The Canadian economic landscape has shifted dramatically, compelling the Bank of Canada to take decisive action. The recent Bank of Canada interest rate cut to 2.75% signals a significant response to the escalating trade tensions with the United States. This move, driven by the looming threat of US tariffs on Canada, underscores the central bank’s commitment to stabilizing the economy in the face of unprecedented uncertainty. This blog will delve into the intricacies of this decision, analyzing the factors that influenced it, the potential impacts on Canadians, and the broader economic implications.

Breaking News: Bank of Canada Cuts Interest Rate to Combat Trade War Fallout

The headlines are clear: the Bank of Canada cut interest rate to mitigate the potential damage from escalating US tariffs. This decision, announced by Governor Tiff Macklem, reflects a proactive approach to safeguarding the Canadian economy against the headwinds of international trade disputes. The Bank of Canada interest rate cuts are not merely a reaction to current events but a strategic move to preempt future economic vulnerabilities.

Why the Bank of Canada Acted: Unpacking the Factors Behind the Rate Cut

The decision to implement the Bank of Canada interest rate cut was not made in isolation. Several key factors converged to necessitate this move:

- Escalating US Tariffs: The implementation of 25% tariffs on Canadian steel and aluminum, with the potential for further tariffs on other sectors, has created significant uncertainty for Canadian businesses. The threat of US tariffs looms large, impacting investment and hiring decisions.

- Trade Uncertainty: The ongoing on-again, off-again nature of trade negotiations with the U.S. has eroded business and consumer confidence. This uncertainty is a significant drag on economic activity.

- Impact on Manufacturing: The manufacturing sector, heavily reliant on trade, has been particularly hard-hit. Businesses have lowered their sales outlooks, leading to reduced investment and hiring.

- Declining Consumer and Business Confidence: Surveys conducted by the Bank of Canada revealed growing concerns about job security and financial health among consumers, as well as reduced investment plans among businesses.

- Inflationary Pressures: While the rate cut aims to stimulate economic activity, the potential for rising prices due to tariffs and a weaker Canadian dollar presents a challenge.

The Economic Ripple Effect: Analyzing the Impact of the Rate Cut

The Bank of Canada interest rate cuts are expected to have a broad impact on the Canadian economy:

- Lower Borrowing Costs: The rate cut will reduce borrowing costs for businesses and consumers, encouraging investment and spending. This will be welcome news for those with variable-rate mortgages or looking to take out loans.

- Stimulating Economic Growth: By lowering borrowing costs, the central bank aims to stimulate economic activity and offset the negative impact of trade tensions.

- Potential for Inflation: The weaker Canadian dollar and rising input costs due to tariffs could lead to inflationary pressures. The Bank of Canada will need to carefully monitor inflation to ensure it remains within its target range.

- Impact on the Canadian Dollar: The rate cut could put downward pressure on the Canadian dollar, making imports more expensive. However, it could also boost exports by making them more competitive.

- Business Investment: The hope is that the lowered intrest rate will help incentivize business investment.

The Consumer Perspective: What the Rate Cut Means for Canadians

For the average Canadian, the Bank of Canada interest rate cut has several implications:

- Mortgage Rates: Those with variable-rate mortgages will likely see their monthly payments decrease. Fixed-rate mortgages are less directly affected but can be impacted by long-term interest rate expectations.

- Savings and Investments: Lower interest rates can reduce returns on savings accounts and fixed-income investments.

- Consumer Spending: Lower borrowing costs could encourage consumer spending, boosting retail sales and supporting economic growth.

- Job Security: The rate cut aims to support economic activity and maintain job security in the face of trade challenges.

Navigating the Trade War: The Bank of Canada’s Balancing Act

Governor Macklem has emphasized that the Bank of Canada cannot fully offset the impact of a trade war. However, the central bank can use monetary policy to mitigate the economic fallout. This involves a delicate balancing act:

- Supporting Growth: The rate cut aims to support economic growth and maintain employment levels.

- Controlling Inflation: The bank must carefully monitor inflation to ensure it remains within its target range, despite potential upward pressures from tariffs and a weaker Canadian dollar.

- Managing Uncertainty: The central bank must navigate the uncertainty created by trade tensions and provide clear communication to businesses and consumers.

The Role of Tariffs: A Closer Look at the Impact of US Trade Policy

The US tariffs on Canadian goods are a significant source of concern. The impact of these tariffs is multifaceted:

- Increased Costs: Tariffs increase the cost of imported goods, which can be passed on to consumers in the form of higher prices.

- Reduced Competitiveness: Tariffs can make Canadian exports less competitive in the US market.

- Disrupted Supply Chains: Tariffs can disrupt supply chains, leading to delays and increased costs for businesses.

- Retaliatory Measures: Canada may impose retaliatory tariffs, further escalating trade tensions.

The Importance of Diversification: Reducing Reliance on the US Market

The trade disputes with the US highlight the importance of diversifying Canada’s trade relationships. Businesses are exploring new markets and seeking to reduce their reliance on the US.

Forward-Looking: The Bank of Canada’s Next Steps

The Next interest rate announcement Canada will be closely watched. The Bank of Canada’s future decisions will depend on several factors, including:

- The Evolution of US Tariffs: Any changes to US trade policy will significantly impact the Canadian economy.

- Inflationary Pressures: The bank will closely monitor inflation to ensure it remains within its target range.

- Economic Growth: The bank will assess the impact of the rate cut on economic growth and adjust its policies accordingly.

- Global Economic Conditions: Global economic conditions, including the performance of the US economy, will also play a role.

- Will Bank of Canada cut interest rates again? That will depend on the above mentioned factors. Did the Bank of Canada cut interest rates? Yes, the bank did, and further cuts are possible.

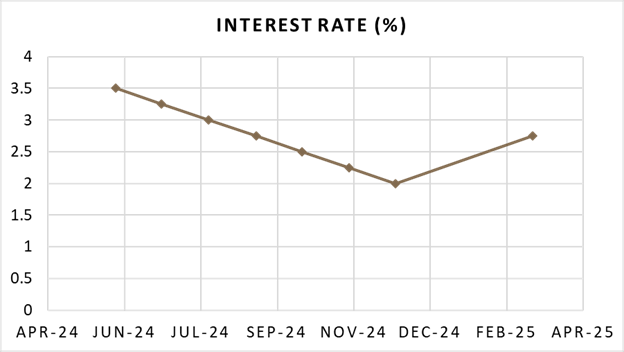

Bank of Canada Overnight Rate History (2024-2025)

Navigating Uncertainty and Building Resilience

The Bank of Canada interest rate cut is a crucial step in navigating the challenges posed by trade tensions with the US. The central bank’s proactive approach aims to support economic growth, maintain job security, and control inflation. However, the path ahead remains uncertain. The Canadian economy must build resilience, diversify its trade relationships, and adapt to the evolving global landscape. The impact of Bank of Canada expected to cut interest rates again today has already been felt, and the effects will continue. The Bank of Canada cut interest rates is a tool used to manage the economic effects of the US tariffs. The Bank of Canada interest rate cuts are a signal that the bank is ready to act. Secure Your Financial Future with Pegasus Mortgage Lending! In these times of economic uncertainty, securing your financial future is paramount. At Pegasus Mortgage Lending, we understand the complexities of the current market and are committed to helping you navigate them. Whether you’re a first-time homebuyer, looking to refinance, or seeking expert advice, our team of experienced mortgage professionals is here to guide you.