As a Canadian homeowner or prospective buyer, you likely keep a close eye on domestic economic news, Bank of Canada announcements, and advertised mortgage rates. But there’s a powerful, external force significantly influencing the fixed mortgage rates available to you right here in Canada: the US 10-Year Bond yield. It might seem distant, an abstract number related to American government debt, but understanding its movements and implications is crucial for making informed decisions about your largest financial commitment. This seemingly obscure figure plays a pivotal role in determining the direction of fixed mortgage rates in Canada, often acting as a leading indicator long before changes hit the headlines. This article will demystify the connection, explaining exactly how fluctuations south of the border ripple through our financial system and directly impact your mortgage payments.

What is the US 10-Year Bond Yield? Demystifying the Global Benchmark

Before diving into the Canadian connection, let’s clarify exactly what we’re talking about. What is US 10 year bond yield? When the United States government needs to borrow money to fund its operations – everything from infrastructure projects to social programs – it issues debt securities known as Treasury bonds. Investors (individuals, institutions, and foreign governments) buy these bonds, effectively lending money to the U.S. government. In return, the government promises to pay back the principal amount at a specified future date (maturity) and typically makes periodic interest payments (coupons) along the way.

The “10-Year” part refers to the time until the bond matures – a decade. Bonds are issued with various maturities (e.g., 2-year, 5-year, 30-year), but the US 10-Year Bond yield is widely considered a benchmark for longer-term interest rates globally. It reflects investors’ collective outlook on inflation, economic growth, and the perceived safety of investing in US government debt over that period.

The “Yield” is the crucial part for our discussion. It represents the annual return an investor can expect to receive if they hold the bond until maturity. While bonds are issued with a fixed interest rate (coupon rate), their prices fluctuate in the secondary market after issuance, based on supply and demand. This is where the yield comes in:

- When demand for bonds is high (investors are eager to buy): Prices go up, but the fixed coupon payment remains the same. This decreases the effective yield for new buyers (they pay more for the same income stream).

- When demand for bonds is low (investors are selling or less interested): Prices go down to attract buyers. This increases the effective yield for new buyers (they pay less for the same income stream).

Therefore, the US 10-Year Bond yield isn’t static; it moves constantly based on market sentiment, economic data, and expectations about the future. It’s essentially the market’s pulse on long-term interest rate expectations and economic health in the US, closely watched by financial institutions worldwide, including those in Canada. Occasionally, you might also see references to the 10 year US government bond yield or the US treasury 10 year bond yield, which all refer to the same critical indicator.

The Ripple Effect: How the US 10-Year Bond Yield Influences Canadian Rates

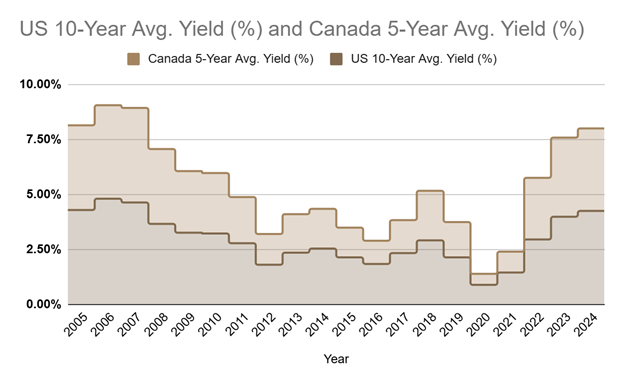

Here’s where the connection becomes critical for Canadians. While Canada has its own independent economy and central bank (the Bank of Canada), our financial markets, particularly the bond market, are deeply intertwined with those of our largest trading partner, the United States. The US 10-Year Bond yield exerts a strong gravitational pull on Canadian bond yields, especially the Government of Canada 5-year bond yield.

