The Bank of Canada (BoC) made a significant announcement on July 24th, 2024, slashing its key interest rate by 25 basis points to 4.5%. This marks the second consecutive cut in recent months, bringing the rate to its lowest level since May 2023. This move comes as no surprise to economists who have been closely monitoring Canada’s economic landscape.

Decoding the Decision: Why Did the BoC Cut Rates?

The Bank of Canada’s recent decision to cut interest rates for the second time this year is a multifaceted response to a complex economic situation. Here’s a breakdown of the key factors driving this decision:

1. Sluggish Economic Growth:

Canada’s economy has shown signs of picking up in the first half of 2024, but it’s not enough. The growth rate hasn’t been able to match the rapid pace of population growth. This means the economy is producing less than it could, creating an excess supply of goods and services. Think of it like a factory making fewer products than people want to buy.

- The Problem: This excess supply can lead to deflationary pressures, as businesses lower prices to try and sell their goods and services. To avoid this and stimulate economic activity, the BoC lowers interest rates, encouraging borrowing and spending.

2. Weakening Consumer Spending:

Canadians are feeling the pinch. Rising prices, increased debt burdens, and economic uncertainty have all contributed to a significant slowdown in consumer spending. This is impacting not only retail sales but also the housing market, where investment has also weakened.

- The Problem: Consumer spending is a major driver of economic growth. When people spend less, businesses suffer, unemployment can rise, and the overall economy can contract. Lowering interest rates is intended to make borrowing more affordable, encouraging consumers to spend and invest, thus boosting the economy.

3. Cracks in the Labour Market:

The unemployment rate is on the rise, now at 6.4%. Job seekers are finding it harder to find work, and the time it takes to secure a job is increasing. Additionally, while wages are still growing, there are indications that this growth might be slowing down.

- The Problem: A weakening labour market is a sign of economic distress. It can lead to reduced consumer confidence and spending, further dampening economic growth. Lower interest rates can help stimulate the economy, potentially leading to job creation and improving the labour market outlook.

4. Inflation Cooling, But Not There Yet:

There’s good news on the inflation front. Headline inflation, which measures the overall change in consumer prices, fell to 2.7% in June. The BoC’s preferred measures of core inflation, which exclude volatile items like food and energy, have also been below 3% for several months.

- The Problem: Despite these positive signs, inflation remains above the BoC’s target of 2%. This is particularly evident in areas like housing and services, where price pressures remain elevated. The BoC’s rate cut is a balancing act: it’s trying to stimulate the economy without reigniting inflation.

The Bank of Canada’s decision to cut interest rates is a calculated move aimed at addressing the current economic challenges facing the country. By making borrowing more affordable, the BoC hopes to stimulate spending and investment, which in turn could boost economic growth and address concerns about rising unemployment and weak consumer confidence. However, the BoC is treading carefully, as it also needs to keep inflation in check and ensure the economy doesn’t overheat.

What Does the 4.5% Rate Mean for Your Wallet?

The Bank of Canada’s decision to lower the key interest rate to 4.5% will undoubtedly affect various aspects of Canadians’ financial lives. Let’s delve deeper into how this rate cut will impact mortgage holders, savers, investors, and borrowers:

| Mortgage Holders | |

| Variable-Rate Mortgages: You’re in for some good news if you have a variable-rate mortgage. Your monthly payments will decrease as your interest rate is directly tied to the BoC’s benchmark rate. For example, on a $500,000 mortgage with 25 years remaining, a 25-basis point decrease could save you around $65 per month. | Fixed-Rate Mortgages: Those with fixed-rate mortgages won’t see an immediate change in their payments. However, if your mortgage term is ending soon, you’ll be able to renew at a lower rate, potentially saving you hundreds or even thousands of dollars over the life of your mortgage. |

The news isn’t as rosy for savers. Lower interest rates mean you’ll earn less interest on your savings accounts. If you have a high-interest savings account, you might see your rate drop by 0.25% or more. This reduced return could prompt you to explore alternative investment options, such as Guaranteed Investment Certificates (GICs) or high-dividend stocks, to potentially achieve higher returns.

