The Bank of Canada’s recent rate cuts have offered a glimmer of hope to borrowers feeling the squeeze of higher interest costs. But what if this is just the beginning? Whispers in the financial world suggest a far more dramatic easing cycle is on the horizon, with TD and CIBC boldly predicting a jaw-dropping 175 basis point reduction to the overnight rate by the end of 2025.

Bank of Canada Rate Cuts: Will They Slash 175 Basis Points?

Could this mean mortgage rates will plummet to levels not seen in years? Will the housing market roar back to life? Or are these predictions overly optimistic, setting borrowers up for disappointment?

Canadians are understandably buzzing with questions about the Bank of Canada’s recent rate cuts and the predictions of a significant easing cycle ahead. Will mortgage rates plummet? Is now the time to switch from a fixed to a variable mortgage? Could we see a resurgence in the housing market?

At Pegasus Mortgage Lending, we understand these concerns, and we’re here to help you navigate this complex landscape. While we can’t predict the future with absolute certainty, we can provide expert analysis and insights to empower you to make informed decisions. Stay tuned as we delve into the implications of the Bank of Canada’s actions, the potential for a 175 basis point rate cut, and the impact on the housing market. We’ll explore the pros and cons of fixed vs. variable mortgages in this evolving environment, providing you with the knowledge you need to make the best choice for your financial situation.

Will the Bank of Canada Deliver Another 175 bps in Rate Cuts? TD and CIBC Say Yes

TD and CIBC’s Stance:

- Potential Market Rebound: If TD and CIBC’s projections materialize, the substantial rate cuts could invigorate the Canadian housing market. Lower borrowing costs may stimulate demand, leading to increased sales activity and potentially a modest rise in home prices.

- Variable-Rate Mortgage Appeal: A significant decline in the overnight rate would make variable-rate mortgages considerably more attractive. Borrowers could benefit from substantially lower monthly payments and reduced interest costs compared to fixed-rate options.

Risk of Overheating: However, such aggressive easing could also raise concerns about reigniting excessive borrowing and unsustainable price growth, potentially jeopardizing financial stability.

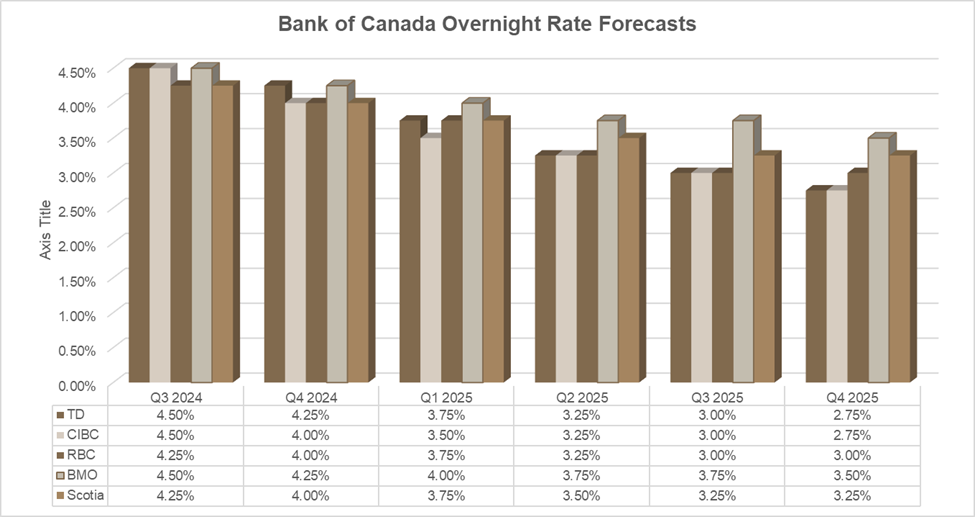

Bank of Canada Overnight Rate Forecasts

Key Observations:

- TD and CIBC are the most aggressive: They forecast the overnight rate to reach 2.75% by the end of 2025.

- RBC is slightly more conservative: They predict the rate will settle at 3.00% by the end of 2025.

- BMO and Scotia are the least aggressive: They see the rate remaining higher, at 3.50% and 3.25% respectively, by the end of 2025.

- All banks anticipate rate cuts: The overall trend is downward, indicating an expectation of easing monetary policy.

- The steepest cuts are expected in the earlier quarters: The most significant decreases in the projected rates occur between Q3 2024 and Q2 2025.

Q: What are the predictions for future rate cuts by the Bank of Canada?

A: There’s a range of predictions among major Canadian banks, showcasing varying levels of optimism regarding future rate cuts by the Bank of Canada.

- TD Bank and CIBC: Project the most aggressive cuts, forecasting a decrease of 175 basis points by the end of 2025. This would bring the overnight rate down to 2.75%.

