The Greater Toronto Area (GTA) condo market is experiencing a significant downturn, with sales plummeting 28% in June 2024 compared to the previous year. This dramatic decline, the sharpest drop across all property types, signals a notable shift in the city’s real estate landscape. While some buyers hoped for relief following the Bank of Canada’s pause in interest rate hikes in early 2024, the market has yet to see a significant rebound. Instead, buyers remain cautious, potentially anticipating further economic changes before making significant investments.

The future of the Toronto condo market remains to be determined. While some experts predict a gradual recovery as the economy stabilizes, others foresee a prolonged downturn. Potential buyers and investors are advised to proceed cautiously and carefully consider the risks and rewards before entering the market.

Understanding the Toronto Condo Crash: An Interplay of Multiple Factors

The June 2024 condo sales crash isn’t an isolated incident; it’s the result of multiple factors converging to create a perfect storm in the market. Let’s delve deeper into each of these contributing elements:

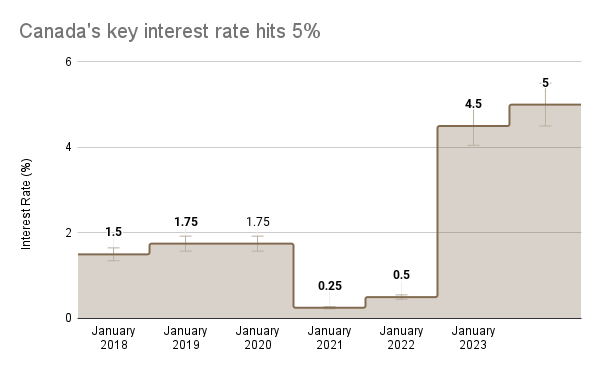

- Skyrocketing Interest Rates: The Bank of Canada’s Role

The Bank of Canada’s aggressive interest rate hikes in 2022 and early 2023 have been a primary driver of the condo market’s decline. Since March 2022, the central bank implemented ten consecutive rate increases, culminating in a benchmark interest rate of 5% in July 2023. This represents a substantial increase from the 0.25% rate in early 2021. This has drastically increased borrowing costs for potential buyers, making mortgages less accessible and dampening demand for condos. As a result, we see a significant drop in sales across all condo types, particularly in the 416 area code (Toronto city center).

- Affordability Crisis: The Price of Homeownership

Rising interest rates have exacerbated the existing affordability crisis in Toronto’s real estate market. As borrowing costs increase, monthly mortgage payments have become unaffordable for many first-time buyers and investors. This financial strain has pushed buyers towards more affordable options like rentals or smaller properties outside the city center. The data from the Toronto Regional Real Estate Board (TRREB) reflects this trend, with the average condo apartment price decreasing slightly by 0.9% year-over-year in the 416 area and 2.6% in the 905 area. However, this slight decrease does little to offset the substantial increase in mortgage payments.

- Oversupply of Condos: An Investor’s Market No More

Toronto witnessed a condo construction boom in recent years, resulting in a surplus of available units. According to Urbanation, the number of unsold condo units in the GTA has increased significantly. This excess supply, coupled with declining demand due to affordability issues, has created a buyer’s market. Sellers face fierce competition and often resort to lowering prices to attract buyers. The data reflects this trend, with a substantial year-over-year decrease in condo sales (-29.1% in 416 and -25.9% in 905) and a slight decrease in average prices.

| June 2024 | Sales | Average Price | ||||

| 416 | 905 | Total | 416 | 905 | Total | |

| Detached | 744 | 2,244 | 2,988 | $17,58,649 | $13,88,144 | $14,80,399 |

| Semi-Detached | 236 | 363 | 599 | $12,82,973 | $9,85,834 | $11,02,904 |

| Townhouse | 232 | 822 | 1,054 | $10,08,467 | $9,09,764 | $9,31,490 |

| Condo Apt | 1,014 | 506 | 1,520 | $7,63,148 | $6,57,147 | $7,27,861 |

| YoY% of Change | 416 | 905 | Total | 416 | 905 | Total |

| Detached | -7.2% | -11.7% | -10.6% | -1.6% | -4.2% | -3.3% |

| Semi-Detached | -20.8% | -4.0% | -11.4% | -8.9% | -7.4% | -9.3% |

| Townhouse | -13.4% | -14.3% | -14.1% | -2.7% | -5.6% | -4.9% |

| Condo Apt | -29.1% | -25.9% | -28.1% | -0.9% | -2.6% | -1.5% |

- Changing Buyer Preferences: The Rise of Remote Work

The pandemic-induced shift to remote work has transformed buyer preferences. Many are now prioritizing larger homes in less densely populated areas, seeking more space and affordability. A 2023 RE/MAX survey found that 68% of Canadians now consider a home office to be essential. This has led to a decline in demand for condos, especially smaller units in the downtown core, which were once highly sought after. This trend is reflected in the data, with detached and semi-detached homes experiencing less severe sales declines compared to condos.

- Investor Exodus: The End of an Era

Investors seeking rental income or capital appreciation heavily influenced Toronto’s condo market in recent years. However, rising interest rates and stricter mortgage regulations, such as the B-20 stress test, have made condo investments less appealing. Consequently, many investors are offloading their properties, adding to the oversupply of condos on the market. The sharp drop in condo sales and the relatively stable average prices suggest that investor activity has significantly decreased.

- Economic Uncertainty: A Cautious Stance

The current economic landscape, marked by high inflation, rising living costs, and the looming threat of a recession, has created uncertainty among buyers and investors. The Conference Board of Canada’s Consumer Confidence Index has declined steadily since early 2023. This hesitance leads many to adopt a cautious approach, waiting for a more stable economic outlook before making significant real estate investments. This cautious sentiment is likely a contributing factor to the overall decline in sales across all property types.

- Government Policies: Cooling Measures and Regulations

The government has introduced various measures to temper the overheated housing market, including the foreign buyers tax and stricter mortgage stress tests. While these policies have achieved some success in curbing demand, they have also made it more challenging for some buyers to enter the market, particularly first-time buyers. These cooling measures likely contributed to the slowdown in the condo market, although their impact is less pronounced compared to interest rate hikes and affordability concerns.

Understanding these factors is crucial for anyone involved in the Toronto real estate market, whether as a buyer, seller, investor, or industry professional. By analyzing these trends and adapting strategies accordingly, stakeholders can navigate the current market challenges and position themselves for future opportunities.

The Bottom Line

The June 2024 crash in Toronto’s condo market paints a stark picture of a market in flux. The interplay of skyrocketing interest rates in 2022 and early 2023, an affordability crisis, oversupply, shifting buyer preferences, an investor exodus, economic uncertainty, and government cooling measures have all contributed to this dramatic downturn. While a slight dip in prices might seem appealing to some buyers, the overall landscape is one of caution and uncertainty. The condo market is no longer the investor’s haven it once was. The combination of factors has created a buyer’s market, where those with the financial means and risk tolerance can potentially find good deals. However, potential buyers should proceed with caution and thoroughly research the market before making any decisions. The future trajectory of the condo market remains unclear. We may see a gradual recovery as the economy rebounds. However, the oversupply of units and the evolving preferences of buyers could also lead to a prolonged downturn.