Are you a millennial wondering how much you should accumulate for your golden years? You’re not alone.

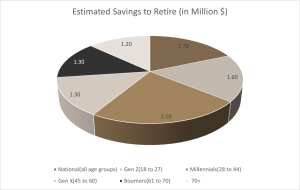

Particularly for our generation, retirement planning is not a universally applicable proposition. Millennials have diverse life paths that can significantly impact their ability to save, such as career breaks and student loans. Recent surveys reveal that Millennials must save more than any other Canadian demographic to retire comfortably. BMO’s annual retirement survey shows Canadians aged 28 to 44 believe they’ll need a whopping $2.1 million to retire, surpassing all other age groups. It’s a hefty figure that highlights the unique financial challenges millennials face. And it doesn’t stop there – for the second year running, the survey found that Canadians think they’ll need around $1.7 million for retirement. But fear not! You’re in the right place if you’re a millennial eyeing retirement with excitement and fear.

What to Save Based on Age?

How much you’ll need in retirement depends on various factors, including when you plan to retire and the lifestyle you wish to maintain. A standard guideline suggests saving 15% of your pre-tax income until retirement while aiming for savings and other income sources to cover around 80% of your pre-retirement income annually. However, projecting future income growth and expenses can be complex, especially if retirement is decades away.

Estimated Retirement Savings Based on Age and Multiples of Salary

| Age | Amount of Salary Saved |

| 30 | 1X: Aim to save at least equal to your current salary. |

| 35 | 2X: Double your current salary in savings. |

| 40 | 3X: Triple your current salary in your retirement account. |

| 45 | 4X: Save four times your current salary. |

| 50 | 6X: Aim for six times your current salary. |

| 55 | 7X: Save seven times your current salary. |

| 60 | 8X: Target eight times your current salary. |

| 67 | 10X: Secure ten times your current salary for a comfortable retirement. |

To simplify planning, set savings goals based on multiples of your current salary relative to your age. For instance, at 30, aim to save an amount equal to your current salary. By 40, triple your salary should be in your retirement account. By 67, the aim is to save ten times your salary for a comfortable retirement.

Whether you’re a millennial seeking to maintain your lifestyle or fantasize about a more lavish retirement, these targets offer a practical roadmap. For example, a 28-year-old should strive to save one year’s salary, while a 40-year-old should aim for three times their annual income. Tailor your savings strategy to match your aspirations and financial situation. If you are behind on savings, assessing your current plan and considering adjustments to catch up is essential. Start early, save consistently, and adjust as needed to ensure a secure retirement.

Projected Retirement Savings Targets by Age Demographics

Empowering Millennials: Overcoming Retirement Doubts

- Mental and Emotional Preparation: Touching on the psychological aspects of retirement, including the transition from working life to retirement, could provide a more holistic approach to retirement planning. Wrap your head around retiring at 70: Statistics Canada reports that the typical retirement age has been climbing steadily, hitting 65.1 years last year, up from 61.6 years in 2000. And guess what? It’s likely to keep rising due to longer life expectancy and a growing understanding of the perks of staying employed. Here’s the deal: continuing to work can bring non-financial and financial benefits. On the one hand, staying employed keeps you engaged and productive. On the economic side, it gives you more time to save for retirement, meaning fewer years of dipping into your savings. You can gradually ease into retirement by working fewer hours or days, giving you the best of both worlds. Additionally, consider the mental and emotional aspects of retirement. Retirement marks a significant life transition, often stirring a mix of emotions such as excitement, uncertainty, and a sense of loss. Preparing mentally and emotionally for this shift is essential. Imagine your ideal retirement lifestyle, set meaningful goals, and find purpose and fulfillment outside work. By addressing the psychological aspects of retirement, you can approach this milestone with confidence and clarity.

Marion, who retired at 58, fell in love with Arthur and discovered a passion for travelling. Despite having a stable income from her government pension, her longing to explore new places surpassed her financial means. Since her pension only covered her essential expenses, Marion devised a strategy. She decided to work part-time during the gardening season to earn extra money. With these earnings, she planned to embark on winter trips to warmer destinations with Arthur. This approach allowed her to enjoy the best of both worlds: fulfilling summer work and exciting retirement adventures alongside Arthur.

