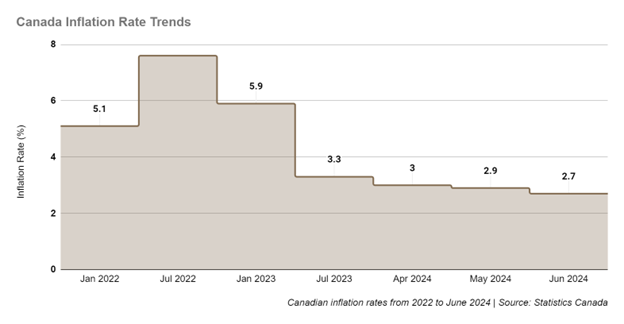

Canada’s economy received a welcome surprise in June 2024 as the annual inflation rate cooled to 2.7%, defying the unexpected spike to 2.9% in May. This deceleration, revealed in Statistics Canada’s Consumer Price Index (CPI) report, is largely attributed to a significant drop in gasoline prices, which fell by 3.1% compared to the previous month. This marks the second consecutive month of falling pump prices, providing much-needed relief for consumers grappling with the rising cost of living.

This unexpected easing of inflation has sparked widespread speculation about the Bank of Canada’s next move on interest rates. With the central bank’s next meeting scheduled for July 24th, the June CPI data has fueled expectations of another rate cut, as policymakers seek to strike a delicate balance between stimulating economic growth and keeping inflation in check.

Key Takeaways from the June 2024 CPI Report

The June 2024 Consumer Price Index (CPI) report from Statistics Canada paints a nuanced picture of the country’s economic landscape:

- Inflation Cools: The annual inflation rate fell to 2.7% in June 2024, down from 2.9% in May. This marks the sixth consecutive month that inflation has remained within the Bank of Canada’s target range of 1% to 3%.

2. Gasoline Prices Plunge: Gasoline prices experienced a significant 3.1% decrease compared to May, contributing significantly to the overall easing of inflation. This decline follows a similar drop in May, indicating a trend of lower prices at the pump.

3. Travel and Communication Costs Ease: Travel tours saw a notable 11.1% decline in prices every month, while cellular service costs fell 12.8% compared to the same period last year.

4. Durable Goods See Declines: Passenger vehicle prices fell by 0.4% year-over-year, the largest decline since February 2015. This was mainly driven by a 4.5% drop in used vehicle prices. Furniture prices also experienced a decline of 3.9% annually.

5. Grocery Prices Climb: Food prices continued their upward trajectory, increasing by 2.1% year-over-year. This marks the second consecutive month of rising grocery prices, which are up 21.9% compared to three years ago. Specific categories like dairy products (+2.0%), fresh vegetables (+3.8%), non-alcoholic beverages (+5.6%), and preserved fruit and fruit preparations (+9.5%) saw notable increases.

6. Shelter Costs Remain High: While the overall shelter index rose 6.2% year-over-year, marking a slight moderation from the 6.4% increase in May, rent and mortgage interest costs remain elevated and continue to strain household budgets.

These findings from the June 2024 CPI report highlight the complex dynamics of Canada’s current economic landscape. While the overall easing of inflation is a positive sign, the persistent rise in food and shelter costs underscores the ongoing challenges faced by consumers.

The Impact on the Housing Market

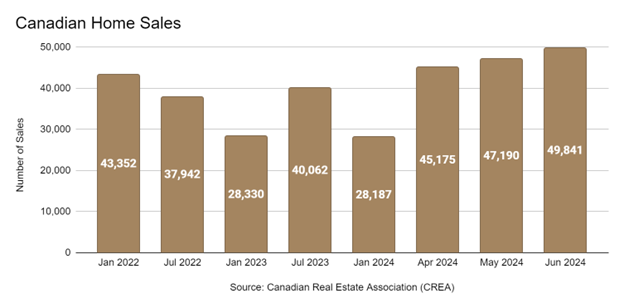

The Bank of Canada’s decision to cut interest rates in June 2024 was widely anticipated to breathe new life into the housing market. The housing market has shown signs of recovery since the June rate cut, with a modest increase in sales. While the rebound has been gradual and not as strong as some anticipated, the Canadian Real Estate Association (CREA) has revised its 2024 forecast to a 6.1% increase in home sales compared to 2023, suggesting a positive outlook for the market.