Why the 5-year Canadian bond? Because this specific bond is the primary benchmark that Canadian lenders use to price their 5-year fixed-rate mortgages – the most popular mortgage term in Canada. Here’s how the influence cascades:

- Interconnected Markets: Global investors often view North American bonds similarly regarding risk and economic trends. When sentiment shifts regarding the US economy or inflation (driving the US 10-Year Bond yield up or down), investors often adjust their expectations for Canada simultaneously. If US bonds become more attractive (higher yield), investors might demand higher yields on Canadian bonds to remain competitive, and vice-versa. Capital flows easily between the two highly integrated markets.

- Investor Behaviour: Large institutional investors (pension funds, insurance companies, mutual funds) operate globally. If the US 10-Year Bond yield rises significantly, offering a better return on perceived safe US debt, these investors might shift funds out of Canadian bonds unless Canadian yields also rise to compensate for the relative change in attractiveness. This selling pressure on Canadian bonds pushes their prices down and their yields up.

- Economic Correlation: The Canadian and US economies are closely linked through trade and investment. Major economic trends, particularly inflation, often move in similar patterns (though not perfectly synchronized). Expectations driving the US 10-Year Bond yield (like anticipated inflation or growth) often mirror expectations for Canada, influencing Canadian bond yields accordingly.

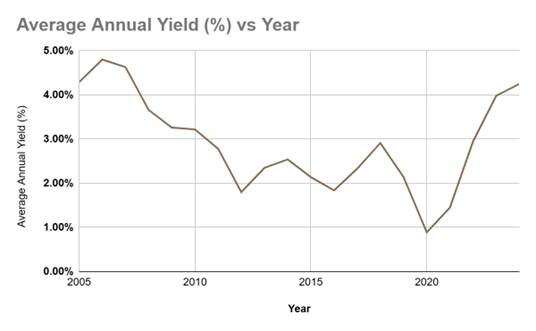

- The 5-Year Benchmark: While the US 10-year yield provides the broader signal, the direct mechanism for fixed mortgage rates in Canada runs through the Government of Canada 5-year bond yield. When the influential US 10-Year Bond yield trends upwards, it typically pulls the Canadian 5-Year bond yield up with it. Conversely, a falling US 10-year yield tends to drag the Canadian 5-year yield lower.

Therefore, a rising US 10-Year Bond yield generally leads to a rising Government of Canada 5-year bond yield. This increase in the Canadian benchmark yield raises the base cost for lenders funding 5-year fixed-rate mortgages, inevitably leading them to increase the rates they offer to consumers. The opposite is also true: falling US yields tend to pave the way for lower fixed mortgage rates in Canada. It’s a clear, albeit slightly indirect, chain reaction. Understanding the 10 year US bond yield gives you insight into forces affecting your Canadian mortgage.

Why is the US 10-Year Bond Yield Rising (or Falling)? Key Drivers Explained

Understanding why the US 10-Year Bond yield moves is key to anticipating potential shifts in Canadian mortgage rates. Several interconnected factors influence its direction:

- Inflation Expectations: This is arguably the most significant driver. Bonds offer fixed payments over time. If investors expect inflation to rise significantly during the bond’s term, the fixed payments they receive will be worth less in real purchasing power. To compensate for this erosion of value, investors demand a higher yield upfront. Conversely, if inflation expectations fall, investors are willing to accept lower yields. Strong economic data suggesting future inflation, or actual high inflation readings, will typically push the US 10-Year Bond yield higher. Answering the question “Why US 10 year bond yield is rising?” often involves looking at inflation data and forecasts.

- Federal Reserve (The Fed) Policy: The US central bank’s actions and communications heavily influence bond yields.

- Policy Interest Rate (Fed Funds Rate): While this is a short-term rate, changes or anticipated changes signal the Fed’s stance on inflation and economic growth, impacting longer-term yields like the 10-year. Rate hikes generally push yields up; rate cuts push them down.

