The Canadian housing market has been on a downward trend for nine straight months, leaving many wondering what’s next. Whether you’re a homeowner, an aspiring buyer, or just interested in the economy, this cooldown is a big deal. It’s a sign of changing mortgage rates, interest rates, and how affordable homes are. Additionally, predictions and forecasts for the 2024 real estate market aim to equip you with the knowledge needed to navigate the changing tides of the housing market in Canada. Whether you’re a homeowner, potential buyer, or investor, understanding these dynamics is crucial in making informed decisions in a fluctuating market.

Background on Canadian Real Estate Market Trends

The Canadian real estate market has experienced significant fluctuations over the decades, influenced by various economic, political, and social factors.

| Period | Key Characteristics | Influences and Impacts |

| Recent Years | High interest rates, scarcity of capital, cautious investment approaches. | The market is segmented with varied asset class performances, and challenges in transaction activities and valuations. |

| Policy Changes | Streamlined approvals for new housing projects. | Potential to address housing supply constraints. |

| Technological Advancements | MLS® Home Price Index (HPI) in 2012 | Provides a robust tool to track price trends and market conditions, and offers insights into regional price dynamics and overall market health. |

| May 2024 | There is a slight dip in home sales, a modest increase in new listings, and a slight decline in National Composite MLS® HPI. | Indicates a cooling market, the potential for increased activity due to rate cuts, price stabilization in most regions, and a slight price increase in Calgary, Edmonton, and Saskatoon. |

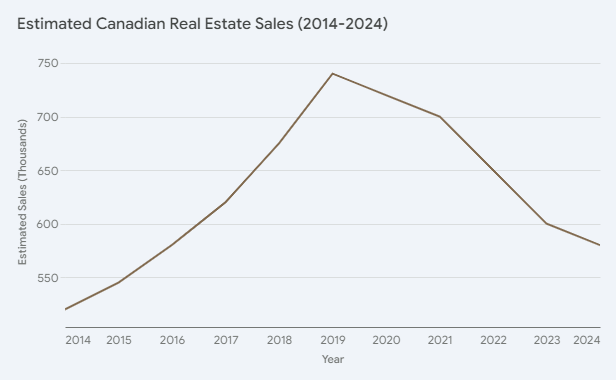

The Canadian real estate market has seen fluctuating sales figures over the past decade, with a peak in 2019 followed by a gradual decline. While 2024 projections suggest a potential stabilization, it’s clear that the market is currently in a period of adjustment.

A Comprehensive Overview of Economic Analysis

The Canadian housing market is a complex ecosystem, with interest rates, economic health, and macroeconomic indicators like employment and income playing pivotal roles.

| National Home Price Trends | Regional Highlights |

| May 2024: Modest decline of 0.2% month-over-month, 2.4% year-over-year.December 2023: 0.8% month-over-month decline, continuing the downward trend.National Average Home Price (May 2024): $699,117, a 4% decrease from the previous year. | Calgary, Edmonton, Saskatoon: Price increases since last year.Montreal: 0.4% decline.Saint John: 0.6% decline.Alberta: Average home price reached a new high of $499,505, a 7.0% annual increase. Benchmark home price up 9.3% annually.Ontario: 1.3% year-over-year decline in benchmark home prices.Saskatchewan: 35% year-over-year increase in home sales.Manitoba: 8.2% annual increase in average price. |

Interest Rate Dynamics & Economic Landscape

Interest rates are a major lever in this ecosystem. When the Bank of Canada lowers its benchmark rate, borrowing becomes more affordable, stimulating demand and potentially driving home prices up. Conversely, higher rates increase borrowing costs, dampening demand and potentially pushing prices down. This dynamic was evident in the contrasting periods of 2004-2008 and 2008 onwards, where shifts in interest rates led to starkly different home price trends

Beyond interest rates, the overall economic climate is crucial. A robust economy generally fosters a strong housing market, as individuals have more disposable income to invest in real estate. Conversely, economic downturns, as seen during the pandemic, can introduce uncertainty and dampen demand, even amidst low interest rates.

