The Canadian economic landscape is a dynamic and often complex terrain, influenced by global events and domestic policies. One of the most critical indicators for both individuals and businesses is the Canada inflation rate. Understanding the Canada inflation rate is essential, as it directly impacts purchasing power, investment decisions, and the overall cost of living. For Canadians, the persistent discussion around the Canada inflation rate is not just an abstract economic concept; it shapes their daily financial realities. Recently, the Bank of Canada (BoC) has acknowledged that while the worst-case fears around trade uncertainties might be fading, economic confidence in Canada remains fragile. This lingering uncertainty, particularly concerning trade, continues to exert pressure on key economic indicators such as hiring, investment, and household spending. As a result, more Canadians are preparing for the possibility of a recession, making the trajectory of the Canada inflation rate a central point of focus for financial planning.

What is the Inflation Rate in Canada and Why Does It Matter?

The Canada inflation rate, often measured by the Consumer Price Index (CPI), represents the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. For Canada, a healthy and stable Canada inflation rate is typically targeted by the Bank of Canada at 2%, within a control range of 1% to 3%. This target is crucial because low and stable inflation provides predictability, allowing consumers and businesses to make informed decisions about spending, saving, and investing. When the Canada inflation rate deviates significantly from this target, it can have profound implications. High inflation erodes the value of savings and can lead to a decrease in real wages, making everyday necessities less affordable. Conversely, deflation (a negative inflation rate) can discourage spending and investment, leading to economic stagnation. Therefore, monitoring the Canada inflation rate is a key responsibility of the Bank of Canada, as it directly impacts the financial well-being of every Canadian.

