The Canadian housing market has always been a topic of national conversation, and in recent years, the discussion has been more dynamic and complex than ever. From soaring highs to more recent corrections, understanding the nuances of Canada home prices is essential for anyone considering buying, selling, or simply investing in real estate. This detailed blog post will delve into the current landscape of Canada home prices, explore the factors influencing the market, and provide a comprehensive overview of what to expect in the coming months. We will examine the regional disparities, the impact of new construction, and the overall trends shaping the future of housing in the country.

The national trend in Canada home prices paints a picture of a market in transition. Following a period of unprecedented growth, we are now seeing a stabilization and, in some areas, a moderate decline. According to the latest data from Statistics Canada, new home prices saw a third consecutive monthly decline in June, falling by 0.2% month-over-month. This downward trend, while modest, is a significant indicator of a shift in market dynamics. This shift is a direct response to a number of economic factors, including elevated interest rates and ongoing economic uncertainty. The softening of Canada home prices is a welcome development for many prospective buyers who have been priced out of the market for years.

The average home price in Canada is a key metric to watch, but it’s important to remember that it’s a national average that can be skewed by the high-priced markets of Toronto and Vancouver. The national average home price in Canada can be misleading, as it doesn’t reflect the significant regional variations across the country. For a more accurate picture, it’s often more useful to look at the median home price Canada, which can provide a clearer view of what a typical home might cost. The median home price in Canada offers a more balanced perspective by removing the influence of extremely expensive properties. This helps prospective buyers in different provinces to understand their local market more effectively.

Unpacking the Regional Disparities in Canada Home Prices

While the national trend for Canada home prices shows a general softening, the story on the ground is a patchwork of divergent regional experiences. The market’s performance is not uniform, with some regions experiencing declines while others continue to see modest growth. This is a crucial point for anyone trying to get a handle on Canada home prices.

Markets in Decline: Ontario and British Columbia

The most significant price declines are concentrated in Southern Ontario and British Columbia, particularly in major urban centers like Toronto and Vancouver. These markets, which experienced explosive growth during the pandemic, are now grappling with historically high inventory levels and challenging affordability conditions. The abundance of homes for sale has shifted the balance of power, giving buyers more time to make decisions and more leverage in negotiations. For example, Toronto’s MLS Home Price Index (HPI) was down 5.5% from a year ago in June. This is a stark illustration of the pressure on Canada home prices in these high-cost regions. The condo market in the Greater Toronto Area (GTA) has been particularly hard-hit, with prices and activity sliding.

Markets Showing Resilience: The Prairies, Quebec, and Atlantic Canada

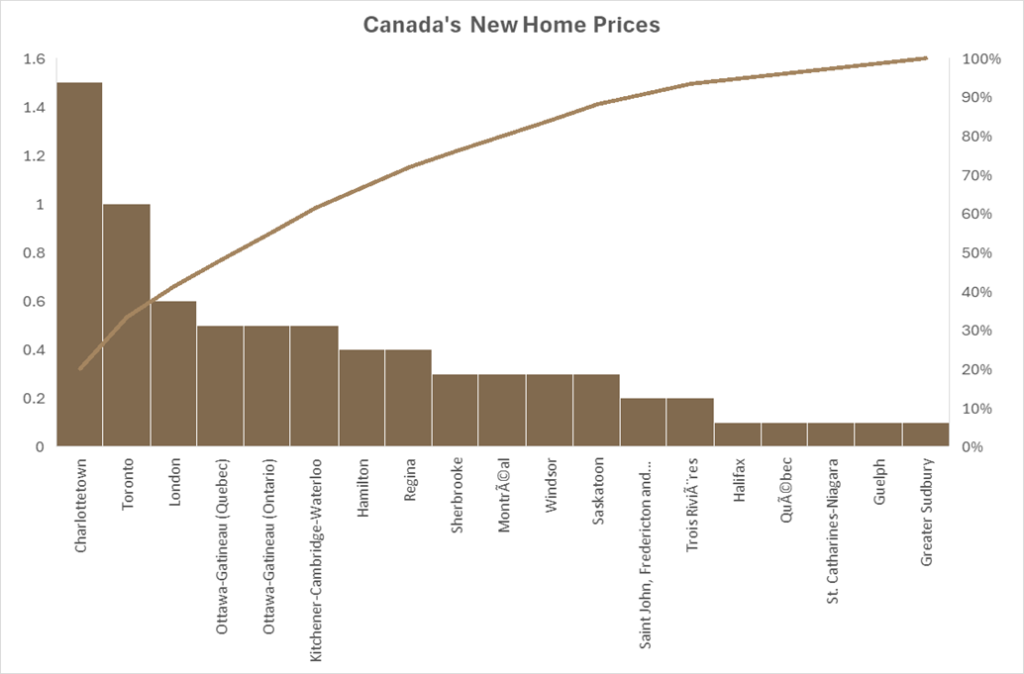

In stark contrast, many markets in the Prairies, Quebec, and Atlantic Canada are showing remarkable resilience and even continued growth. This is largely due to tighter supply-demand conditions and a greater degree of affordability. Cities like Regina and Saskatoon, for instance, have posted solid annual price increases. Similarly, markets in Atlantic Canada, such as Halifax and St. John’s, have seen significant year-over-year growth, driven by a combination of tight supply and rising construction costs. The average home price in Canada for these regions is significantly lower than in the major metropolitan areas, making them attractive to a wider range of buyers. The consistent growth in these areas demonstrates a different dynamic for Canada home prices.