- Access Employer-Sponsored Retirement Plans: Utilize every opportunity your company provides to save for retirement, including any registered retirement savings plan (RRSP) or a registered pension plan (RPP). Many employers in Canada provide matching contributions, meaning they’ll match a portion of your contributions to the plan. For instance, you can obtain a guaranteed 50% return on your investment if your company matches 50% of your contributions up to 5% of your income.

Example: Suppose your annual salary is $50,000, and you contribute 5% ($2,500) to your employer’s RRSP plan. If your employer matches 50%, they’ll contribute an additional $1,250, doubling your retirement savings.

- Allocate Assets Properly: Diversifying your investments is vital to long-term success. This means spreading your money across different types of investments like stocks, bonds, real estate, cryptocurrencies and other vehicles. Each type of investment behaves differently in different situations, so having a mix can protect your money when the market goes down and help you make more money when it goes up. But it would help to think before putting your money into different things. You need to look at each type of investment and understand the risks before you decide what to do. Real estate and cryptocurrencies can make you more money. Still, they can also be risky, so be careful and research or talk to an expert before investing. And don’t just pick investments randomly – think about how much of each type of investment you want in your portfolio based on a few parameters:

- Risk Tolerance: To what extent do you feel at ease with the prospect of losing money? You might lean towards safer investments like bonds or cash if you’re more risk-averse. If you’re comfortable with volatility, you might allocate more to stocks, which historically offer higher returns over the long term.

- Time Horizon: When do you need the money? Suppose you’re investing for retirement decades away. You can take more risk in that case because you have time to ride out market fluctuations. But suppose you’re saving for a short-term goal, like a down payment on a house. In that case, you’ll want to prioritize stability to protect your principal.

Example: A young investor with a long time horizon before retirement may allocate a higher percentage of their portfolio to stocks, which historically offer higher returns over the long term despite short-term volatility.

- Financial Goals: What are you investing for? Whether it’s retirement, home buying, or funding your children’s education, your goals will dictate your investment strategy. For example, if retirement is your primary goal, you might prioritize growth investments like stocks to build wealth over time.

- Combatting Inflation: Inflation poses a significant threat to retirement savings by eroding the purchasing power of accumulated funds over time. As prices for goods and services escalate, the value of money diminishes. This implies that compared to now, fewer products and services will be available for the same amount of money in the future. Consequently, stagnant investments or low-interest savings accounts may lead to a decline in real wealth over the long term. However, people may lessen the negative impacts of inflation and protect their retirement portfolios by using a wise investing strategy and allocating funds to assets that have historically outperformed inflation, such as equities or real estate.

- Build Emergency Savings: Establish an emergency fund to cover unforeseen costs such as lost wages, auto repairs, or medical expenditures. Aim to save at least three to six months of living expenses. Keep your emergency savings in a liquid and accessible account, such as a high-interest savings account or a Tax-Free Savings Account (TFSA), so you can easily access the funds when needed.

Example: Aim to save between $9,000 and $18,000 in your emergency fund to act as a safety net if your monthly costs come to $3,000.

- Budget Every Dollar: Track your income and expenses meticulously to ensure that every dollar has a purpose. This involves creating a detailed budget that outlines your income, fixed expenses, variable expenses, and savings goals. Use budgeting tools and apps to streamline the process and identify areas where you can cut costs or reallocate funds toward savings.

Example: By reviewing your monthly spending habits, you may discover that you spend significantly on subscription services you rarely use. Cancelling or downsizing these subscriptions can free up extra money for your retirement savings.

- Focus on Reverse Budgeting: Prioritize savings first instead of saving whatever’s left after covering expenses. Determine how much you want to save each month for retirement and other financial goals, and then allocate the remaining income towards expenses. This approach ensures that saving becomes a priority and helps you avoid the temptation to overspend.

Example: If your goal is to save 15% of your income for retirement, set up automatic contributions to your RRSP or TFSA each month before allocating funds for rent, groceries, and other expenses.

The Bottom Line

Surveys highlight the need for millennials to save more than any other group for a comfortable retirement. But fear not! It’s time for millennials to seize control of their retirement funds. From setting age-based savings goals to smartly allocating assets and crafting robust financial plans, each step taken today paves the way for a secure future. Whether your vision is modest or extravagant, take action now. Save diligently, invest wisely, and stay steadfast in your financial objectives. You can lay the groundwork for a comfortable and deeply fulfilling retirement with determination and perseverance.