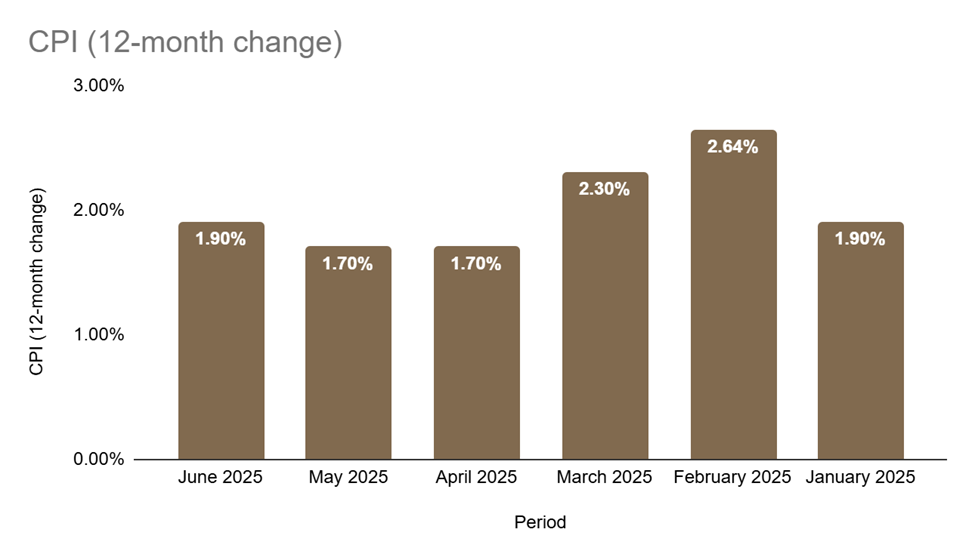

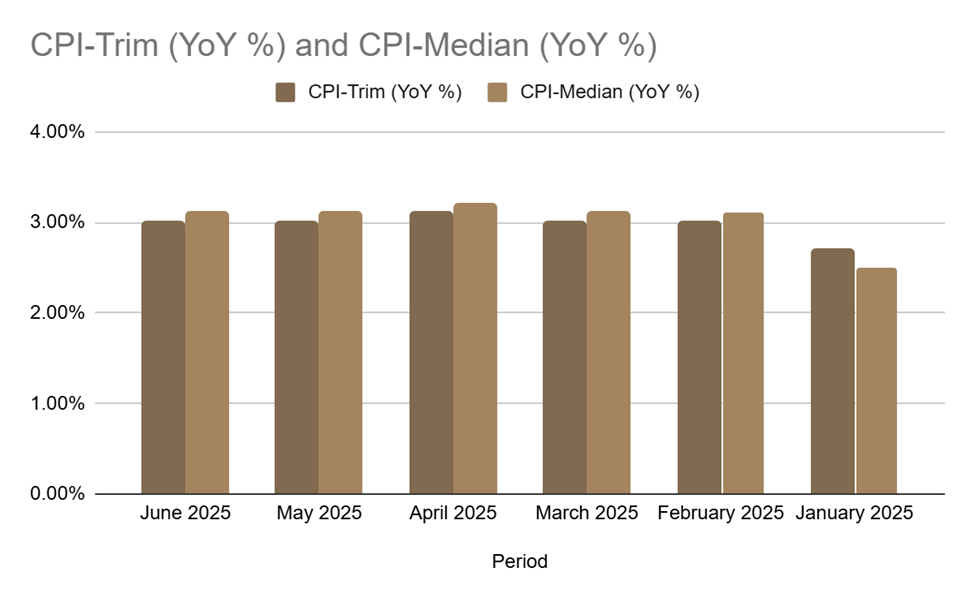

The current inflation rate Canada is a crucial data point that influences not only the cost of consumer goods but also the Bank of Canada’s monetary policy decisions. As of June 2025, the Canada inflation rate saw a slight increase to 1.9% on a year-over-year basis, up from 1.7% in May. This uptick was primarily influenced by a slower decline in gasoline prices compared to previous months, alongside faster price growth for certain durable goods like passenger vehicles and furniture. While this figure remains within the Bank of Canada’s target range, the nuances within the data provide a deeper insight into the underlying economic pressures. The Bank of Canada consistently monitors various core inflation measures, such as CPI-trim and CPI-median, to gauge the persistence and breadth of price changes, providing a more stable reflection of the overall Canada inflation rate trend, excluding volatile components.

Decoding the Factors Influencing the Canada Inflation Rate

Several interconnected factors contribute to the current inflation rate Canada, shaping the overall economic climate. Understanding these drivers is crucial for grasping the broader implications of the Canada inflation rate.

1. Global Trade Uncertainty and Supply Chains:

Ongoing global trade tensions, as highlighted by the Bank of Canada, continue to be a significant factor. While some trade fears may be “fading,” the lingering uncertainty leads to cautious business investment and can disrupt global supply chains. These disruptions can translate into higher input costs for Canadian businesses, which are often passed on to consumers in the form of higher prices, directly impacting the Canada inflation rate. When companies face unpredictable import costs or delays, it limits their ability to plan and invest, ultimately affecting the supply of goods and services within the country and putting upward pressure on the Canada inflation rate.

2. Domestic Demand and Consumer Spending:

The strength of domestic demand plays a pivotal role in shaping the Canada inflation rate. When consumers are confident about the future and have strong purchasing power, they tend to spend more, which can stimulate economic growth but also potentially fuel inflation if supply cannot keep pace. Conversely, a decline in household spending, often seen during periods of economic uncertainty or recessionary fears, can dampen inflationary pressures. The Bank of Canada closely watches consumer confidence and spending patterns as key indicators for future Canada inflation rate movements.

3. Labour Market Dynamics:

Wages and employment levels are intimately linked to the Canada inflation rate. A tight labour market, characterized by low unemployment and strong wage growth, can lead to increased consumer demand and higher production costs for businesses, contributing to inflationary pressures. The recent data on Canada’s labour market, including surprising job gains in some sectors, suggests that while overall economic confidence may be fragile, there are pockets of strength that could influence the Canada inflation rate.

4. Energy Prices:

As evidenced by the recent CPI report, fluctuations in energy prices, particularly gasoline, have a direct and immediate impact on the overall Canada inflation rate. Geopolitical conflicts and global supply dynamics can lead to volatility in oil prices, affecting transportation costs for businesses and the daily commutes of Canadians. While the decline in gasoline prices in June was less pronounced than in May, it still contributed to the upward movement of the Canada inflation rate.

5. Housing Market Dynamics:

Shelter costs, including rent and mortgage interest, constitute a significant portion of the Consumer Price Index and thus heavily influence the Canada inflation rate. Rapidly increasing housing costs can place a substantial burden on households and contribute to broad-based inflationary pressures. While the Bank of Canada has taken steps to cool the housing market through interest rate adjustments, the impact of housing on the Canada inflation rate remains a critical area of observation.

The Bank of Canada’s Stance and Monetary Policy

The Bank of Canada plays a crucial role in managing the Canada inflation rate through its monetary policy. The primary tool is the policy interest rate, also known as the overnight rate. By adjusting this rate, the Bank influences borrowing costs for banks, which in turn affects interest rates on mortgages, loans, and other credit products for consumers and businesses. When the Canada inflation rate is deemed too high, the Bank of Canada typically raises its policy interest rate to slow down economic activity and curb demand, thereby bringing inflation back towards the 2% target. Conversely, if inflation is too low or the economy is weakening, the Bank may lower interest rates to stimulate spending and investment.

The current environment presents a delicate balancing act for the Bank of Canada. While headline Canada inflation rate figures are within the target range, the underlying factors, such as ongoing trade uncertainty and pockets of economic fragility, necessitate a cautious approach. The Bank has held its benchmark interest rate steady in recent decisions, seeking to assess the full impact of past adjustments and the evolving economic landscape before making further moves. This strategic patience reflects the complexity of the current situation and the Bank’s commitment to achieving its inflation target while supporting overall economic stability for the Canada inflation rate.

