For many Canadians, a home represents their largest asset and their most significant financial commitment. The cost of financing this dream, primarily through a primary mortgage, is a crucial factor in the homeownership journey. Mortgage pricing isn’t simply a number pulled out of thin air; it’s a complex interplay of economic indicators, market forces, and individual borrower profiles. Understanding how mortgage pricing works, especially in the nuanced Canadian market, is key to making informed decisions. This detailed blog will explore the various facets that influence mortgage pricing, from the broader economic climate to the specifics of how lenders determine your rate, all within the Canadian context. We’ll also delve into related concepts like mortgage-backed securities pricing and the role of mortgage automators in this intricate process, providing a comprehensive look at mortgage pricing.

The Bedrock of Mortgage Pricing: Bond Yields and Economic Indicators

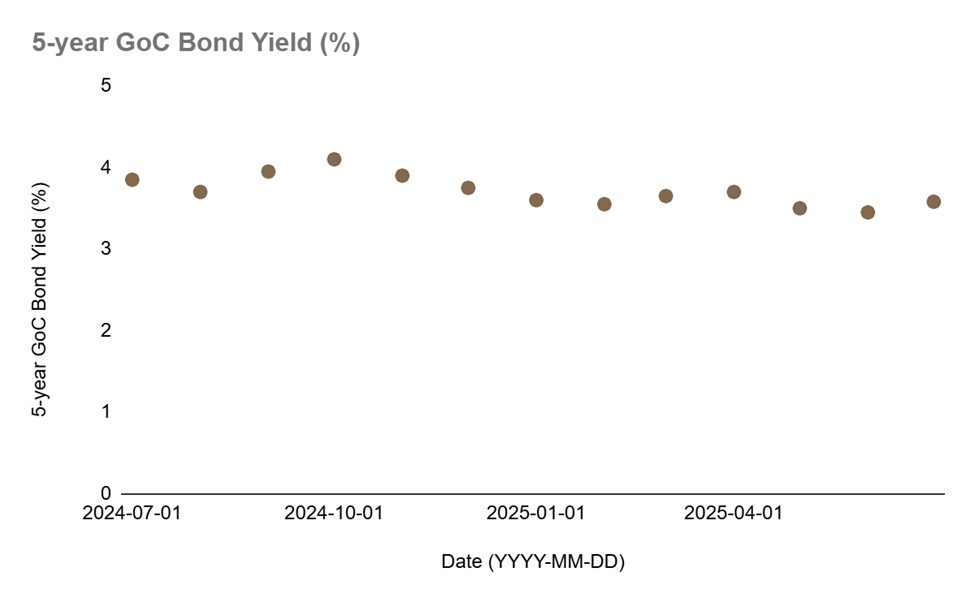

The foundation of mortgage pricing in Canada, particularly for fixed-rate mortgages, is deeply intertwined with government bond yields. Specifically, the 5-year Government of Canada (GoC) bond yield serves as a primary benchmark for 5-year fixed mortgage pricing. Lenders use these bond yields as their cost of funds; effectively, it’s the interest rate they pay to borrow money in the market before lending it out to you. Therefore, when bond yields rise, fixed mortgage pricing tends to follow suit.

Recent trends have shown fixed mortgage rates creeping higher as bond yields rise. This upward movement is often fuelled by stronger-than-expected economic data, both domestically and internationally. For instance, rising U.S. Treasury yields, driven by robust inflation data south of the border, often exert upward pressure on Canadian bond yields due to the close linkage between the two economies. On the domestic front, strong employment reports, indicating a healthy labour market, can also contribute to rising bond yields, as they suggest economic growth and potential inflationary pressures. This directly impacts mortgage pricing for fixed terms.

