The Office of the Superintendent of Financial Institutions (OSFI) in Canada has recently announced significant changes in borrowing requirements for mortgage applicants, marking a major shift in the country’s economic environment

This action is in response to concerns about increasing risky loans with high debt levels in banks’ home loan collections. Canadian borrowers carry some of the highest debt levels globally. The new stress test may make it harder for first-time buyers to get mortgages. Existing homeowners might need help to refinance if their loan-to-income ratio is high. Borrowers must understand how these changes could affect their ability to buy or refinance homes. This analysis will discuss the upcoming income stress test, what it means for borrowers, and how to prepare for it.

OSFI Introduces New Stress Test for Borrowers’ Loan-to-Income Ratios

The Office of the Superintendent of Financial Institutions (OSFI) in Canada is gearing up to strengthen borrowing requirements for certain mortgage applicants, aiming to mitigate risks in the lending landscape. These upcoming regulations will target borrowers’ loan-to-income (LTI) ratios, setting a cap at 4.5%. Unlike the widely known B-20 mortgage stress test, which applies to individual borrowers, this new policy will operate at the lender level, allowing flexibility in managing borrowers who exceed the ratio. The LTI ratio is calculated by combining all loans secured against the property, including Home Equity Lines of Credit (HELOCs), and dividing it by the borrower’s gross income. It’s a pivotal metric to assess the borrower’s financial health and ability to repay the mortgage. This new rule, expected to roll out soon, will solely affect new mortgage agreements, leaving existing loans and renewals unaffected. This rule won’t affect mortgages that have mortgage default insurance. OSFI aims to stabilize lenders’ portfolios, especially with varying interest rates. The housing bubble during the pandemic showed the risks of large loans in a volatile market. Many borrowers, tempted by low rates and rising home prices, struggled with mortgage payments when rates increased later.

This rule avoids similar problems, protecting borrowers and lenders from financial stress. According to Bank of Canada data, its initial impact might be small, affecting only a few borrowers who exceed the 4.5% LTI limit. However, if mortgage rates drop, more borrowers might feel the impact, especially if they borrow more than they earn.

OSFI Stands Firm: Stress Test for Uninsured Switches to Remain

The Competition Bureau of Canada recently advocated for borrowers, urging the elimination of the mortgage stress test for uninsured mortgage holders seeking to switch lenders during renewal. On March 21, the Bureau released this recommendation to enhance competition within Canada’s financial sector. Only insured mortgage holders can switch lenders without being subjected to a re-stress test, provided their mortgage size and amortization period remain unchanged. People who stick with their bank when renewing their mortgage need to prove they can handle higher payments if their financial situation changes significantly. The stress test ensures borrowers can handle payments if the interest rate increases by 2%. Right now, most borrowers are tested to see if they can manage payments at rates between 7% and 8%.

Many argue about whether it’s fair to stress test uninsured mortgage switches. Some say it stops competition, makes lenders less likely to offer reasonable rates, and stops borrowers from getting the best deals. Most mortgages (73%) don’t have insurance, affecting many people with mortgages. The Bureau says it’s essential for borrowers to get good mortgage deals when renewing. They think making borrowers do stress tests again at renewal makes it hard to get reasonable rates and terms, which isn’t fair. A Bank of Canada report says people who stick with their bank at renewal pay more than new borrowers or those who switch banks. However, OSFI disagreed with the Bureau’s suggestions. They say the new bank will take on more risk if you switch banks without insurance. However, the Bureau thinks their risk will be lower if borrowers get better rates.

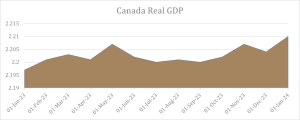

Surprising GDP Growth May Unsettle Bank of Canada’s Confidence

The Bank of Canada closely monitors various data reports to inform its rate policy decisions, with inflation, labour numbers, and overall economic growth taking center stage. However, January’s latest report on gross domestic product (GDP) surprised many because it did better than expected. This might change what the central bank planned to do about cutting interest rates. The latest data shows that the economy grew by 0.6% in January, which is more than expected and the best in a year. This growth came mainly from services like healthcare and retail, which increased by 0.7%, and industries like manufacturing, which increased by 0.2%.

Analysts expect more growth in February, around 0.4%. Douglas Porter, Chief Economist at BMO, says this growth is important because the economy grew by 1.0% in just two months, more than last year’s. He thinks this sudden growth is because the economy is doing better at the beginning of this year after slow growth in 2023.

Porter says these unexpectedly strong numbers changed what people thought would happen in the first part of the year. If February’s numbers are good, the economy might grow by 3.5% compared to last year, more than what experts predicted. However, there are concerns about whether the Bank of Canada will still lower interest rates later. Porter thinks the Bank of Canada might change its mind about inflation because the economy is doing so well at the beginning of 2024. If the economy keeps doing well in the second part of the year, the Bank of Canada might not need to lower rates soon, but it depends on the following inflation reports.

The Bottom Line

As the income stress test implementation draws nearer, borrowers must take proactive steps to understand its implications and prepare accordingly. Whether you’re a prospective homebuyer, an existing homeowner, or looking to refinance, staying informed about the changing regulatory landscape is critical to making informed financial decisions. While the new rules may pose challenges in accessing mortgage financing, they also promote responsible lending practices and safeguard the long-term stability of the housing market. To navigate mortgage changes confidently, borrowers should utilize a mortgage stress test calculator, stay informed, and seek advice from financial experts.