- Quantitative Easing (QE) / Quantitative Tightening (QT): During QE, the Fed buys bonds, increasing demand and pushing prices up (yields down). During QT, the Fed sells bonds or lets them mature without reinvesting, increasing supply and pushing prices down (yields up). The Fed’s communication about future plans is as important as its current actions.

- Economic Growth Prospects: When the economy is expected to grow strongly, businesses borrow and invest more, potentially leading to higher inflation and increasing the demand for capital. This pushes interest rates and bond yields higher. Conversely, expectations of slowing growth or a recession tend to lower yields as borrowing demand falls and inflation fears recede. The health of the US economy directly impacts the US 10-Year Bond yield.

- Global Uncertainty & Risk Appetite (“Flight to Safety”): US Treasury bonds are often considered one of the safest investments in the world. During periods of global economic turmoil, geopolitical instability, or market stress, investors often sell riskier assets (like stocks) and buy US Treasuries for safety. This increased demand pushes Treasury prices up and the US 10-Year Bond yield down. When confidence returns and risk appetite increases, investors may sell Treasuries to buy riskier assets, pushing yields back up.

- Supply and Demand Dynamics: The sheer amount of debt the US government needs to issue can impact yields. If the government significantly increases borrowing (issuing more bonds), the increased supply can push prices down and yields up, unless demand keeps pace. Foreign demand, particularly from central banks holding US dollar reserves, also plays a role. Changes in buying patterns from major holders can influence the US treasury 10 year bond yield.

- Global Interest Rate Differentials: If interest rates in other major economies (like Europe or Japan) change significantly, it can influence demand for US bonds as investors compare relative returns, adjusting the 10 year US treasury bond yield accordingly.

These factors rarely act in isolation. They constantly interact, creating the dynamic environment that determines the direction of the US 10-Year Bond yield.

Why Monitoring the US 10-Year Bond Yield is a Smart Strategy for Canadians

Staying informed about the US 10-Year Bond yield isn’t just for financial analysts; it has practical benefits for Canadian mortgage holders and buyers:

- Anticipating Rate Changes: Bond yields react much faster to economic news and changing expectations than advertised mortgage rates. By watching the trend in the US 10-Year Bond yield and its Canadian counterpart, you can get a sense of the likely direction of fixed mortgage rates weeks or even months ahead.

- Timing Your Mortgage Decision:

- Buying a Home: If you see yields trending sharply upwards, it might signal that locking in a fixed mortgage rate sooner rather than later could be advantageous before rates climb further. Conversely, if yields are falling, waiting might result in securing a lower rate (though timing the absolute bottom is impossible).

- Renewing Your Mortgage: If your fixed-rate mortgage is coming up for renewal and you see the US 10-Year Bond yield consistently rising, it’s a strong indicator that renewal offers will likely be higher than your current rate. Starting the renewal process early (typically 4-6 months before maturity) and securing a rate hold becomes even more critical. If yields are falling, you might have more negotiating power or benefit from waiting closer to the renewal date.

- Refinancing: If you’re considering refinancing to consolidate debt or access home equity, the trend in bond yields will directly impact the fixed rates available for the refinance. Rising yields might make refinancing less attractive or more costly.

- Choosing Between Fixed and Variable: While variable rates are tied to the Bank of Canada’s policy rate (influenced by different, though related, factors), understanding the outlook for fixed rates based on bond yields helps inform the fixed vs. variable decision. If the US 10-Year Bond yield suggests fixed rates are poised to rise significantly, locking in might seem more appealing, even if variable rates are currently lower.

- Informed Conversations: Knowing about the US 10-Year Bond yield allows you to have more informed discussions with mortgage professionals. You can understand the underlying forces driving the rates they offer.

It’s not about becoming a bond trader, but about adding a crucial piece of forward-looking information to your financial toolkit.

Beyond Fixed Rates: Does the US 10-Year Yield Affect Variable Mortgages?