- BMO: Expect a more moderate cut of 100 basis points by the end of 2025.

- Scotiabank and RBC: Predict less significant easing, with the overnight rate settling at 3.25% and 3.00% respectively by the end of 2025.

Q: Why do TD and CIBC believe there will be significant rate cuts?

A: The reasoning behind TD and CIBC’s bolder predictions lies in their economic outlook:

- CIBC: Foresees an economy reaching full employment with inflation hitting its target. In such a scenario, they believe the Bank of Canada will aim for a neutral interest rate setting, which they estimate to be 2.75%.

- TD: Anticipates easing inflationary pressures in the medium term, coupled with slower long-term economic growth and subdued consumer spending. These factors, they argue, will allow the Bank of Canada to comfortably reduce rates without risking an inflationary surge.

Q: What factors will influence the Bank of Canada’s decision on rate cuts?

A: The Bank of Canada has consistently emphasized its data-dependent approach, suggesting its decisions will hinge on key economic indicators:

- Inflation: The central bank is closely monitoring whether inflation continues its downward trajectory towards the 2% target. Any unexpected spikes in inflation could prompt them to pause or even reverse rate cuts.

- Economic Weakness: The Bank has already acknowledged a slowdown in economic growth. If this weakness persists or intensifies, it could provide further justification for rate reductions to stimulate the economy.

Q: Has the Bank of Canada made significant rate cuts in the past?

A: Yes, historical data reveals the Bank of Canada’s willingness to implement substantial rate cuts when economic conditions warrant it:

- 2001 Easing Cycle: A prime example is the period following the dot-com bubble burst and the 9/11 attacks. The Bank responded with 11 consecutive rate cuts, totalling a 375 basis point reduction over 12 months.

- Typical Easing Cycles: CIBC’s analysis indicates that the Bank usually returns its policy rate to a neutral level within one or two years of an easing cycle. The exception was during the 2014 oil price shock when rates remained below neutral for an extended period.

Q: What are the implications of these rate cuts for mortgage rates?

A: If the Bank of Canada follows through with the aggressive rate cuts predicted by TD and CIBC, it would translate into significant savings for borrowers, particularly those with variable-rate mortgages:

- Reduced Borrowing Costs: A 175 basis point cut in the overnight rate would likely lead to a similar reduction in prime rates, lowering variable mortgage rates by the same amount. This could result in annual savings of approximately $1,250 for every $100,000 in mortgage debt.

- Benefits for Variable-Rate Holders: Roughly 30% of Canadian mortgage holders have variable-rate mortgages. These individuals would directly benefit from the decreased interest costs, potentially freeing up significant cash flow.

Q: Will these rate cuts lead to a resurgence in variable-rate mortgages?

A: The prospect of lower rates could certainly reignite interest in variable-rate mortgages:

- Increased Appeal: Lower monthly payments and reduced interest costs make variable-rate mortgages more attractive, especially in a declining rate environment.

- Potential Shift in Borrower Behavior: We may see a shift away from the recent preference for fixed-rate mortgages, as borrowers seek to capitalize on potential savings.

- Unlikely to Reach Pandemic Levels: However, it’s improbable that variable-rate mortgages will regain the unprecedented popularity they enjoyed during the pandemic when they accounted for nearly 57% of new mortgages. The inherent risk associated with fluctuating rates will likely temper their appeal to some extent.

Remember, these predictions are based on current economic forecasts and expert opinions. The actual decisions of the Bank of Canada will be driven by real-time economic data and could deviate from these projections.

Navigating the Uncertain Future

The Bank of Canada’s recent rate cuts, combined with bold predictions from major banks like TD and CIBC, have fueled speculation about the future of mortgage rates and the housing market. While the potential for substantial rate decreases is exciting, it’s crucial to remember that economic forecasting is not an exact science. The actual path of interest rates will be determined by real-time economic data and could differ from current projections.

If you’re a homeowner considering switching from a fixed to a variable mortgage or are in the market for a new home, this is a critical time to seek expert guidance. The landscape is shifting, and making informed decisions requires careful analysis of your financial situation, risk tolerance, and long-term goals.

Partner Now with Pegasus Mortgage Lending

At Pegasus Mortgage Lending, we’re here to help you navigate these uncertain times. Our team of experienced mortgage professionals is dedicated to providing you with personalized advice and solutions tailored to your specific needs. We’ll stay abreast of the latest economic developments and their implications for the mortgage market, ensuring you have access to the most up-to-date information. Whether you’re looking to switch to a variable-rate mortgage, refinance your existing loan, or purchase a new home, we’re ready to guide you every step of the way. Contact us today for a free consultation and let us help you achieve your homeownership dreams. Don’t leave your financial future to chance. Reach out to Pegasus Mortgage Lending today and empower yourself to make informed decisions in this ever-changing landscape.