The Bank of Canada’s focus remains on achieving sustainable price stability, which means keeping the Canada inflation rate low, stable, and predictable. This allows Canadians to plan their finances with greater certainty and encourages long-term investment. The Bank monitors a range of economic data, including employment figures, retail sales, and international trade balances, to inform its decisions regarding the Canada inflation rate and the overall health of the Canadian economy.

The Consumer Price Index (CPI) is the headline measure for the Canada inflation rate. Here’s a look at recent trends:

Canada Consumer Price Index (CPI) – Latest as of June 2025

Source: Statistics Canada

Bank of Canada’s Preferred Core Inflation Measures – Latest as of June 2025

Source: Statistics Canada

The Broader Economic Impact of Canada’s Inflation Rate

The Canada inflation rate has a ripple effect across the entire economy. For households, it dictates the purchasing power of their income and savings. When the Canada inflation rate is high, the cost of living increases, making it harder for families to stretch their budgets. This is particularly true for essential goods and services such as food, shelter, and transportation, which form a significant portion of household expenditures. Understanding the Canada inflation rate is therefore crucial for personal financial planning. Businesses also feel the impact of the Canada inflation rate in various ways. Rising input costs, from raw materials to labour, can squeeze profit margins. Companies might then face the difficult decision of absorbing these costs, passing them on to consumers, or reducing their operations. The ongoing trade uncertainty, as noted by the Bank of Canada, adds another layer of complexity, as businesses grapple with unpredictable tariffs and their effects on supply chains and the overall Canada inflation rate.

Furthermore, the Canada inflation rate plays a critical role in the housing market. Higher inflation can lead to increased interest rates as the Bank of Canada attempts to cool the economy. For prospective homeowners, this translates to higher mortgage costs, potentially impacting affordability and demand. Existing homeowners with variable rate mortgages may also see their payments rise, adding financial strain. The intricate relationship between the Canada inflation rate, interest rates, and housing affordability is a central concern for many Canadians. The Bank of Canada’s actions, therefore, have a direct bearing on the accessibility and cost of homeownership across Canada.

The Canada inflation rate also influences investor sentiment. When inflation is stable and predictable, investors have greater confidence in the long-term returns of their investments. However, volatile or unexpectedly high inflation can introduce uncertainty, leading investors to seek assets that offer better protection against eroding purchasing power. This can shift investment flows and impact capital markets in Canada. The current inflation rate Canada, while within the target range, still requires careful monitoring from investors.

Navigating the Future: What to Expect from Canada’s Inflation Rate

| Category | Factor | Impact on Canada Inflation Rate |

| Monetary Policy | Bank of Canada’s Interest Rates | Current steady rates signal a period of assessment. Future adjustments (increases or decreases) directly influence borrowing costs, consumer spending, and ultimately, inflationary pressures. |

| Global Factors | Global Trade Landscape (Trade Tensions) | Lingering uncertainty or changes in trade tensions can impact supply chains and commodity prices, directly affecting the cost of imported goods and, in turn, the Canadian inflation rate. |

| Domestic Factors | Canadian Labour Market Resilience | A strong labour market can boost economic confidence and consumer spending, potentially creating upward inflation pressure. |

| Consumer Spending | Robust consumer spending can exert upward pressure on inflation. A significant pullback due to recession fears could ease inflationary pressures. | |

| Economic Confidence (Fears of Recession) | Increased confidence can lead to higher spending and inflation. Intensified recession fears can lead to reduced spending and lower inflation. | |

| Bank of Canada’s Goal | Achieving a Soft Landing | The Bank aims for inflation to return to target without a severe economic downturn. The path of the Canada inflation rate is central to achieving this. |

| Individual Impact | Personal Financial Impacts (Mortgage Rates, Cost of Goods) | The inflation rate has a direct impact on personal finances. Understanding it empowers individuals to make informed decisions about budgets, savings, and investments. The current rate is a snapshot of a constantly moving target. |

Adapting to Canada’s Evolving Economic Landscape

The Canada inflation rate is a dynamic force that shapes the financial well-being of every Canadian. From the daily cost of groceries to the affordability of homeownership, its trajectory directly impacts household budgets and economic confidence. The Bank of Canada’s ongoing efforts to manage the Canada inflation rate through its monetary policy are crucial for maintaining price stability and fostering sustainable economic growth. While recent data shows the Canada inflation rate within the Bank’s target range, the lingering effects of global trade uncertainty and domestic economic fragility necessitate continued vigilance. Canadians must remain informed about these economic indicators and adapt their financial strategies to navigate the evolving landscape.

Don’t let economic uncertainty deter your dream of homeownership. Get an instant pre-approval in minutes and experience the possibility of a finalized mortgage within 24 hours. Contact Pegasus Mortgage Lending today for a free consultation and let us help you achieve your homeownership goals with confidence!