Understanding the interplay of economic factors is essential for anyone involved in Canada’s real estate market. Whether you’re a prospective buyer, investor, or simply interested in market dynamics, recognizing how interest rates and economic conditions influence trends can empower you to make informed decisions.

The analysis of the housing market data for Ontario, British Columbia, and Alberta reveals distinct trends and challenges in each province:

- Average Home Prices (April 2024): British Columbia has the highest average home price, followed by Ontario and then Alberta. This suggests that affordability is a greater challenge in British Columbia compared to the other two provinces.

- Year-over-Year Change in Home Sales (April 2024): Alberta experienced the most significant increase in home sales, indicating a strong demand in the province. Conversely, Ontario saw a substantial decrease in sales, suggesting a cooling market. British Columbia experienced a slight increase, reflecting a more stable market.

- Sales-to-New Listings Ratio (SNLR) (April 2024): Alberta’s SNLR of 76% indicates a strong seller’s market, where demand significantly outpaces supply. Ontario’s SNLR of 41% suggests a more balanced market. Data for British Columbia’s SNLR was not provided.

Challenges and Opportunities

The Canadian housing market is in a state of flux, grappling with several headwinds including,

- Rising Rates & Cooling Demand: The Bank of Canada’s rate hikes have cooled the recent rebound in housing activity. Home resales are dipping nationwide, signalling a shift towards a more balanced market.

- Regional Disparities: British Columbia, especially the Fraser Valley, is experiencing a significant slowdown in sales. Ontario’s market is mixed, with declines in some areas and gains in others, highlighting the complex regional dynamics.

- Construction Challenges: Rising costs and labour shortages are hindering new home construction, exacerbating the existing supply crunch.

- Affordability Crisis: Soaring home prices and rising mortgage rates are making homeownership increasingly out of reach for many Canadians.

Meanwhile, there are still significant opportunities for those willing to navigate the changing landscape:

- Strong Underlying Demand: Immigration and a stable economy continue to fuel demand for housing, ensuring that the market won’t completely collapse.

- Rental Market Boom: High demand for rentals, coupled with low vacancy rates, is driving rents up, creating a lucrative opportunity for investors.

- New Construction Growth: The projection of increased housing starts, particularly for more affordable multi-unit developments, offers a glimmer of hope for addressing the supply shortage.

- Immigration Boost: The government’s ambitious immigration targets will further bolster demand for housing in the coming years.

- REITs and Rental Innovation: Investors can capitalize on growing markets and changing preferences by focusing on specific regions and offering rentals with attractive amenities.

Government Interventions

Governments at all levels are actively working to alleviate the housing crisis by reducing regulatory barriers that have historically hindered the supply of needed homes. A significant step in this direction is the $4-billion federal Housing Accelerator Fund, initiated in March 2023, which aims to expedite the creation of over 750,000 new homes. Out of more than 500 applications, 179 have resulted in agreements with the federal government, with a requirement for applicants to commit to significant reforms such as addressing exclusionary zoning practices.

The Bottom Line

The Canadian housing market is at a crossroads. While recent trends paint a picture of cooling demand and regional disparities, underlying economic strengths and demographic shifts point towards continued opportunities. The key takeaway for real estate professionals? It’s time to adapt and innovate.

- Don’t rely on national averages. Understand the unique dynamics of your local market and target your strategies accordingly.

- The rental sector is booming. Whether you’re an investor or a property manager, capitalize on the high demand for rentals and consider offering attractive amenities to secure top-tier tenants.

- With rising interest rates and affordability concerns, there’s a growing need for more accessible housing options. Explore opportunities in multi-unit developments and consider catering to first-time homebuyers.

- The market is shifting rapidly, so be prepared to adjust your strategies. Stay up-to-date on policy changes, economic indicators, and emerging trends.

The Canadian housing market may be cooling, but it’s far from frozen. By understanding the challenges and embracing the opportunities, real estate professionals can survive and thrive in this evolving landscape. Remember, the key is to stay informed, be strategic, and adapt to the changing tides. The Canadian housing market still holds immense potential for those willing to seize it.