New vs. Existing Homes: A Tale of Two Markets

Another important aspect of the Canadian housing market is the distinction between new and existing homes. While the overall trend for Canada home prices is one of moderation, new home prices are showing their own unique characteristics. The Statistics Canada data cited earlier, which showed new home prices declining for the third straight month, points to a specific set of influences on this segment of the market. Builders are citing softer demand and increased buyer negotiation as key factors.

Conversely, the market for existing homes can be influenced by a different set of factors, including the number of new listings coming onto the market and the sentiment of current homeowners. During the pandemic, existing home prices in many areas grew at a faster rate than new construction. This was partly due to soaring construction costs, which put upward pressure on new home prices. However, the current environment of increasing inventory and softening demand is putting pressure on both new and existing Canada home prices. It’s a complex interplay where both markets are now feeling the pinch.

The Role of Economic Factors and Policy in Canada Home Prices

The current state of Canada home prices is a direct result of several powerful economic forces. High interest rates, set by the Bank of Canada to combat inflation, have significantly increased the cost of borrowing for prospective homebuyers. This has naturally cooled demand and, in turn, put downward pressure on prices. While a moderation of home prices may improve affordability in some areas, the higher cost of financing a mortgage can still make homeownership a challenge. The relationship between interest rates and the average home price in Canada is undeniable. Government policies, such as the ban on foreign buyers and immigration targets, also play a role in shaping the market. The federal government’s immigration cooldown, for example, is expected to primarily affect rental demand, which could have a ripple effect on the overall housing market. The goal of these policies is often to stabilize the market and improve affordability, but their full impact can be complex and long-lasting.

The Myth of a Single Market: Why Location Matters

It’s clear that there is no single “Canadian housing market.” Instead, the country is home to a collection of diverse and regional markets, each with its own unique characteristics and trajectory. From the booming markets in the Prairies to the cooling markets of Ontario, Canada home prices are subject to local supply and demand, economic conditions, and consumer sentiment. For this reason, potential buyers and sellers should focus on the data and trends specific to their local area. Relying on national averages can lead to misinformed decisions. For example, while the median home price Canada might give a national benchmark, a buyer in Halifax should be looking at the specific trends in their city, where prices are still rising.

Frequently Asked Questions (FAQs)

What is the current average home price in Canada?

The average home price in Canada is a moving target and can vary significantly based on the data source and the specific month. It’s important to consult recent reports from organizations like the Canadian Real Estate Association (CREA) and Statistics Canada. As of recent reports, the national average has shown a slight increase or decrease month-over-month, but it’s important to recognize that this figure is heavily influenced by high-cost markets like Toronto and Vancouver.

How does the median home price Canada differ from the average home price?

The average home price is calculated by adding up all the home prices and dividing by the number of homes sold. This number can be skewed by a few very expensive sales. The median home price Canada represents the middle value of all home prices, with half of the homes selling for more and half for less. The median is generally considered a better representation of a “typical” home’s price, as it is less affected by a small number of luxury sales.

Does Home Depot price match in Canada?

Yes, Home Depot does have a price match policy in Canada, known as the “Price Guarantee.” Their policy is quite detailed. If you find a lower price on an identical, in-stock item from a local competitor’s physical store or website, they will match the price and beat it by 10%. For online-only retailers, they will match the price but will not offer the additional 10% discount. The item must be identical in brand, model, and size, and the competitor must have it in stock. Exclusions apply, such as special orders, clearance items, and prices from third-party sellers.

Are Canada home prices expected to continue to fall?

Forecasts for Canada home prices vary depending on the source. Some reports, like a recent one from RBC, suggest a gradual recovery is underway, with sales expected to rebound in the coming year. However, price trends are expected to remain divergent. Markets with high inventory, like Ontario and British Columbia, may continue to see prices under pressure, while markets with tighter supply, like the Prairies and parts of Atlantic Canada, may see modest price gains. The trajectory of interest rates and the broader economic climate will be key factors in determining the future of Canada home prices.

What are the main factors influencing Canada home prices right now?

The primary factors influencing Canada home prices are high interest rates, which have increased borrowing costs and cooled demand; a shift in supply-demand conditions, with more homes for sale in many markets; and regional economic differences. Additionally, government policies and consumer confidence in the face of ongoing economic uncertainty play a significant role. These factors contribute to the varied and complex landscape of Canada home prices.

Why are home prices still rising in some parts of Canada but falling in others?

This divergence is a result of regional supply-demand dynamics. In markets with tight supply and a strong local economy, like parts of the Prairies and Atlantic Canada, competition among buyers can still drive prices up. In contrast, markets that saw a massive influx of inventory, like Toronto and Vancouver, have shifted into a buyer’s market where there are more sellers than buyers. This competition among sellers puts downward pressure on prices.

A Market in Flux and the Path Forward

The Canadian housing market is in a period of significant recalibration. The days of a single, monolithic trend are behind us, replaced by a complex and varied landscape where local factors dictate the trajectory of Canada home prices. While the national headlines may point to a general softening, the reality is a nuanced story of regional winners and losers. For prospective buyers, this environment presents both challenges and opportunities. For those in markets with softening prices and high inventory, there may be more bargaining power and less urgency to act. Conversely, in markets with continued price growth, competition remains fierce.

Understanding these dynamics is more important than ever. Whether you’re a first-time homebuyer or a seasoned investor, a thorough analysis of local market data is essential. The future of Canada home prices is not a foregone conclusion but a story that is still being written, influenced by everything from global economic shifts to individual consumer choices.

Ready to Navigate the Canadian Housing Market?

Whether you’re looking to purchase your first home, refinance your existing mortgage, or invest in a new property, we’re here to guide you every step of the way. Don’t let the shifting tides of Canada home prices deter you from your goals.