The Bank of Canada interest rates are a crucial topic for every Canadian, influencing everything from mortgage payments to the overall health of the economy. As we move through 2025, the trajectory of the Bank of Canada interest rates has been a subject of intense speculation and frequent revision. Just recently, the economic landscape shifted, prompting a re-evaluation of earlier forecasts for the Bank of Canada interest rates. This article delves into the current situation, the factors at play, and what Canadians can expect from the Bank of Canada interest rates in the coming months.

Understanding the Bank of Canada Interest Rate Environment

The Bank of Canada interest rate is the target for the overnight rate, which is the rate at which major financial institutions borrow and lend to each other for one day. This rate influences other interest rates in the economy, such as those for mortgages, loans, and savings. The Bank of Canada uses this rate as its primary tool to manage inflation and support economic growth. When the Bank of Canada interest rates are high, borrowing becomes more expensive, which can cool down an overheating economy and curb inflation. Conversely, lower Bank of Canada interest rates make borrowing cheaper, stimulating economic activity. The current Bank of Canada interest rate is 2.75%, a level that has held steady since March 2025 following a reduction from 3.00%.

For much of early 2025, the consensus among economists and financial institutions was that the Bank of Canada interest rate would be cut sooner rather than later. This expectation was largely based on a perceived slowdown in economic activity. However, recent economic data has presented a more complex picture, leading to a significant shift in the outlook for the Bank of Canada interest rates.

The Unexpected Strength of Canadian GDP and its Impact on the Bank of Canada Interest Rates

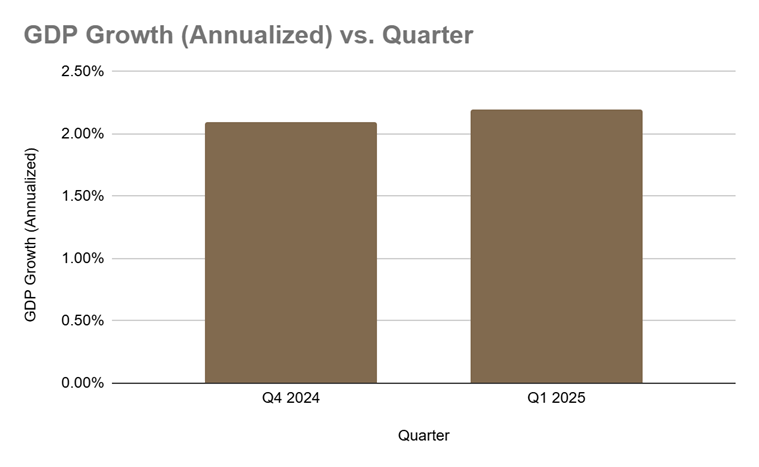

A major turning point in the discussion around the Bank of Canada interest rates came with the release of the first-quarter GDP data for 2025. Canada’s GDP grew at an annualized rate of 2.2% in the first quarter of the year, a surprising performance that matched the growth seen in the last quarter of 2024. This defied earlier expectations of a tariff-driven economic slowdown.

According to Statistics Canada, this increase in GDP was primarily driven by a rise in both imports and exports, particularly for tariff-affected products like cars, oil and gas, and industrial machinery, equipment, and parts. While this strong headline number painted a positive picture, some economists remain cautious. There’s a concern that this robust growth might be masking underlying vulnerabilities, possibly fueled by a pre-tariff buying spree as businesses rushed orders ahead of anticipated price hikes. For instance, several sectors, including manufacturing, utilities, residential construction, household spending, and household savings, showed downward trends. The Bank of Canada will carefully consider this nuanced data in its deliberations on the Bank of Canada interest rates.

What is the Bank of Canada interest rate now, and why the shift in forecasts?

Prior to the latest GDP report, nearly all of Canada’s major financial institutions were forecasting a June Bank of Canada interest rate cut. Institutions like BMO, CIBC, National Bank, and RBC had projected a 25 basis points (bps) reduction, with TD even suggesting a larger 50 bps cut. However, the stronger-than-expected GDP data has prompted many to revise these forecasts.

