customer relationships and a diverse product range directly benefits you:

- More Options, More Freedom: A wider array of mortgage products and financial solutions empowers you to choose what best suits your unique situation.

- Peace of Mind: The bank’s emphasis on stability and responsible lending gives you confidence in their ability to support your homeownership dreams, even in uncertain economic times.

- Expert Guidance: Scotiabank’s dedication to personalized service means you’ll have a knowledgeable advisor by your side, offering tailored advice and support at every stage of the mortgage process.

Real Results That Make a Difference

- 7% Increase in Deposits: Scotiabank’s substantial deposit growth strengthens its capacity to provide you with mortgage solutions.

- 82% ‘Mortgage Plus’ Uptake: The popularity of their bundled offerings demonstrates the value and convenience these packages bring to customers like you.

- 3.1 Additional Products per Client: New mortgage clients are embracing the benefits of having multiple financial products with Scotiabank, showcasing the strength of their offerings.

- High Customer Loyalty: More clients are choosing to stay with Scotiabank for their mortgages, a testament to their customer satisfaction.

- Stable Mortgage Portfolio: Their consistently low delinquency rates emphasize Scotiabank’s commitment to responsible lending and financial well-being.

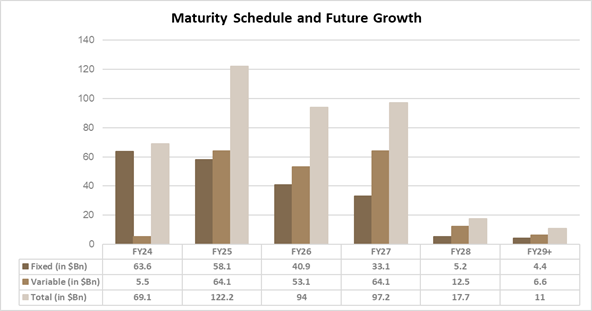

Maturity Schedule and Future Growth

Scotiabank’s maturity schedule further reinforces the positive outlook. The steady decline in maturing mortgages over the next few years, as depicted in the image, indicates a reduced need for refinancing and a potential opportunity to capture new business as these mortgages come due.

- FY24: While a significant portion of the portfolio matures this year, the bank’s strong customer relationships and multi-product offerings should help retain a substantial portion of these clients.

- FY25-FY27: The decreasing maturity volumes in these years suggest a period of relative stability, allowing the bank to focus on new originations and further expand its market share.

- FY28 Onward: The relatively low maturity volumes in the outer years highlight the long-term stability of the bank’s mortgage portfolio and its potential for sustained growth in the future.

The Future of Homeownership Looks Bright with Scotiabank Mortgages

Scotiabank is optimistic about the future of its mortgage business, which translates to more opportunities for you:

- Increased Access to Mortgages: Expect more mortgage options to become available soon, making it easier to find the perfect solution for your dream home.

- Customer-Centric Approach: Scotiabank’s dedication to personalized service means you’ll receive the individual attention and support you deserve throughout your home-buying journey.

- Sustainable Growth: Their focus on building a strong foundation ensures Scotiabank can continue providing reliable and innovative mortgage solutions for years to come.

Ready to Take the Next Step?

Scotiabank’s positive outlook is exciting, but remember, it’s essential to compare your options. That’s where Pegasus Mortgage Lending comes in. As a valued partner of Scotiabank, we can help you access their competitive rates and diverse mortgage products.

Contact Pegasus Mortgage Lending Today!

Our experienced mortgage agents have access to a vast network of lenders, including Scotiabank. We’ll work closely with you to find the most competitive rates and terms available, customized to your unique financial situation. Let us help you navigate the mortgage landscape with ease and confidence.

Your dream home is within reach. Let’s make it happen together!