This close correlation means that even seemingly minor fluctuations in bond yields can translate into shifts of five to ten basis points (0.05% to 0.10%) in mortgage pricing. Mortgage brokers and financial observers keenly watch these movements, often predicting further increases when bond yields show a sustained upward bias. The overall economic outlook, including the specter of growing government deficits, can also shape longer-term yields, as increased government borrowing can compete with private sector borrowing, potentially driving up interest rates. This emphasizes the sensitivity of mortgage pricing to macroeconomic conditions.

The Bank of Canada’s Influence on Mortgage Pricing

While bond yields largely dictate fixed primary mortgage rates, the Bank of Canada (BoC) plays a pivotal role in influencing variable primary mortgage rates and, indirectly, the overall mortgage pricing environment. The BoC’s key policy interest rate (also known as the overnight rate) directly impacts the prime rate offered by commercial banks. Variable-rate mortgages are typically priced as prime plus or minus a certain spread.

The Bank of Canada’s primary mandate is to maintain price stability, often targeting an inflation rate of around 2%. When inflation rises above this target, the BoC typically raises its policy rate to cool down the economy and curb inflationary pressures. Conversely, during periods of economic slowdown or low inflation, the BoC may lower rates to stimulate borrowing and spending. These decisions have immediate consequences for variable mortgage pricing.

For example, if Canada’s annual inflation rate ticks up, and core inflation measures remain stubborn, it firms expectations that the Bank of Canada will hold or even raise its key rate. This directly impacts existing variable-rate and HELOC borrowers, as their payments adjust in tandem with the prime rate. Even though fixed rates are tied to bond yields, the overall interest rate environment created by the Bank of Canada’s monetary policy indirectly influences the competitiveness and attractiveness of different primary mortgage products, affecting overall mortgage pricing.

Deeper Dive into Mortgage-Backed Securities Pricing

Beyond the immediate interplay of bond yields and central bank policy, the broader financial markets, particularly the mortgage backed securities pricing (MBS) market, also play a significant role in primary mortgage availability and mortgage pricing. In Canada, National Housing Act (NHA) MBS are a crucial component of the mortgage finance system. These securities are created by pooling together a large number of individual mortgages and then selling interests in these pools to investors. The timely payment of principal and interest on NHA MBS is guaranteed by the Canada Mortgage and Housing Corporation (CMHC), a federal Crown corporation fully backed by the Government of Canada, making them highly attractive to investors.

How are mortgage backed securities priced? The mortgage backed securities pricing mechanism is complex but hinges on several factors:

- Underlying Mortgage Pool Characteristics: The average interest rate of the mortgages in the pool, their remaining terms, and the creditworthiness of the borrowers all influence the value and therefore the mortgage backed securities pricing.

- Prepayment Risk: One of the key risks for MBS investors is prepayment risk. This occurs when borrowers pay off their mortgages early (e.g., by selling their homes, refinancing at a lower rate, or making lump-sum payments). If interest rates fall, borrowers are more likely to prepay, reducing the expected yield for MBS investors. Mortgage backed securities pricing must account for this potential loss of future interest income.

- Interest Rate Environment: Similar to individual mortgages, the prevailing interest rate environment directly impacts mortgage backed securities pricing. When overall interest rates rise, existing MBS with lower coupon rates become less attractive, and their prices may fall. Conversely, when rates fall, existing MBS with higher coupon rates become more valuable.

- Guarantor Strength: In Canada, the CMHC guarantee significantly enhances the credit quality of NHA MBS. This guarantee reduces credit risk for investors, making these securities more appealing and influencing their mortgage-backed securities pricing favourably compared to unguaranteed mortgage pools.

- Market Liquidity: The ease with which MBS can be bought and sold in the secondary market also affects their mortgage-backed securities pricing. A liquid market means investors can exit their positions easily, which generally commands better pricing.

The efficient functioning of the mortgage-backed securities pricing market allows lenders to originate more mortgages. By selling off existing mortgages into MBS pools, lenders free up capital to issue new loans, thereby increasing the supply of funds in the mortgage market and contributing to competitive mortgage loan pricing. This entire ecosystem is vital to maintaining a healthy and accessible primary mortgage market in Canada.