Interestingly, Scotiabank was the outlier, consistently predicting no change to the Bank of Canada interest rates for the upcoming meeting. Their reasoning, articulated by Derek Holt in a post titled “No way the Bank of Canada Should Be Cutting,” centered on persistently elevated core inflation, even before the full impact of tariff-related supply shocks. Holt highlighted that April’s inflation data came in hotter than the Bank’s own projections, suggesting that despite some economic slack, other forces were keeping core inflation sticky and elevated.

Following the robust GDP report, other major banks are now echoing this more cautious outlook regarding the Bank of Canada interest rate. Douglas Porter, Chief Economist at BMO, noted that the GDP figures are sending “no obvious distress signals so far in 2025.” This strong set of results led BMO to abandon its call for a June rate cut, now expecting the next Bank of Canada interest rate cut to occur in late July. Porter suggests that the market might have overestimated the impact of trade tensions, and with the economy holding relatively steady and core inflation remaining high, the Bank of Canada may not be inclined to cut Bank of Canada interest rates as aggressively or quickly as once anticipated.

“All of this adds up to a less pressing need for monetary policy to support the economy,” Porter wrote. “The back-up of core inflation to above 3% will keep the Bank more cautious, suggesting that Bank of Canada interest rates will be held steady at this week’s decision. We continue to believe that this is not the end of the line for Bank of Canada interest rate cuts, but we are officially pushing back our timing of those trims, to restart in late July, and perhaps stretching into early next year.” This re-evaluation highlights the dynamic nature of economic forecasting and the importance of timely data for the Bank of Canada’s decisions.

When is the next Bank of Canada interest rate announcement?

The next Bank of Canada interest rate announcement is scheduled for Wednesday, June 4, 2025. This announcement is highly anticipated, as it will provide further clarity on the Bank’s current assessment of the economic situation and its future plans for the Bank of Canada interest rates.

As of Friday, May 30, 2025, bond markets were pricing in only a 32% chance of a Bank of Canada interest rate cut at the June meeting, signaling a strong consensus for a hold. However, expectations for July remained high, with markets assigning a 75% probability to a 25-bps Bank of Canada interest rate cut. This suggests that while a June cut might be off the table, the prospect of a Bank of Canada interest rate cut in the near future is still very much alive. Canadians keenly await the Bank of Canada interest rate announcement.

Bank of Canada Policy Rate Forecasts from Major Canadian Banks

The major Canadian banks have adjusted their forecasts for the Bank of Canada interest rates in light of the recent economic data. Here’s a summary of their updated outlooks:

| Bank | Current Policy Rate | June 2025 Decision | Q3 2025 | Q4 2025 | Q4 2026 |

| BMO | 2.75% | 2.75% | 2.25% | 2.00% | 2.00% |

| CIBC | 2.75% | 2.75% | 2.25% | 2.25% | 2.25% |

| National Bank | 2.75% | 2.75% | 2.25% | 2.00% | 2.00% |

| RBC | 2.75% | 2.75% | 2.25% | 2.25% | 2.50% |

| Scotiabank | 2.75% | 2.75% | 2.75% | 2.75% | 2.00% |

| TD | 2.75% | 2.50% | 2.25% | 2.25% | 2.25% |

As you can see from the table, a general consensus for a hold in June has emerged, with most banks now pushing back their expectations for the first Bank of Canada interest rate cut to later in the year, primarily Q3 2025. The variations in their forecasts for Q4 2025 and Q4 2026 suggest ongoing uncertainty about the pace and extent of future reductions in Bank of Canada interest rates.

Canadian GDP Growth (Annualized)

The recent Q1 2025 GDP data came in stronger than anticipated, defying earlier forecasts for a significant slowdown. This resilience in economic activity gives the Bank of Canada more leeway before considering a Bank of Canada interest rate cut.