Several factors contribute to this hesitant recovery:

- High Household Debt: The burden of high household debt remains a significant factor influencing buyer behaviour. Despite the recent rate cut, borrowing costs are still relatively high, deterring some potential buyers from entering the market.

- Economic Uncertainty: Lingering economic concerns, including the possibility of a recession, are casting a shadow over the housing market. Many potential buyers are hesitant to make large investments amidst this uncertainty.

- Affordability Concerns: While the rate cut has provided some relief, housing affordability remains a major challenge in many parts of Canada, especially in major urban centers. High home prices and stricter mortgage qualification rules continue to pose barriers for many aspiring homeowners.

- Psychological Impact: The rapid rise in interest rates over the past year has left a lasting impact on buyer psychology. Many individuals may be waiting for further rate cuts or more stability in the market before feeling confident enough to make a purchase.

Despite these challenges, there are some positive signs on the horizon. The Canadian Real Estate Association (CREA) has revised its forecast for home sales in 2024, expecting a 6.1% increase compared to 2023. This suggests that while the recovery may be gradual, the market is not expected to decline further.

Canadian Home Sales: A Seasonal Rollercoaster with Signs of Recovery

The Canadian housing market has experienced a dynamic trajectory over the past few years, heavily influenced by economic factors like interest rates and broader seasonal trends.

- Seasonal Influence: The data underscores the significant impact of seasonal trends on the Canadian housing market, with predictable peaks in spring and summer and lulls in winter.

- Interest Rate Impact: Rising interest rates in 2022 and early 2023 significantly dampened sales, but the market has shown signs of recovery since then.

- Resilient Market: Despite challenges, the market has demonstrated resilience, particularly with the strong rebound in the spring and summer of 2024.

- June 2024 Significance: The June 2024 sales figure stands out as a beacon of hope, surpassing expectations and signalling the potential for further recovery.

Overall, the Canadian housing market presents a complex picture, shaped by both economic factors and seasonal fluctuations. While challenges remain, the recent sales data offers a glimmer of optimism for a gradual recovery in the coming months.

The Bank of Canada’s future decisions regarding interest rates will be crucial in determining the trajectory of the housing market. Further rate cuts could provide the necessary impetus to encourage more buyers to enter the market, potentially leading to a more robust recovery. However, the effectiveness of such a move will depend on a multitude of factors, including the overall economic climate, household debt levels, and the pace of new housing construction.

The coming months will be critical in revealing whether the housing market’s muted response to the June rate cut is a temporary blip or a sign of deeper underlying issues. As potential buyers weigh their options amidst economic uncertainty, the Bank of Canada faces the challenging task of balancing the need to stimulate the economy to maintain financial stability.

BoC Rate Cut Odds Surge: What’s Next?

The June inflation data has solidified expectations for another rate cut by the Bank of Canada at its upcoming meeting on July 24th. Financial markets currently predict an 88% probability of a 25-basis-point cut, highlighting the growing consensus among investors and economists.

The BoC’s decision will be influenced by several factors, including:

- Core Inflation Measures: The BoC will closely monitor core inflation measures, which exclude volatile items like food and energy. Core inflation is a key indicator for the central bank as it provides a clearer picture of underlying price pressures and helps assess whether broader inflationary trends are becoming entrenched.

- Economic Growth: Recent data indicating a slowing economy will likely play a significant role in the BoC’s decision-making process.

- Global Economic Conditions: The BoC will also consider global economic developments, such as a slowdown in major economies like the United States or China, or geopolitical events that could disrupt global supply chains. These factors can significantly impact Canada’s economy and influence the BoC’s monetary policy decisions.

While another rate cut seems increasingly likely, the BoC will need to carefully weigh the risks and benefits of such a move. It must strike a delicate balance between stimulating economic growth and ensuring that inflation remains under control.

The Bottom Line

The June 2024 inflation data has brought a wave of optimism to Canada’s economic outlook. The cooling inflation, driven by falling gasoline prices, suggests that the BoC’s efforts to tame price pressures are taking effect. However, the muted response of the housing market and the persistent challenges of high household debt and affordability concerns highlight the complexities of the economic landscape. The coming months will be crucial in determining the pace of economic recovery and the trajectory of interest rates. The Bank of Canada’s decisions will play a pivotal role in shaping this trajectory, and all eyes will be on the central bank as it navigates this challenging economic landscape.