Delving into Mortgage Loan Pricing for the Borrower

Beyond the macro factors, the actual mortgage loan pricing that a borrower receives is also highly individualized. Lenders consider a range of factors specific to each applicant to determine their eligibility and the final mortgage loan pricing offered.

Key factors influencing individual mortgage loan pricing include:

- Credit Score and History: A strong credit score signals to lenders that you are a reliable borrower with a history of timely payments. This reduces the perceived risk for the lender, often resulting in more favourable mortgage loan pricing. Conversely, a lower credit score may lead to higher rates or even a refusal of the loan.

- Down Payment Amount: A larger down payment reduces the loan-to-value (LTV) ratio, meaning the borrower has more equity in the property from the outset. This lowers the lender’s risk exposure, as there’s more collateral cushion in case of default. Mortgages with a down payment of less than 20% in Canada require mortgage default insurance (e.g., from CMHC, Sagen, or Canada Guaranty), which, while protecting the lender, can also allow borrowers to access slightly better rates than they might otherwise.

- Amortization Period and Term Length: The amortization period (the total time to pay off the mortgage) and the term length (the duration of the current mortgage contract, typically 1 to 10 years in Canada) both impact mortgage loan pricing. Longer amortization periods generally mean lower monthly payments but higher total interest paid, and potentially a slightly higher rate due to increased interest rate risk for the lender over a longer period. Longer fixed terms generally come with a slightly higher rate than shorter terms due to the lender taking on more interest rate risk.

- Loan-to-Value (LTV) Ratio: As mentioned, this is the ratio of the mortgage amount to the appraised value of the property. A lower LTV (higher down payment) is generally associated with better mortgage loan pricing.

- Property Type and Location: Certain property types (e.g., condominiums vs. detached homes) and locations can be perceived as higher or lower risk by lenders, influencing mortgage loan pricing.

- Income Stability and Debt-to-Income Ratio: Lenders assess a borrower’s income stability and their debt-to-income ratio to ensure they can comfortably manage the mortgage payments. A high debt-to-income ratio indicates a higher risk, potentially leading to less favourable mortgage loan pricing.

- Loan Features: “Open” mortgages, which allow for full prepayment at any time without penalty, typically come with higher mortgage loan pricing than “closed” mortgages, which restrict prepayment options but offer lower rates. Other features like payment frequency, portability, and assumability can also subtly impact the offered rate.

Lenders also incorporate their own operational costs, desired profit margins, and risk assessments into their mortgage loan pricing strategies. This combination of macro-economic influences and individual borrower characteristics determines the final primary mortgage rate a Canadian consumer will pay.

The Role of Mortgage Automator Pricing in Efficiency and Access

In the modern mortgage landscape, technology plays an increasingly vital role in streamlining processes and influencing mortgage pricing. Platforms and software often referred to as “mortgage automators” are transforming how lenders and brokers operate, ultimately impacting efficiency and potentially contributing to more competitive mortgage automator pricing for consumers.

Mortgage automator pricing refers to the impact of automated systems on the cost structure of mortgage origination and servicing. These sophisticated software solutions handle a wide array of tasks, including:

- Loan Origination: Automators can streamline the application process, from pre-approvals and document collection to credit checks and initial underwriting. This reduces the manual effort and time involved, potentially lowering administrative costs for lenders, which can indirectly lead to more favourable mortgage pricing.

- Compliance Management: Staying abreast of ever-evolving regulatory requirements is critical in the mortgage industry. Mortgage automators often have built-in compliance features, reducing the risk of errors and penalties, and thus contributing to a more stable and efficient mortgage pricing environment.

- Loan Servicing: Post-origination, these platforms can automate payment processing, ledger tracking, and even investor reporting for entities involved in mortgage backed securities pricing. This efficiency in servicing can translate to cost savings that can be passed on, in part, to borrowers through better mortgage pricing.