Source: Statistics Canada

Inflation Trends

Core inflation, which excludes volatile items like food and energy, remains a key concern for the Bank of Canada. Despite a headline CPI drop in April 2025 to 1.7% year-over-year (from 2.3% in March), largely due to energy price declines, the core CPI measures (like CPI Trim and CPI Median) accelerated to 3.1% and 3.2%, respectively. This persistence in underlying inflation pressures plays a significant role in the Bank of Canada’s cautious stance on Bank of Canada interest rates.

Canada Consumer Price Index (CPI) and Core Inflation (Year-over-Year)

| Measure | March 2025 | April 2025 |

| All-items CPI | 2.3% | 1.7% |

| CPI excluding energy | 2.5% | 2.9% |

| CPI Trim (BoC) | 2.9% (approx.) | 3.1% |

| CPI Median (BoC) | 2.8% (approx.) | 3.2% |

Source: Statistics Canada, Bank of Canada

Bond Market Expectations

The bond market is often seen as a forward-looking indicator of interest rate expectations. The significant shift in the probabilities of a June Bank of Canada interest rate cut reflects the market’s reaction to the latest economic data.

Probability of a Bank of Canada Interest Rate Cut at June Meeting

| Date | Probability of 25 bps Cut |

| ~1 month ago | High (e.g., >70%) |

| May 30, 2025 | 32% |

Source: LSEG Data & Analytics

This reduction in the perceived likelihood of a June Bank of Canada interest rate cut underscores the impact of the stronger GDP data and the Bank’s ongoing vigilance regarding inflation.

The Path Forward for Bank of Canada Interest Rates

The current environment suggests that the Bank of Canada is prioritizing a sustained return to its inflation target of 2%. While an eventual Bank of Canada interest rate cut is still expected, the timing and pace will be highly dependent on incoming economic data, particularly inflation readings and signs of economic rebalancing. The Bank will be carefully monitoring the impact of global trade developments and domestic demand on the Canadian economy. The next few Bank of Canada interest rate announcement dates will be critical in shaping the financial landscape for Canadians.

For homeowners and prospective buyers, the future of Bank of Canada interest rates holds significant weight. Variable mortgage rates are directly tied to the prime rate, which typically moves in lockstep with the Bank of Canada’s policy rate. A hold on Bank of Canada interest rates means variable mortgage payments will remain stable for now, while any future Bank of Canada interest rate cut would provide relief. Fixed mortgage rates, on the other hand, are influenced by bond yields, which can react to a broader range of economic factors and expectations around future Bank of Canada interest rates.

It’s important for Canadians to stay informed about the Bank of Canada’s decisions and their potential implications. The Bank of Canada interest rate outlook remains dynamic, and adapting financial strategies accordingly will be key.

Navigating the Future of Bank of Canada Interest Rates

The path of Bank of Canada interest rates in 2025 is proving to be less straightforward than many initially anticipated. The surprising resilience of Canada’s GDP in the first quarter has given the Bank of Canada more breathing room, reducing the immediate pressure for a Bank of Canada interest rate cut. While headline inflation has eased, the persistence of core inflation and underlying price pressures remain a key concern for the central bank. As a result, the consensus has shifted towards a hold on Bank of Canada interest rates for the upcoming June announcement, with a potential Bank of Canada interest rate cut pushed back to later in the year, likely July or beyond.

The Bank of Canada will continue to assess incoming economic data meticulously, balancing the need to control inflation with supporting sustainable economic growth. Canadians should remain attentive to future Bank of Canada interest rate announcement dates and their accompanying economic assessments. Understanding these developments is crucial for making informed financial decisions, especially concerning mortgages and lending.

Ready to Explore Your Mortgage Options Amidst Shifting Rates?

Whether the Bank of Canada interest rates are holding steady or are on the verge of a Bank of Canada interest rate cut, navigating the mortgage landscape requires expert guidance. At Pegasus Mortgage Lending, we understand the complexities of the Canadian market and the impact of the Bank of Canada interest rates on your homeownership dreams.

Start your mortgage journey today with Canada’s premier lender. Expert guidance, fast approvals, and personalized solutions await you.