The direct, mechanical link described above applies primarily to fixed-rate mortgages, especially the popular 5-year term. Variable-rate mortgages in Canada are typically priced based on a lender’s Prime rate, which moves in lockstep with the Bank of Canada’s overnight policy rate. So, does the US 10-Year Bond yield have any bearing on variable rates? Indirectly, yes.

The factors driving the US 10-Year Bond yield – inflation, economic growth, Federal Reserve policy – are the same types of factors the Bank of Canada considers when setting its policy rate. While the Bank of Canada makes decisions based on Canadian economic conditions, the powerful influence of the US economy means trends south of the border often foreshadow or coincide with trends here.

For example:

- If persistently high US inflation pushes the US 10-Year Bond yield higher and prompts the Federal Reserve to raise rates aggressively, it often puts pressure on the Bank of Canada to follow suit to manage its own inflation and prevent excessive currency depreciation, eventually leading to higher variable mortgage rates.

- Conversely, if a US recession looks likely, causing the US 10-Year Bond yield to fall and the Fed to cut rates, it might signal that the Bank of Canada will also need to lower its policy rate to support the Canadian economy, leading to lower variable rates.

The connection is less direct and operates on a different timeline compared to fixed rates, but the underlying economic narrative influencing the US 10-Year Bond yield is still relevant background information for those considering variable-rate mortgages.

Navigating the Landscape: Practical Takeaways

The interplay between global bond markets and your Canadian mortgage can seem complex, but the core takeaway is simple: the US 10-Year Bond yield serves as a vital early warning system for the direction of Canadian fixed mortgage rates.

- Stay Informed: Regularly check financial news sources for updates on the US 10-Year Bond yield and the Government of Canada 5-year bond yield. Many financial websites display this data prominently.

- Understand the Trend: Look beyond daily fluctuations. Is the overall trend over weeks or months upwards, downwards, or sideways? This broader trend is more indicative of future mortgage rate direction.

- Context Matters: Remember the “Why.” Is the yield rising due to positive economic growth expectations (potentially good) or stubborn inflation (potentially bad for borrowing costs)? Understanding the drivers adds valuable context.

- Don’t Panic, Plan: Don’t make rash decisions based on one day’s yield movement. Use the information to inform your planning, especially around renewals or new purchases.

- Seek Professional Guidance: Bond yields are just one piece of the puzzle. Your personal financial situation, risk tolerance, and long-term goals are paramount.

Empowering Your Mortgage Decisions

The journey from a government bond auction in Washington D.C. to the fixed mortgage rate offered on your Canadian home might seem long and winding, but the connection is undeniable and impactful. The US 10-year Bond yield acts as a global bellwether, heavily influencing investor sentiment and capital flows, which in turn shape the Government of Canada bond yields that underpin fixed mortgage pricing in our country. By paying attention to this key indicator and understanding the factors driving its movements – inflation, central bank policies, economic growth, and market sentiment – you gain valuable foresight into potential shifts in Canadian fixed mortgage rates. This knowledge empowers you, whether you’re buying your first home, renewing an existing mortgage, or considering refinancing. While predicting precise rate movements is impossible, understanding the powerful undercurrents driven by indicators like the US 10-Year Bond yield allows you to navigate the mortgage landscape with greater confidence and make more informed, strategic financial decisions for your future.

Navigate Mortgage Complexity with Confidence: Talk to Pegasus Mortgage Lending

Understanding market indicators like the US 10-Year Bond yield is the first step. The next is translating that knowledge into the best mortgage strategy for your unique situation. Market conditions change, and navigating bond yield fluctuations, lender policies, and product options can feel overwhelming. That’s where Pegasus Mortgage Lending comes in. Since 2008, we’ve helped thousands of Canadians achieve their homeownership dreams, even through challenging economic times. Contact Pegasus Mortgage Lending today for expert guidance and personalized mortgage solutions tailored to the current market environment.