- Data Analysis: Advanced mortgage automators can analyze vast amounts of data, providing insights into market trends, borrower behaviour, and risk profiles. This data-driven approach allows lenders to refine their mortgage loan pricing models, making them more accurate and responsive to market conditions.

While mortgage automator pricing isn’t a direct rate that borrowers pay, the underlying efficiency gains achieved through these technologies can contribute to a more competitive market. By reducing operational overhead and accelerating processing times, lenders can potentially offer more attractive primary mortgage rates. For consumers, this means a faster, more transparent application process and potentially better deals as lenders compete on efficiency and cost. The long-term trend suggests that the increasing adoption of these technologies will continue to exert downward pressure on administrative costs, which could ultimately benefit mortgage pricing for Canadian homeowners.

Current Landscape and Future Outlook for Canadian Mortgage Pricing

As of mid-2025, the Canadian mortgage market continues to navigate a complex environment. The upward creep in fixed primary mortgage rates observed earlier, driven by rising bond yields and strong economic data, is a key factor influencing mortgage pricing. While inflation has shown some moderation, core inflation measures remain a focus for the Bank of Canada. The housing market itself presents a mixed picture. While some regions in the Prairies, Quebec, and Atlantic Canada are experiencing strong demand and resilient prices, major markets like Ontario and British Columbia are grappling with higher inventory levels, affordability challenges, and softer job prospects in some areas. This regional disparity can also influence mortgage loan pricing, as lenders might adjust their risk appetite based on local market conditions.

Looking ahead, the consensus amongst many experts points to continued volatility. While some anticipate further interest rate cuts from the Bank of Canada later in the year, which would ease variable primary mortgage rates, the timing and magnitude of these cuts remain uncertain. The ongoing global economic landscape, including potential trade tensions, also adds layers of complexity, as international factors can significantly influence Canadian bond yields and, by extension, mortgage pricing. For homeowners and prospective buyers, staying informed about these trends is paramount. Whether choosing a fixed or variable primary mortgage, understanding the underlying factors driving mortgage pricing and the associated risks and rewards is essential. Comparing offers from various lenders and seeking expert advice from mortgage professionals will be crucial in securing the most favourable mortgage pricing in this evolving environment.

Mastering Canadian Mortgage Pricing

The world of Canadian mortgage pricing is multifaceted, influenced by a dynamic interplay of global bond markets, the Bank of Canada’s monetary policy, the intricacies of mortgage backed securities pricing, and individual borrower profiles. Understanding these components is not merely academic; it’s essential for making sound financial decisions when it comes to your home. We’ve explored how fixed rates are closely tied to bond yields, particularly the 5-year GoC bond, and how variable rates dance to the tune of the Bank of Canada’s overnight rate and the prime rate. We’ve also delved into the behind-the-scenes mechanics of how are mortgage backed securities priced, demonstrating how these financial instruments ensure liquidity in the market, ultimately benefiting primary mortgage availability. Furthermore, the increasing adoption of sophisticated tools, contributing to mortgage automator pricing efficiencies, is reshaping the very landscape of mortgage origination and servicing, leading to potentially more competitive mortgage loan pricing for consumers.

In this ever-evolving environment, marked by shifting economic data and central bank actions, securing the optimal mortgage pricing demands vigilance and informed choices. Whether you’re a first-time homebuyer or looking to renew, navigating the complexities of the market requires expert guidance.

Secure Your Dream Home with Expert Mortgage Pricing Guidance!

Ready to navigate the dynamic world of mortgage pricing with confidence? At Pegasus Mortgage Lending, we offer personalized primary mortgage solutions tailored to your unique needs. With over two decades of experience helping thousands of Canadians achieve homeownership, our expert team understands the nuances of mortgage pricing, mortgage-backed securities pricing, and how to secure the best mortgage loan pricing for you. Don’t leave your financial future to chance.