| Investors | |

| Stock Market: Lower interest rates can often stimulate economic activity as businesses and consumers are more likely to borrow and spend. This increased economic activity can boost corporate earnings, leading to potential stock market gains. However, it’s important to remember that stock market performance depends on various factors and is not solely determined by interest rates. | Bonds: The relationship between interest rates and bond yields is inversely proportional. When interest rates fall, bond yields typically decline as well. This means if you hold bonds, their value may decrease, and you may experience lower returns on your fixed-income investments. |

| Borrowers | |

| Easier Access to Credit: With lower interest rates, borrowing becomes more affordable. This could make it easier for you to qualify for loans, such as personal loans, car loans, or lines of credit. The reduced interest rates mean you’ll pay less in interest over the life of the loan. | Existing Debt: If you have existing debt, such as a car loan or credit card balance, consider refinancing your debt at a lower interest rate. This can significantly reduce your interest payments and help you pay off your debt faster. |

While the rate cut presents opportunities for some, it’s essential to be aware of potential risks. For instance, lower interest rates can sometimes lead to higher inflation, which could erode your purchasing power over time. It’s crucial to stay informed about economic developments and adjust your financial strategy accordingly.

A Deep Dive into Canada’s Economic Indicators

The Bank of Canada’s (BoC) recent decision to cut the key interest rate for the second time this year wasn’t a knee-jerk reaction. It was a calculated move based on a thorough analysis of several critical economic indicators that paint a picture of a slowing economy struggling with persistent inflation.

Navigating Canada’s Economic Recovery

The Bank of Canada’s recent rate cut to 4.5% signals a cautious optimism about the country’s economic future. While the central bank anticipates a gradual recovery with GDP growth picking up in the latter half of 2024 and continuing into 2025, it acknowledges that the road ahead will be challenging. The BoC’s forecast of a gradual recovery underscores the complex nature of the economic challenges facing Canada. Factors like high household debt, geopolitical uncertainties, and potential global economic slowdowns could all impede the pace of recovery. The BoC’s primary mandate is to maintain price stability, which it aims to achieve by keeping inflation at or near its 2% target. While the recent moderation in inflation is encouraging, it remains above the target, particularly in the housing and services sectors.

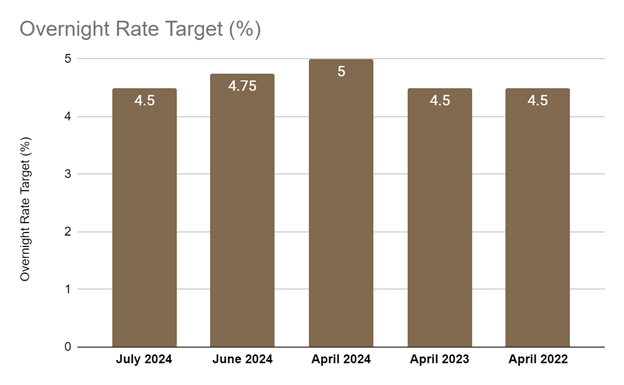

| Date | Overnight Rate Target (%) | Change (Basis Points) | Notes |

| July 24, 2024 | 4.5 | -25 | The second consecutive cut, the lowest rate since May 2023, aimed at stimulating the economy amidst weak growth and easing inflation. |

| June 5, 2024 | 4.75 | -25 | The first-rate cut in over four years reflects concerns about slowing economic growth and easing inflationary pressures. |

| April 10, 2024 | 5 | 0 | The rate held steady after a series of increases in 2022 and 2023 to combat rising inflation. |

| March 8, 2023 | 4.5 | 0 | The rate held steady as the BoC assessed the impact of previous rate hikes on the economy and inflation. |

| January 24, 2023 | 4.5 | +25 | The rate increased to address rising inflation, marking the beginning of a series of rate hikes throughout 2022 and early 2023. |

| 2022 | Multiple increases | Various | Throughout 2022, the BoC implemented multiple rate hikes to combat surging inflation, with the overnight rate reaching 5% by July 2023. |

The BoC has made it clear that its future decisions will be data-driven. It will closely monitor key economic indicators, such as inflation, GDP growth, employment data, and consumer spending. If these indicators suggest that the economy is recovering as expected and inflation remains under control, further rate cuts could be on the table. However, if inflation shows signs of accelerating or the economic recovery stalls, the BoC may need to reconsider its monetary policy stance. It may even need to reverse course and raise interest rates to curb inflation.

The Bottom Line

The Bank of Canada’s decision to cut the key interest rate to 4.5% is a strategic response to a multifaceted economic situation. By lowering borrowing costs, the BoC aims to stimulate economic activity, encourage spending and investment, and ultimately support a sustainable economic recovery. However, the central bank remains cautious and data-dependent, as it navigates the delicate balance between promoting growth and keeping inflation in check. The road to full economic recovery may be long and winding, but the BoC’s actions indicate a commitment to steering the Canadian economy toward a more stable and prosperous future.